5 Important Bitcoin Facts of the Week You Should Know!

2024-11-26

Bittime - Bitcoin has experienced interesting movements in the past week. Starting from attempts to pass the $100,000 level to experiencing a price correction.

Here are 5 important facts about Bitcoin this week that you must know! Read this article to find out more!

1. Bitcoin Facts: Bitcoin Weekly Closing Record

This week, Bitcoin recorded a new ATH with the highest weekly close in history at $98,000. This figure shows Bitcoin's performance in November, which was the best month in the last 5 years.

However, even though it is close to $100,000, Bitcoin has still not managed to break through that level. Some analysts call the $100,000 level more of a psychological symbol than a technical reference.

In fact, some believe that a short-term correction could occur before resuming the uptrend. This correction is considered important to maintain market balance.

2. Bitcoin Facts: The Role of Liquidity and Potential for Corrections

At the end of last week, the price of Bitcoin fell to $95,800 before strengthening again. This drop triggered massive liquidations worth $500 million across the crypto market.

Source: TradingView.com

Data from Hyblock Capital shows that there are two main liquidity zones, namely $88,500 on the downside and $100,600 on the upside.

According to some analysts, the $88,500 zone has greater liquidity than $100,600, so there is a possibility that Bitcoin will test the lower zone again before moving higher.

However, if the market is able to maintain the $98,500 level, the prospect of closing the gap at $99,000 remains open.

3. Bitcoin Facts: Long-Term Holders Surge Activity

Long term investors or long-term holders (LTH) are now starting to take profits amidst the surge in Bitcoin prices.

Data from CryptoQuant shows that this week, realized profits from LTHs reached a new record of $443 million.

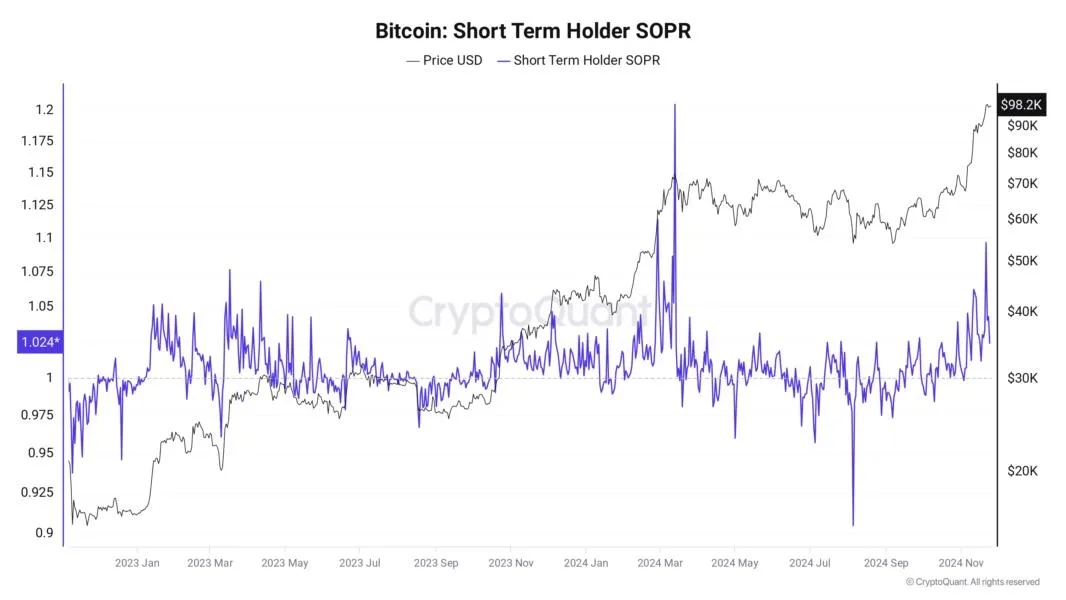

However, this profit-taking action is not only carried out by LTH. Short term holders or short-term holders (STH) are also actively selling their assets.

Source: TradingView.com

According to analysis, when the Spent Output Profit Ratio (SOPR) indicator for STH reaches 1.02, price corrections often occur. Currently, SOPR is at that level, which indicates the potential for a small correction in the near future.

4. Bitcoin Facts: US Macroeconomic DAta Affects Bitcoin

Currently, market attention is focused on US macroeconomic data, including Personal Consumption Expenditures (PCE) inflation reports and unemployment figures.

This report is important because it will influence the Federal Reserve's interest rate policy. The Federal Reserve previously decided to lower interest rates by 0.25% at its November meeting.

However, with inflation rising again, the likelihood of further rate cuts is uncertain. This Fed policy will have a direct impact on the risk asset market, including Bitcoin.

5. Bitcoin Facts: Record of Bitcoin ETF Inflow

Bitcoin ETFs continue to attract interest from institutional investors. In the last 5 trading days, total net inflow reached $3.35 billion, setting a new weekly record.

So far, November has recorded an inflow of close to $7 billion, making it the best performing month of the year.

Bitcoin ETFs provide a balance to selling pressure from long-term investors. With demand continuing to increase, some analysts believe that this inflow is capable of pushing the price of Bitcoin beyond $100,000 in the near future.

That's are 5 important facts about Bitcoin this week. This week has been one of the most interesting Bitcoin price movements, with record weekly closings, a surge in investor activity, and the impact of macroeconomic data.

Even though the $100,000 level has not been reached, market dynamics show that Bitcoin still has great appeal in the eyes of global investors.

Read Also: Bums Lottery Daily Combo 26 November 2024, Choose These 3 Cards!

Bitcoin FAQ

What is Bitcoin?

Bitcoin is the world's first crypto asset and the largest crypto asset by market capitalization. Bitcoin was first created in 2009 by Satoshi Nakamoto, whose true identity until now no one knows.

How many Rupiah is 1 BTC?

Currently, 1 BTC is worth IDR 1,481,973,598 based on the Bittime market.

How much 1 BTC is USD?

Currently, 1 BTC is worth $92,866.20 according to Coinmarketcap.

How to Buy Crypto di Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your knowledge in the world of crypto.

Reference:

Trading View, Media Crypto Trading View, accessed November 26, 2024.

Coin Market Cap, Media Crypto Coin Market Cap, accessed November 26, 2024.

Author: IPR

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.