Crypto Analyst Calls Bitcoin Entering Bull Trap Phase

2024-10-17

Bittime - Bitcoin is back in the spotlight. After briefly stabilizing above the crucial level of $65,000 (around IDR 1 billion), several analysts warned that this price spike may not be an indication of a healthy recovery. But Bitcoin is entering a “bull trap” phase. What's that? Check out the explanation in this article!

Crypto trading expert Alan Santana, in an analysis on TradingView on October 16, 2024, emphasized that the current market movement has the typical characteristics of a “bull trap” — a trap that can deceive investors with false hopes.

In his explanation, Santana compared Bitcoin's growth from early August to October with the previous price spike in January 2024. He said that the recent 39% increase was different from the strong increase earlier in the year which reached 91% in 51 days.

The current market movement actually shows a weaker pattern, with a pattern of "lower highs" and "lower lows" — an indication that market strength is decreasing.

What is a Bull Trap?

A bull trap or bullish trap is a situation where asset prices show signs of significant increases, making traders believe that the uptrend (bullish) will continue.

This phenomenon often triggers euphoria, making many traders feel tempted to buy in the hope that prices will rise higher. However, after they bought, the price suddenly reversed direction and fell drastically.

This situation causes traders to experience losses because they are trapped in the illusion that the bullish trend will continue. In conditions like this, caution is needed so that investors are not trapped and suffer large losses.

Read also: Google Removes Bitcoin and Other Crypto Price Charts from Search: What's Up?

Potential Bitcoin Decline of up to IDR 604 Million

Source: Binance Square

Santana warns that the Bitcoin market is at high risk. According to him, if this pattern continues, the price of Bitcoin has the potential to fall again to $39,000 (Rp. 604.5 million) or even lower.

He emphasized that despite high optimism regarding Bitcoin reaching $100,000 (around Rp. 1.55 billion), the signals in the market currently indicate otherwise.

"This is not a bullish impulse, but rather a reverse correction. Bitcoin is heading for a decline," he said.

Not only Santana, economist and Bitcoin critic Peter Schiff also supports this pessimistic view. Through an upload on the X platform on October 16, Schiff emphasized that even though Bitcoin experienced short-term strength, this asset remained trapped in a price range below its all-time high.

"People were too focused on the Trump-inspired Bitcoin surge, when gold actually set a new record above $2,680 (Rp. 41,540,000)," wrote Schiff.

Optimism of the Symmetrical Triangle Pattern on the Bitcoin Chart

On the other hand, some analysts are still optimistic. A pseudonymous crypto analyst The Moon said that Bitcoin managed to re-test the support level at around $65,000 (Rp. 1,007,500,000) and remained in a symmetrical triangle pattern.

This pattern often signals a period of consolidation before a significant price spike occurs. If momentum maintains and Bitcoin manages to break upwards, this asset could reach the $70,000 (Rp. 1,085,000,000) level in the near future.

Additionally, some market players think that Bitcoin's current price movement may be part of the "Uptober" trend — a phenomenon in which Bitcoin typically sets a new record every October. In the analysis presented by Trading Shot, there is a possibility that the next price target will reach $88,000 (Rp. 1.36 billion).

Read also: $760 Million Worth of Bitcoin Moved by Tesla! What is Elon Musk's Plan?

Bitcoin Long Term Projections

Fundamentally, macroeconomic factors and political developments also influence market expectations. Analysts from Standard Chartered predict that Bitcoin could reach $150,000 (Rp. 2.3 billion) by the end of the year.

This could happen if Donald Trump is re-elected as president. Trump is known to support digital asset innovation and is committed to making the US a leader in the crypto industry.

Price Bitcoin Today

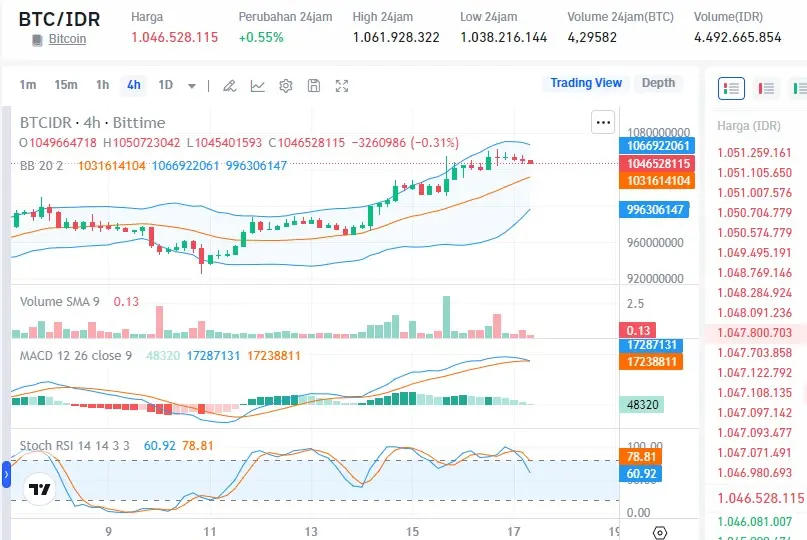

When this article was written, Bitcoin was trading at $67,300 (Rp. 1,046 billion), up 0.55% in the last 24 hours and more than 10% over the week. Bitcoin is currently above its 50-day and 200-day moving averages, indicating a strong bullish trend in both the short and long term.

However, with the Relative Strength Index (RSI) at 65.99, Bitcoin is approaching the overbought zone, which signals a possible price correction in the near future.

Conclusion

Although some analysts are optimistic that Bitcoin can still set a new record, signs of correction and potential bull traps need to be watched by investors.

In a fluctuating market situation like this, the wise step is to remain alert and consider the risks carefully before making a decision. Will Bitcoin manage to break through the $70,000 resistance or will it be trapped in a sharp correction? Only time will tell.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.