Bitcoin Price Analysis: Can BTC Rebound?

2025-02-03

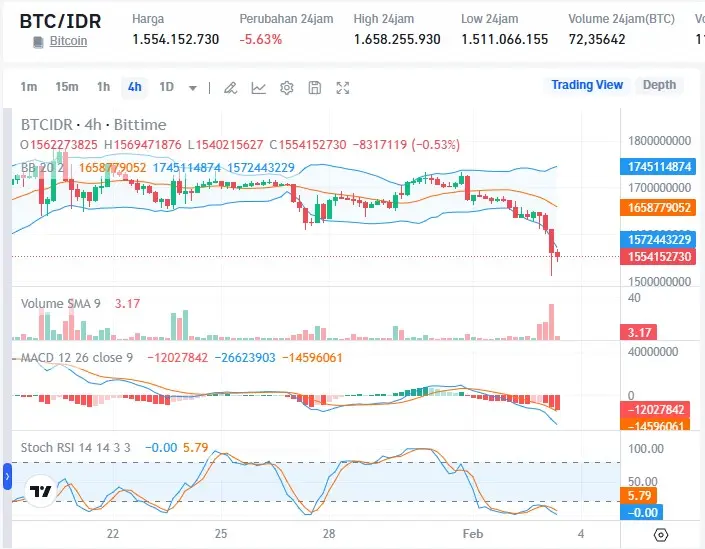

Bittime - Bitcoin (BTC) price has fallen in recent days. Currently, BTC is trading at $93,517 or around IDR 1.5 billion, down more than 6% in the last 24 hours. Can BTC rebound? Check out the Bitcoin price analysis in this article.

However, amidst growing bearish sentiment, several technical indicators are starting to give positive signals. Is this a sign that Bitcoin is rebounding?

This article will discuss current market conditions and opportunities for BTC price recovery based on technical analysis and market sentiment.

Bitcoin Price Down

In the last week, the price of Bitcoin fell quite deeply. The price of BTC fell to the level of $98,638 (around Rp. 1.6 billion), before moving back to around $99,190 (around Rp. 1.618 billion).

This decline also had an impact on market capitalization which fell by 2.72%. This weakening was caused by various factors, including selling pressure from short-term investors and global macroeconomic uncertainty.

Read also: Bitcoin Price Prediction Today February 2

Apart from that, the crypto asset market is also affected by monetary policy which is still tight, making investors tend to be careful in taking positions in high-risk assets such as Bitcoin.

Bitcoin Price Analysis

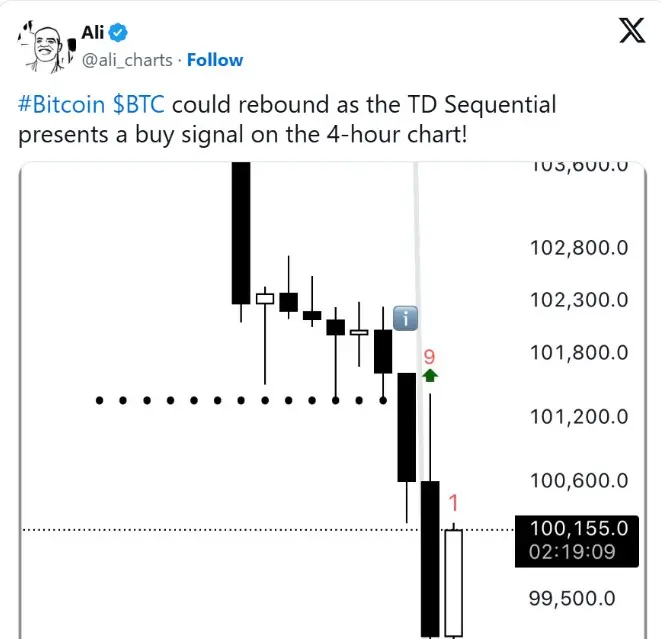

1. TD Sequential Indicator Shows Buy Signal

Source: The Coin Republic

Crypto analyst Ali Martinez observed that the TD Sequential indicator on Bitcoin's 4-hour chart is showing a buy signal. This indicator is often used by traders to identify trend reversal points.

If historical patterns repeat themselves, this could be a strategic opportunity for investors looking to get into the market before prices rise again.

2. Trading Sentiment on Binance Still Bullish

Data from Binance shows that 60.94% of Bitcoin futures traders currently have long positions. The long-to-short ratio on this platform is recorded at 1.56, which indicates that there are more buyers than sellers.

This shows that in general, market players are still optimistic about BTC's medium-term prospects.

Read also: Tesla Profits $589 Million from Bitcoin Investment

3. MACD Indicator Reduces Bearish Pressure

The Moving Average Convergence Divergence (MACD) indicator shows that bearish pressure is starting to weaken. A MACD histogram that is getting smaller indicates that the downward price momentum is starting to wane.

If this trend continues, BTC has the potential to enter a consolidation phase before experiencing another rise.

Can Bitcoin Price Rebound?

Although Bitcoin prices have fallen in recent days, several factors support a possible rebound. The following is the explanation:

Increased Open Interest: Data shows that more and more traders are starting to re-enter the market with long positions.

Support at Key Levels: BTC is still holding above the important support level, namely $98,638 (around IDR 1.6 billion). If this level is not broken down, then it is very likely that BTC could start rising again.

Overall Market Optimism: Positive sentiment among traders and institutional investors is still quite strong, which could be a catalyst for price increases in the medium term.

Some analysts even project that Bitcoin could reach the $120,000 level (around IDR 1,956 billion) in the next few months if the recovery trend continues.

Read also: FOMC Meeting Will Influence Crypto Market: How Will Bitcoin Price Movement?

Conclusion

Overall, although Bitcoin prices are down in the short term, various technical indicators point to a potential trend reversal.

With a buy signal from TD Sequential, bullish sentiment on Binance, and weakening bearish pressure from MACD, the opportunity for a rebound remains open.

However, investors still need to be aware of market volatility and pay attention to key support levels before making investment decisions.

FAQ

1. What is the main cause of the Bitcoin price drop?

The decline in BTC prices was caused by short-term investor selling, macroeconomic uncertainty, and market sentiment which still tends to be cautious towards crypto assets.

2. What is the TD Sequential indicator?

TD Sequential is a technical indicator used to identify trend reversal points in the market. A buy signal from TD Sequential is often considered an early indication of a price increase.

3. What is the market sentiment towards Bitcoin currently?

Data from Binance shows that the majority of futures traders still have long positions, indicating that they are optimistic about BTC's upside potential in the near future.

4. What should investors pay attention to before buying Bitcoin?

Investors should pay attention to key support levels, technical trends such as MACD and TD Sequential, as well as the latest news that can influence Bitcoin prices.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Reference

The Coin Republic, Is a Bitcoin Price Rebound on the Horizon? Analyst Weigh in, accessed February 3, 2025.

Ali Martinez, Account X @ali_charts, accessed February 3, 2025.

Author: Y

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.