Bitcoin Price Analysis and Prediction According to Crypto Academy

2024-08-27

Bittime - Bitcoin, as one of the most dominant digital assets, continues to attract the attention of global investors. Price movements are often influenced by macroeconomic factors, market behavior, and strategic decisions from big players in this industry.

This article will discuss Bitcoin price analysis and predictions based on data and views expressed by the Crypto Academy.

What is Bitcoin?

Bitcoin is a decentralized digital currency that was first introduced in 2009 by a person or group using the pseudonym Satoshi Nakamoto.

Bitcoin uses blockchain technology to record all transactions carried out, thereby ensuring high transparency and security.

Since its launch, Bitcoin has become a popular investment asset and is widely used as a means of payment on various platforms.

Read also: Solve the Daily Cipher Hamster Kombat August 27 Today

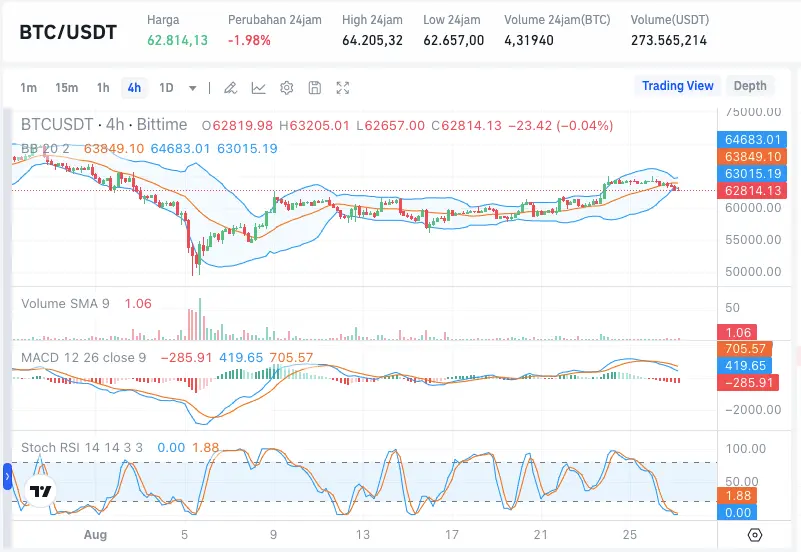

Bitcoin Price Analysis

Summer: Over

Currently, Bitcoin is in a challenging phase where the price is ranging between $55,000 to $60,000. This level is considered a strong resistance area, and there are no strong indications that Bitcoin will break through it any time soon.

Bitcoin's weekly close below $60,000 indicates significant selling pressure, although there have been several attempts to maintain this level.

According to Crypto Academy, the Bitcoin market is currently dominated by large players who are less likely to want to sell their assets at current price levels.

This phenomenon is reinforced by the increase in Bitcoin accumulation by large institutions such as Marathon Digital Holdings, which recently purchased Bitcoin as part of their reserve strategy.

Data from hodl wave also shows that 75% of Bitcoin holders are still holding on to their assets, even though the market is in uncertain conditions.

Bitcoin Price Prediction

In the short term, Bitcoin price is predicted to remain in the consolidation area between $55,000 to $60,000.

However, if Bitcoin is able to break through resistance above $60,000, then a significant price spike is likely. On the other hand, if it is unable to do so, Bitcoin could experience further correction.

Predictions from the Crypto Academy also indicate a negative correlation between Bitcoin and the stock market, especially the S&P 500 index. Currently, the S&P 500 index is increasing, while Bitcoin tends to fall.

This suggests that investors may prefer traditional assets over crypto assets in current market conditions.

Conclusion

Bitcoin price is currently at a crucial point with the potential to experience a further spike or correction.

With the dominance of large players in the market and the uncertain macroeconomic situation, it is important for investors to continuously monitor market developments and adjust their investment strategies.

Crypto Academy views resistance at $60,000 as the key to Bitcoin's future price movements.

How to Buy Crypto on Bittime

You can buy and sell crypto assets easily and safely via Bittime. Bittime is one of Indonesia's best crypto applications, officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also ensure you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application. Study Complete Guide How to Buy Crypto on Bittime.

Monitor graphic movement of Bitcoin (BTC) price, Ethereum (ETH), Solana (SOL), and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.