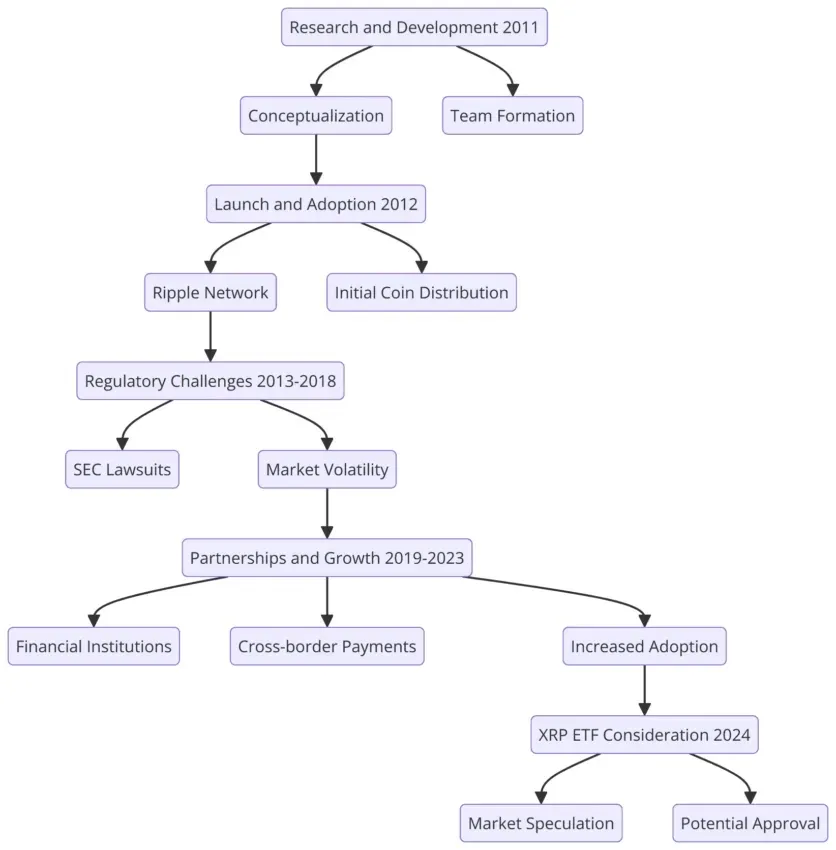

What Is XRP ETF? Completely examine prices, Benefits and Availability on the global stage

2024-12-04

Bittime - The United States regulators' approval of Bitcoin ETF and Ethereum ETFs, the crypto market is now paying attention to the potential of a Solana ETF and an XRP ETF. The XRP ETF will offer a new way to get involved in the crypto market without having to hold the asset directly.

This article will explain in more depth about the XRP ETF, including its meaning, working mechanism, and benefits and risks.

What Is an XRP ETF?

XRP ETF or (Exchange-Traded Fund ETF) the underlying asset used is XRP, managed by a professional investment management company. With this ETF, investors can buy or sell ETF units representing a portfolio of XRP assets without having to own the crypto directly.

For example, when choosing to invest in an XRP ETF, you are actually buying shares that track XRP price movements in the market.

Investment managers are responsible for ensuring the price of an ETF remains in line with the value of its underlying assets, using a process known as the creation and redemption of ETF units.

How Do XRP ETFs Work?

The XRP ETF operates by involving a “unit creation” and “fund disbursement” process that ensures the ETF unit price remains in line with the value of the underlying asset, namely XRP.

Unit Creation

Authorized Participants (AP) buy XRP in large quantities when demand for ETFs increases. The XRP is sent to the ETF provider, which then issues new XRP ETF units.

Disbursement of funds

When ETF demand decreases, the AP returns the ETF units to the provider. The provider then returns the equivalent XRP to the AP, causing the supply of ETF units to decrease.

Method XRP ETF Price Set?

The XRP ETF price is influenced by several key factors:

Creation of Units and Disbursement of Funds

- The unit creation process is carried out by Authorized Participants (APs) who buy XRP in large quantities and exchange them for new ETF shares. This ensures that the supply of ETF shares remains stable and the price does not deviate too much from the price of XRP.

- Conversely, if ETF demand decreases, the AP returns the ETF shares to the ETF provider to be exchanged back for XRP, reducing the supply of ETF shares in the market.

Other Market Factors

- Factors such as market liquidity, institutional investor participation, regulatory challenges, and market sentiment also influence the price of an XRP ETF.

That process keeps the price of the ETF in line with the value of XRP in the market, supported by arbitrage opportunities exploited by the AP to stabilize the price.

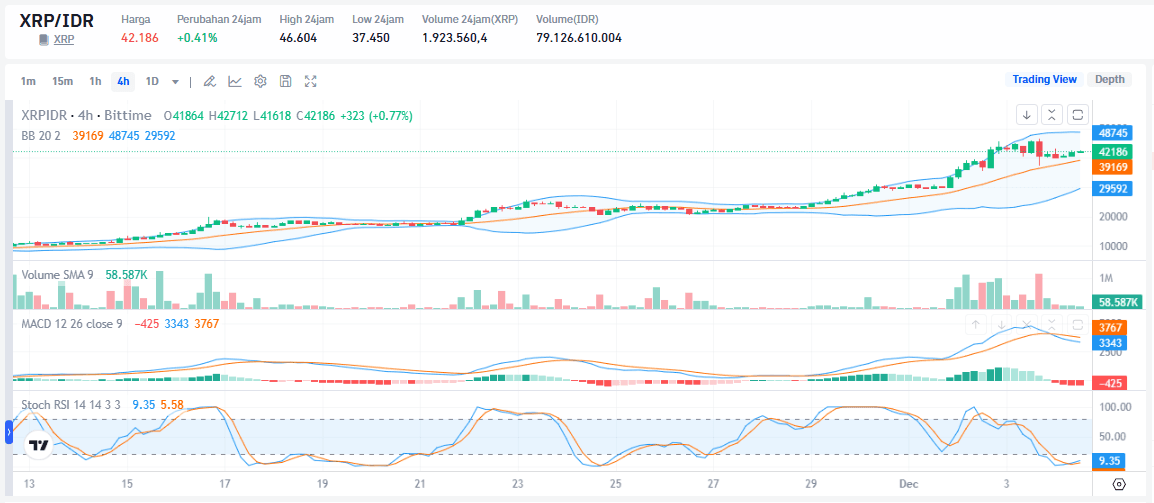

Current Ripple (XRP) Price

Check the price chart XRP/IDR today and the crypto market as a whole in real-time on Bittime.

XRP ETF Benefits and Risks

Benefits of XRP ETFs

The XRP ETF offers several significant advantages for investors:

1. Ease of Access

Investors can purchase ETF shares through traditional trading platforms without having to understand the intricacies of blockchain technology or the risks of holding crypto.

2. Professional Management

These funds are managed by professional investment managers who are responsible for managing risk and keeping ETF prices stable.

3. High Liquidity

ETFs listed on major stock exchanges have higher liquidity than crypto trading on traditional exchanges.

4. Portfolio Diversification

The XRP ETF provides a structured and diversified investment alternative for investors looking to explore digital assets.

Risk XRP ETF

However, like any investment product, XRP ETFs also have risks that need to be considered:

1. Market Volatility

XRP is known for high price fluctuations, which can impact the value of ETFs.

2. Regulatory Risk

Regulatory approval, especially in the United States, remains a major challenge for XRP ETFs.

3. Management Fees

XRP ETFs may have higher management fees than other ETF products.

4. Risk Technology

Risks related to technology failure or hacking are also a major concern.

Global Availability of XRP ETFs

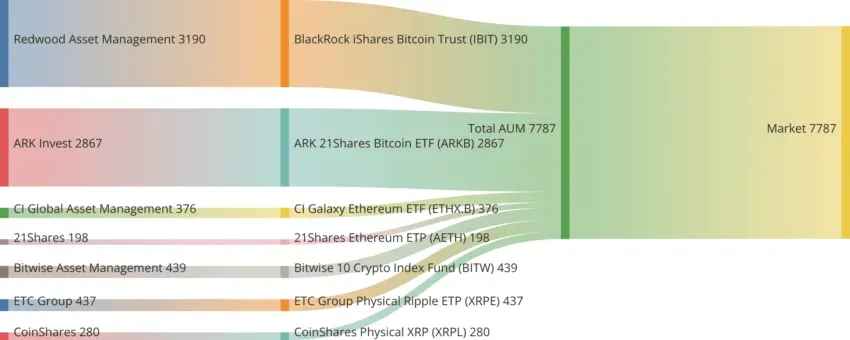

Currently, global availability of XRP ETFs is still limited. In Europe, several countries such as Switzerland and Germany have approved products that track the price of XRP.

For example, 21Shares Ripple XRP ETP (AXRP) is listed on the SIX Swiss Exchange and CoinShares Physical XRP (A3GRUE) on Xetra, Germany.

Outside Europe, Singapore also shows great potential for adopting XRP ETFs with its progressive regulations. However, in the United States, the approval of an XRP ETF is still hampered by legal processes and the cautious attitude of the Securities and Exchange Commission (SEC).

Comparison of XRP ETFs with Bitcoin and Ethereum ETFs

As an investment product, the XRP ETF has several similarities and differences compared to Bitcoin and Ethereum ETFs:

The main difference lies in the regulatory challenges that XRP faces in the US, related to the SEC's lawsuit against Ripple Labs. However, optimism remains as global markets progress.

Conclusion

The XRP ETF offers an exciting opportunity for investors to engage in the crypto market in a safer and more regulated way.

Despite regulatory challenges and market risks, their potential benefits in increasing liquidity and attracting institutional investment make these ETFs a noteworthy innovation.

With increasingly clear regulations and growing global adoption, XRP ETFs could become an important instrument in the digital asset investment ecosystem. However, investors should always conduct in-depth research and consider the risks before investing.

FAQ

What Is XRP Used For?

XRP is used as a means of payment and transaction settlement on the Ripple Net network, which facilitates money transfers between financial institutions, businesses and organizations.

XRP also serves to increase liquidity in cross-border transactions and reduce costs and time required for settlement.

Whose XRP Coin Does It Own?

XRP is a token developed by the company Ripple Labs Inc.

Although Ripple owns the majority of the XRP supply, the token operates on an open-source blockchain network and is not owned by a single entity.

What is the Highest Price of XRP?

The highest price of XRP reached $3.40 in January 2018.

Since then, the price of XRP has experienced significant fluctuations, influenced by various market and regulatory factors.

Author: Fkey

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.