Bitcoin Halving 2024

Bitcoin halving is a dramatic event occurring every four years, where the reward for mining new coins gets cut in half. This not only impacts miner income but often sparks market volatility due to the decreasing supply of new Bitcoin hitting the market.

BTC halving countdown

0

D

:

0

H

:

0

M

:

0

S

The next Bitcoin halving is estimated to occur on 2024.04.20.

Buy BTC

Current BTC price : Rp 0

Every four years, the Bitcoin network experiences a pivotal event called the halving.

This comprehensive guide dives into the fundamentals of Bitcoin halving, exploring past events and their impact, and analyzing the potential future of Bitcoin in the ever-evolving cryptocurrency market, including:

- The Significance of Bitcoin Halving

- Importance of Bitcoin Halving for Investors

- Comprehensive Analysis of Bitcoin Halving in 2012, 2016, 2020, and 2024

- When will the total mining of 21 million Bitcoins be completed?

- Impact of Bitcoin Halving on the Cryptocurrency Market

- FAQs about Bitcoin Halving

Bitocin Halving explained

The Bitcoin whitepaper states that block rewards should be permanently reduced by half every 210,000 blocks, or approxiately every four years, inorder to decrease the number of new coins entering the Bitcoin network.

What is Bitcoin Halving?

A Bitcoin halving is when block rewards for miners on the Bitcoin blockchain are cut in half to reduce the number of new coins entering the networkThe initial Bitcoin block reward was 50 BTC. Currently, the block reward is 6.25 BTC and after the next halving the block reward wilbe 3.125 BTC.

Why was the Bitcoin halving done?

A Bitcoin halving helps to manage Bitcoin's inflation rate by controlling supply, which is fixed at 21 million bitcoins. This mechanism curbs the flow of new coins coming into circulation, ensuring scarcity and avoiding devaluation.

When is the Next Bitcoin Halving?

The next halving is estimated to take place on 2024.12.21. It will reduce the block reward to 3.125 BTC. This date is based on current estimates that change with every new block.

Why Bitcoin Halving is Important for Investors?

Every Bitcoin halving is one of the most anticipated events in the cryptocurrency market. It can have a significant impact on the price of Bitcoin and the overall market dynamics, even during the countdown period. The reasons include:

Rarity

Bitcoin introduced the concept of digital rarity, a novel idea before Bitcoin's creation. It proves that it's possible to have a digital asset with a known, limited supply, which is verifiable by anyone using the blockchain.

Deflationary Asset

Unlike fiat currencies, which are inflationary due to their potentially unlimited supply, Bitcoin is considered a deflationary asset. This is because its supply is fixed, which means that over time, assuming demand remains constant or increases, its purchasing power could increase.

Miner Impact

As block rewards become less significant some miners cease operations because it is no longer profitable due to rising costs. The potential decline in hash rate could affect the price of Bitcoin.

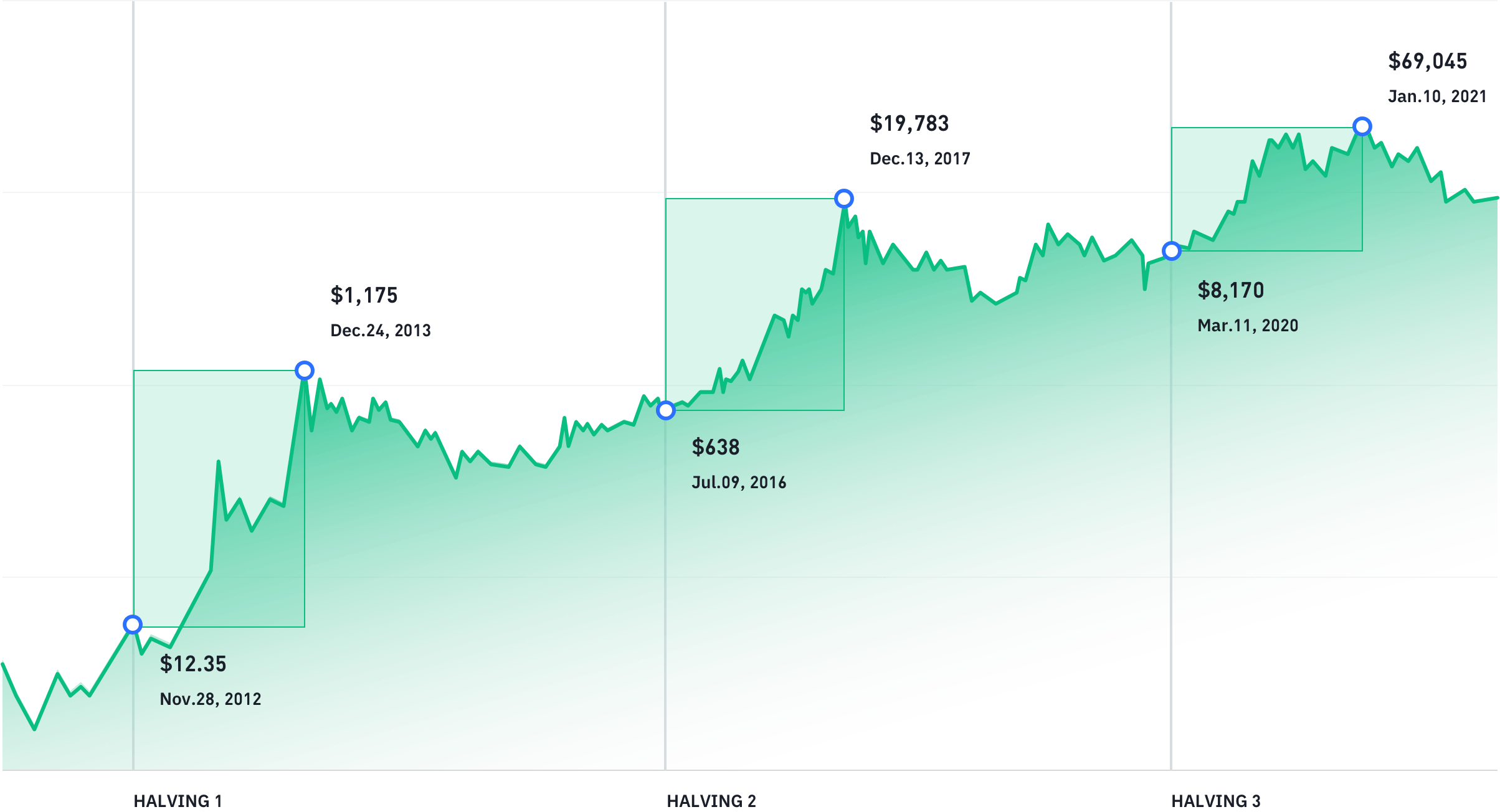

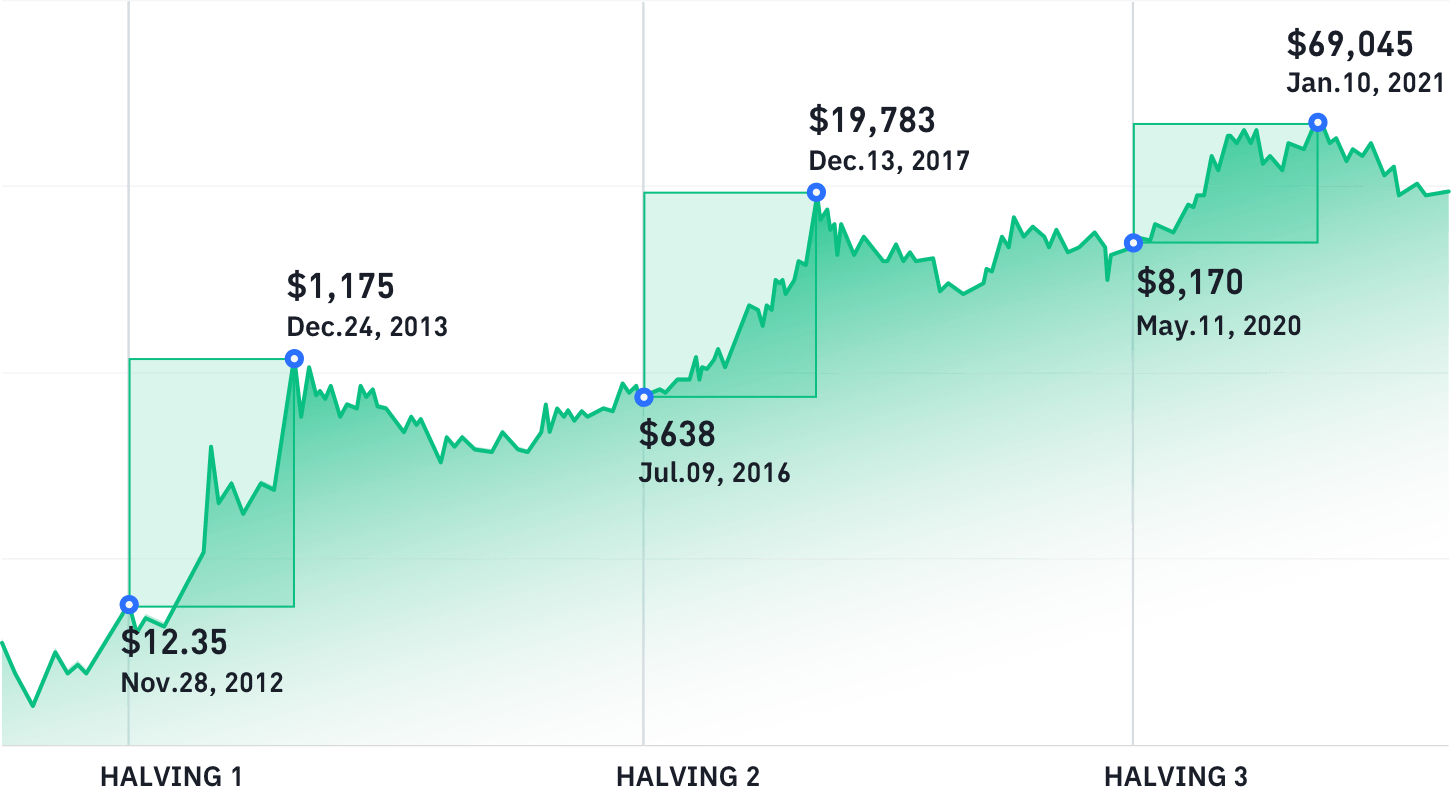

Bitcoin Halving Dates History

In each past Bitcoin Halving, it has stimulated a significant surge in Bitcoin prices and further growth in the cryptocurrency market, leading to increased investments across the entire market

Bitcoin Halving Chart

Bitcoin has experienced three halving events since its inception. Here's how each halving impacted the market:

First Halving

November 2012• Pre-Halving Block Reward: 50 BTC

• Post-Halving Block Reward: 25 BTC

• Market Impact: The price of Bitcoin had a more gradual increase after the second halving. The cryptocurrency was trading around $5 at the time of the halving and experienced significant growth throughout 2013, ultimately reaching an all-time high close to $1140 in December 2013.

01

Second Halving

July 2016• Pre-Halving Block Reward: 25 BTC

• Post-Halving Block Reward: 12.5 BTC

• Market Impact: Bitcoin's journey post-second halving was a spectacle, soaring from a modest $650 to an astonishing peak near $20,000 by December 2017. This meteoric rise turned heads, marking a defining chapter in the saga of digital currencies

02

Third Halving

May 2020• Pre-Halving Block Reward: 12.5 BTC

• Post-Halving Block Reward: 6.25 BTC

• Market Impact:Bitcoin's price trajectory saw a more measured ascent. Initially priced at approximately $3400 around the halving event, the digital currency charted a notable growth path through 2021, culminating in an unprecedented peak nearing $6900 by November of that year

03

Fourth Halving

2024-12-21It's important to note that although Bitcoin halvings are often followed by a price increase, there are many other factors that influence its price. Things like the general market sentiment, regulatory changes, an increasing number of institutions adopting Bitcoin, and the overall economic conditions, all play a role in determining the price of Bitcoin.

04

When will the total supply of 21 million Bitcoins be fully mined?

Given the curent trajectory of the Bitcoin blockchain, the Bitcoin haling is likely to occur approximately every four years until the block rewardreaches zero. It is challenging to predict what the future trends in block rewards will look like.

The quantity of Bitcoin and the rewards will halive with each event. Based on the current Bitcoin haiving cycle and schedule, 100% of all Bitcoins areprojected to be mined around the wear 2140.

What to Know 98% of the total Bitcoin supply will be mined by 2032.

Impact of Bitcoin Halving on the Cryptocurrency Market

Every time a Bitcoin halving occurs, it usually attracts a lot of attention and speculation in the crypto world. Because the amount of Bitcoin that can be mined decreases, and many people hope its demand will rise, the price of Bitcoin often fluctuates.

Based on previous halvings, the price of Bitcoin usually rises again in the following months or years, starting from the price before the halving and then continuing to increase.

However, the increase in Bitcoin's price after a halving is not influenced solely by the reduced supply. There are many other factors at play. Over time, as fewer new Bitcoins are mined, the extremely high price increases may start to diminish. Factors such as people's sentiment towards the market, how many people want to buy Bitcoin, investor speculation, and real-world events, can all influence how the price of Bitcoin reacts to a halving.

Although halvings typically help to increase the price of Bitcoin over the long term, short-term price changes can be unpredictable and depend on the market conditions at that time.

Know More about BTC Halving

FAQ

What is Bitcoin Halving ?

Bitcoin Halving is an event where the block reward obtained by Bitcoin miners is cut in half.

When is Bitcoin Halving 2024?

The estimated time for the Bitcoin Halving in 2024 is on April 19, 2024.

What month is the Bitcoin Halving in 2024?

The estimated time of Bitcoin Halving 2024 is April 2024.

Will BTC prices rise after Halving?

Historically, halvings have been followed by an increase in the price of BTC, but it's important to remember that the cryptocurrency market is influenced by many factors. Halving reduces the supply of new Bitcoin, which could drive up the price if demand remains high. However, market conditions, investor sentiment, regulatory developments, and global economic factors also play a role in determining price. So, although halving can be a positive indicator, there is no absolute guarantee that prices will rise. Investors should consider all these factors and proceed with caution, given the volatility of the crypto market.

How often does Bitcoin Halving occur?

Bitcoin Halving occurs every four years. This is part of the mechanism specified in the Bitcoin code to reduce half the block prizes received by miners, which aims to control inflation and limit the supply of bitcoin to a maximum of 21 million coins.

What happened during Bitcoin halving?

When a halving occurs, the reward given to Bitcoin miners for each block they successfully mine is cut in half. This means that the amount of new Bitcoin released into circulation as a reward for mining a block is reduced. The halving is done to decrease the rate at which new Bitcoin is created, thus extending the period of Bitcoin distribution until about the year 2140 and helping to control inflation. Halving is part of the Bitcoin protocol designed to maintain Bitcoin's scarcity and value over the long term.

What to do before Bitcoin Halving?

Before a Bitcoin Halving, it is important for both investors and miners to evaluate their strategies, prepare for market volatility, and consider operational efficiency. Investors may consider buying in early, while miners might need to think about cost efficiency. Both parties should be ready with a risk management plan and financial reserves to handle potential price fluctuations.

What happened after Bitcoin Halving?

After a Bitcoin Halving, the reward for miners is reduced by half, which could potentially increase the price of Bitcoin if demand remains high due to the reduced new supply. This could also increase market volatility and affect mining profitability.

What are the benefits of Bitcoin Halving?

One of the benefits of Bitcoin Halving is the increase in BTC price. This is because the halving reduces the amount of new Bitcoin created and awarded to miners by half, which can make Bitcoin more scarce and potentially increase its price. It also aims to keep mining profitable, ensure network security, and prevent Bitcoin inflation from becoming too high. By scheduling Halving regularly, Bitcoin tries to ensure stability and make its future more predictable. Nevertheless, the change in Bitcoin price after Halving can vary, depending on many factors such as demand and global market conditions.

When was the first Bitcoin Halving?

The first Bitcoin Halving occurred on November 28, 2012.