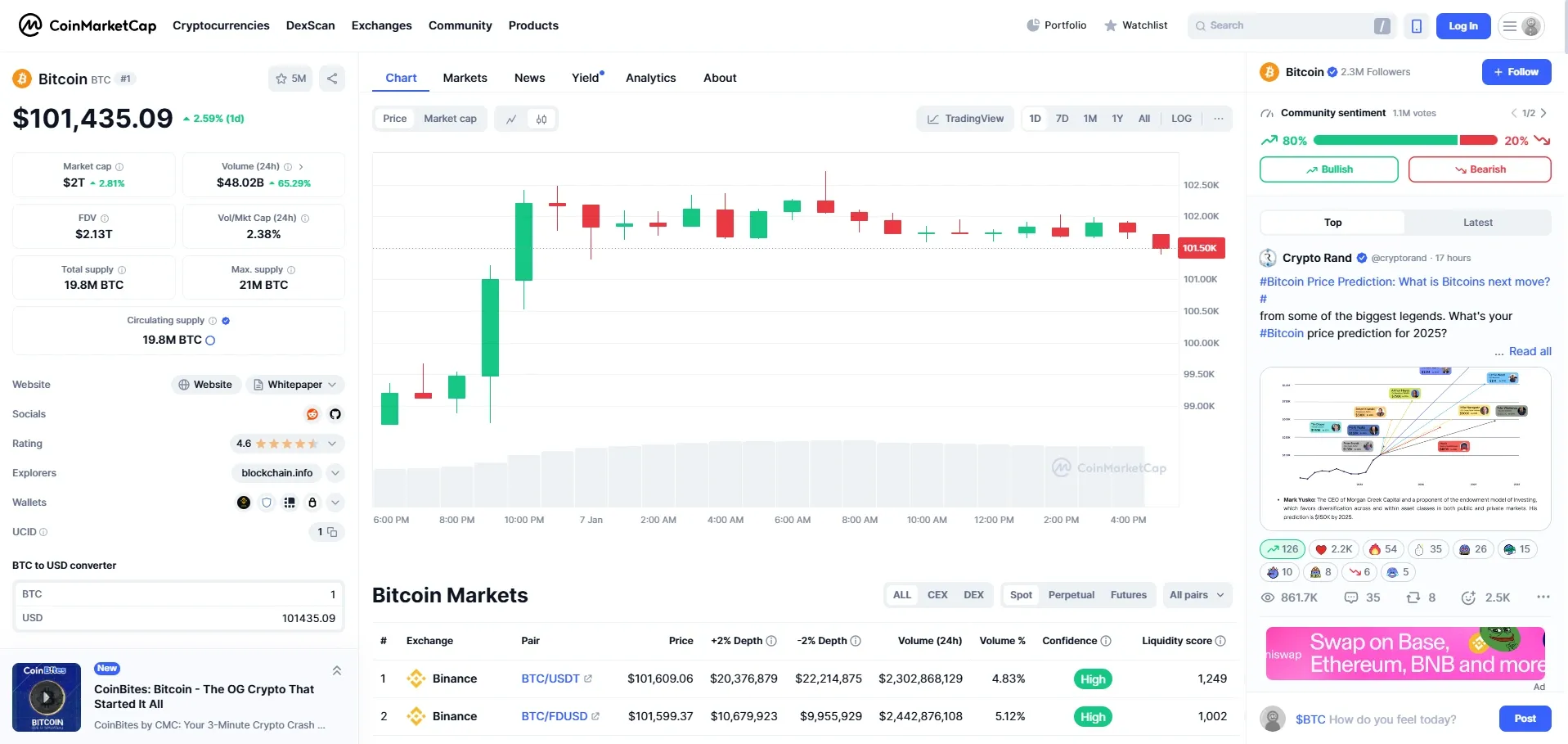

Bitcoin Price Returns to $100K Again, To The Moon or Dropping Again?

2025-01-07

Bittime - The beginning of 2025 was a big surprise because Bitcoin, the most popular digital asset, managed to once again break through the psychological mark of $100,000. But, is this a sign of "reaching the moon" or will it face a sharp decline later? Let's take a closer look at the future!

Reason Bitcoin Price Rising?

Bitcoin hit the $100,000 mark thanks to very strong market momentum and tighter supply. According to the latest report from Bitfinex, the liquidity inventory ratio (Liquidity Inventory Ratio) shows a sharp decline.

In October 2024, that figure was 41 months, but now only 6.6 months remain. What does it mean? The supply of Bitcoin available on the market is decreasing, while demand continues to increase.

In addition, the activity of Bitcoin miners (miners) who usually sell their coins to exchanges is now at its lowest level in recent years. With reduced pressure from the sales side, prices are pushed up.

Apart from that, the block reward cut (halving) in 2024 also has an important role. Miners chose to hold their BTC, instead of selling, due to favorable market conditions.

The Role of Global Trends in the $100K BTC Price Increase

Bitcoin's increase was also driven by positive global sentiment. The election of Donald Trump as the 47th US President created optimism in financial markets. At the end of 2024, Bitcoin even reached an all-time high of $108,100 before correcting 15%.

However, it is not only political factors that play a role. The US economy also shows solid performance at the end of 2024, especially in the labor sector. This drives investor interest in risky assets such as Bitcoin.

Has the market reached its peak?

Despite high optimism, some analysts warned of the risk of the market starting to "overheat." CryptoQuant notes that 36% of Bitcoin supply has been traded in the past month.

This activity indicates that we may be approaching the end of the bull market cycle that began in January 2023.

According to CryptoDan, a leading analyst, the price peak will most likely occur in the first or second quarter of 2025. However, he also reminded investors to be careful of a potential correction.

“Big profits are still possible, but risk management is critical. "I personally plan to sell in stages," he said.

Risk or Opportunity?

With all the data at hand, we face two big scenarios:

- To The Moon: If demand continues to outstrip supply, Bitcoin's price could surpass $100,000 and set a new record. The halving that occurs in 2024 provides a strong basis for a bullish trend. Plus, if the global economic situation remains favorable, institutional investors may become increasingly interested in entering the crypto market.

- Plummets Again: However, as the old adage in the investment world goes, "What goes up, must come down." An overheated market can trigger a major correction, especially if there is negative sentiment such as restrictive government policies or a weakening global economy.

Conclusion

Bitcoin at $100,000 is a historic moment that brings both hope and challenge. For investors, this is a time to remain vigilant and manage risks wisely.

Don't be too lulled by euphoria, but also don't be afraid to take opportunities amidst this momentum. So, in your opinion, will Bitcoin continue to "go to the moon" or will it experience a major correction?

FAQ Bitcoin $100K

What caused the price of Bitcoin to return to $100,000?

Bitcoin price reached $100,000 due to tighter supply in the market and ever-increasing demand. The Bitfinex report shows that the liquidity inventory ratio has dropped drastically, meaning there are fewer Bitcoins available for sale.

In addition, the block reward cut (halving) in 2024 makes miners prefer to keep their Bitcoins, thereby reducing selling pressure. Plus positive global sentiment, such as the election of Donald Trump as the 47th US President, also drove this increase.

Will Bitcoin price continue to rise after reaching $100,000?

Although there is a chance for further upside, some analysts believe that the market is nearing the peak of the bull market cycle. Bitcoin's high trading activity, as noted by CryptoQuant, indicates that a peak will likely be reached in the first or second quarter of 2025.

However, the potential for profits remains as long as demand continues to exceed supply, especially if there are no major disruptions from external factors.

What are the main risks facing Bitcoin investors today?

The biggest risk is the potential for a significant price correction if the market overheats. Untimely price increases are often followed by massive profit-taking by investors, which can trigger sharp price drops.

Additionally, government policies or changes in global economic conditions may add pressure to the market. Therefore, it is important for investors to manage risk with strategies such as portfolio diversification or selling in stages.

References

Bitcoin surges past $100K as market eyes bullish cycle peak, Crypto Briefing, accessed on January 7, 2025

Author: Fkey

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.