Solana Falls, This is the Cause of SOL Prices Dropping Sharply

2025-02-19

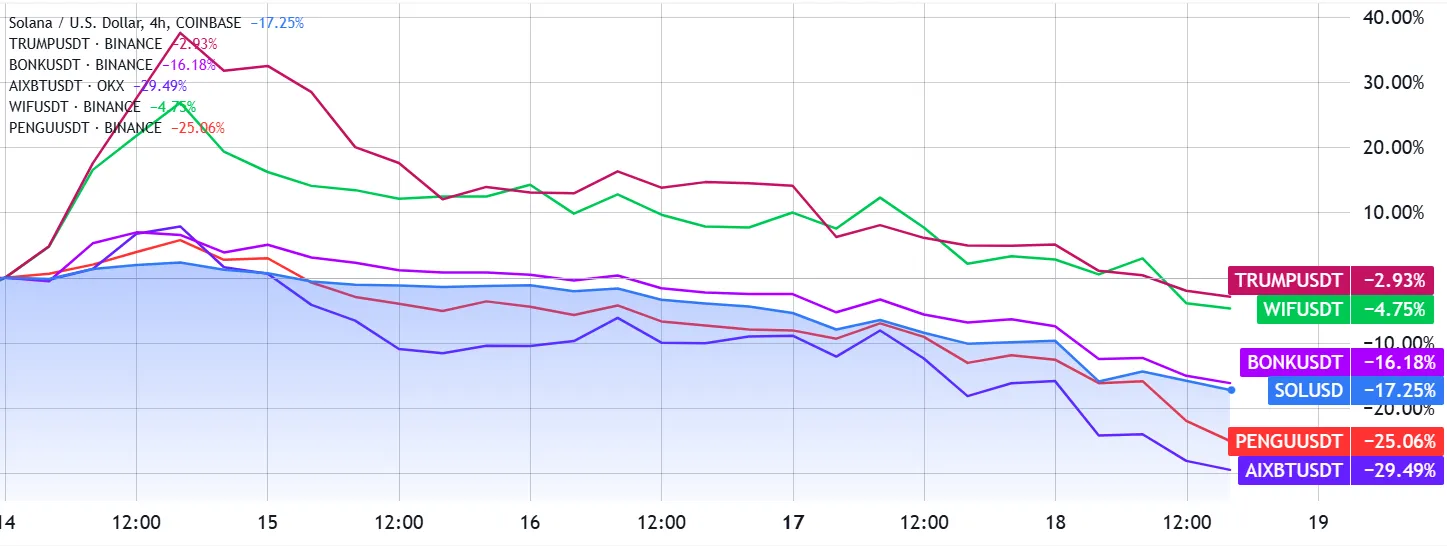

Bittime - Price Solana (SUN) experienced a sharp decline of up to 17% between February 14 to 18, 2025, bringing it to around $164. Despite the launch Libra memecoin, involving Argentinian President Javier Milei, occurred at the same time, the main cause of SOL's price decline cannot only be blamed on the memecoin pump-and-dump phenomenon. The decline in SOL prices is more related to the decline in on-chain activity, the decline in total value locked (TVL) of decentralized applications (DApps), as well as the approaching period unlocking SOL token the big one.

Impact of Decreasing On-Chain Activity and DEX Volume

One of the main factors influencing the price of SOL is the significant decline in the volume of on-chain activity on the Solana network. On February 17, 2025, Solana's on-chain activity plummeted from its peak of $35.5 billion on January 17, 2025 to just $3.1 billion. This decline is seen in volume DEX which plummeted by 91% in the last 30 days. Memecoin, although affecting short-term prices, cannot be completely linked to this broader decline.

Also read: Today's Pi Network Price According to the Latest Data, How Much Is PI Coin Rupiah?

Solana also saw its DEX volume drop by 20% in a week, while its competitors like BNB Chain actually experienced an increase of 35%. Projects that play a role in BNB Chain, such as Thena, Uniswap, And DODO, each recorded significant increases in volume, which shows that the decline in SOL prices was not only influenced by the memecoin phenomenon.

Decrease in Total Value Locked (TVL)

One of the key metrics that also points to Solana's weakness is the drop TVL (Total Value Locked) on DApps on the network. Over the past two weeks, Solana experienced a 19% drop in TVL, fueled by outflows from platforms like jito, Chimney, Marinade Finance, And Sanctum. Some applications like Meteor And Drift posted slight gains, but overall Solana lagged behind Ethereum And BNB Chain, each of which saw a much smaller decrease or even increase in their TVL.

Also read: PEPE Coin Price Prediction 2025 – 2031: Analysis and Price Target

If the SOL price drop was caused solely by the Libra memecoin, it should have a greater impact on Solana's on-chain metrics following the launch. However, there was no significant decline in these metrics after the event, indicating that other factors, such as decreased activity and TVL, played a larger role.

Effect of Unlocking SOL Tokens

One factor that adds to the concerns for SOL holders is the schedule unlocking token SOL a major one in the first quarter of 2025. More than 15 million SOL, worth more than $2.5 billion, is expected to enter circulation in that period. This number is much larger than that opened in the previous quarter, which was only around 12 times more. This sparked fear among investors, worsening negative sentiment and pushing SOL prices lower.

Conclusion

Overall, a drop in price SUN caused by a combination of decreased on-chain activity, reduced TVL on DApps, as well as SOL token unlocking schedule which is significant. Although the launch of the Libra memecoin coincided with the decline in SOL prices, this factor cannot be considered the main cause. This drop in SOL prices is more reflective of deeper structural challenges in the Solana ecosystem. As demand for Solana weakens and concerns about unlocking token, SOL is at its lowest point since November 2024.

FAQ

1. What caused the SOL price to drop sharply in February 2025?

The price of SOL fell sharply due to a decrease in on-chain activity, a decrease in total value locked (TVL) on DApps, and the approaching schedule for the grand unlocking of SOL tokens, which fueled bearish sentiment.

2. Did the Libra memecoin play a role in the SOL price decline?

Libra memecoin does influence the price of SOL in the short term, but the decline in SOL prices is more caused by other structural factors, such as decreased activity on the Solana network and DApps.

3. When is the next SOL token unlocking schedule?

More than 15 million SOL, worth more than $2.5 billion, is expected to enter circulation in the first quarter of 2025, worsening market sentiment towards SOL.

How to Buy Crypto with Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your knowledge in the world of crypto.

Reference

Cointelegraph, LIBRA memecoin scandal dings Solana’s image, but here’s the real reason why SOL is down, accessed 19 February 2025.

Author: MF

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.