Bitcoin Price Analysis with NUPL

2024-08-05

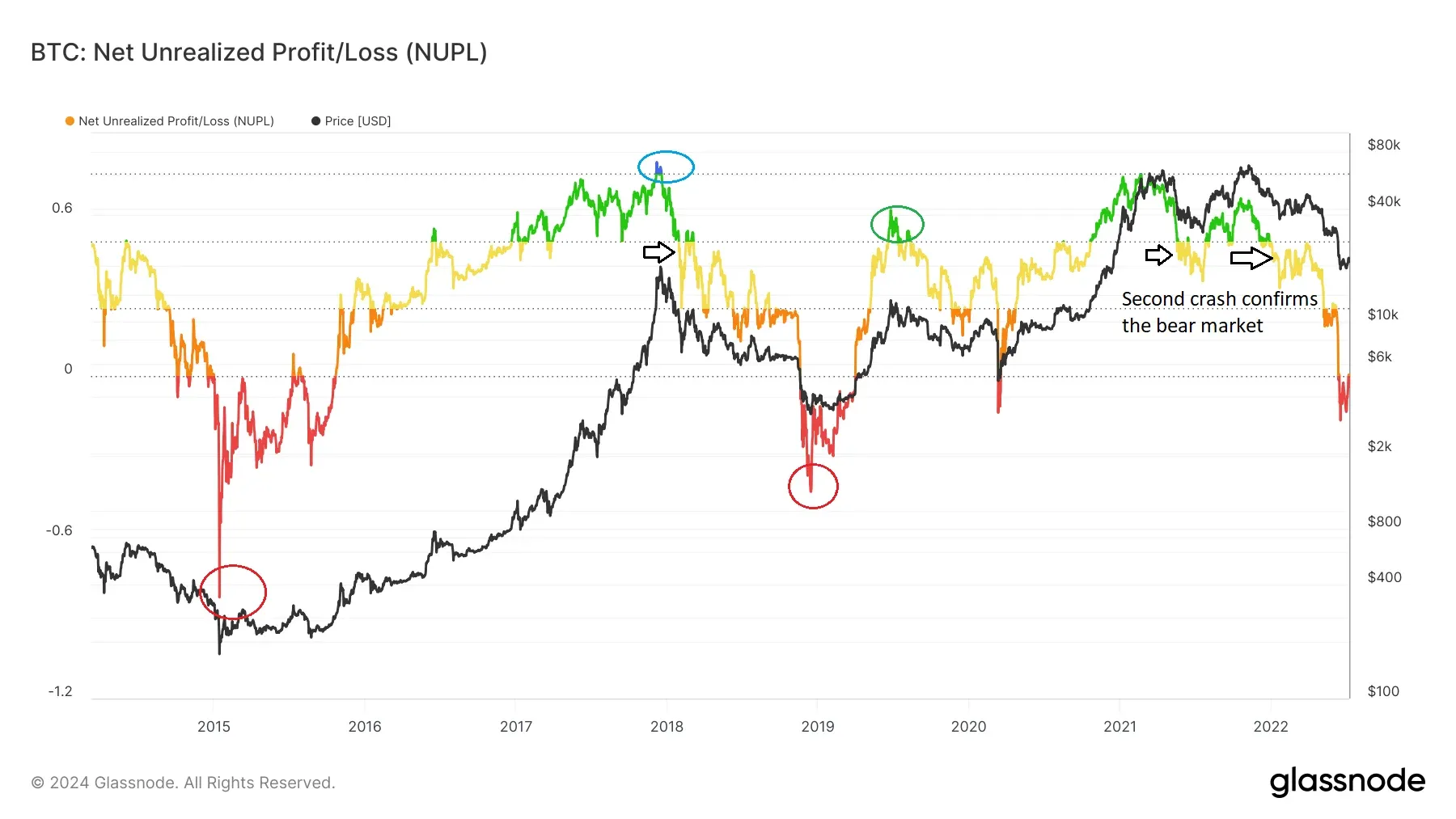

Bittime - NUPL is an on-chain metric that indicates the profitability or loss of the crypto market. The latest NUPL analysis indicates that the Bitcoin market cycle has not yet reached its peak, with bearish patterns dominating.

What is meant by NUPL?

NUPL is an on-chain metric that shows whether the market is experiencing profits or losses. It is calculated by dividing the ratio of unrealized relative gains by unrealized relative losses. A positive NUPL value indicates market profitability, while a negative value indicates the market is losing money.

A loss state means that the total value of BTC purchased at a price higher than the current price is greater than the total value of BTC purchased at a lower price. As a result, losses that have not occurred are greater than profits that have not occurred.

NUPL in Last Year's Market Cycle

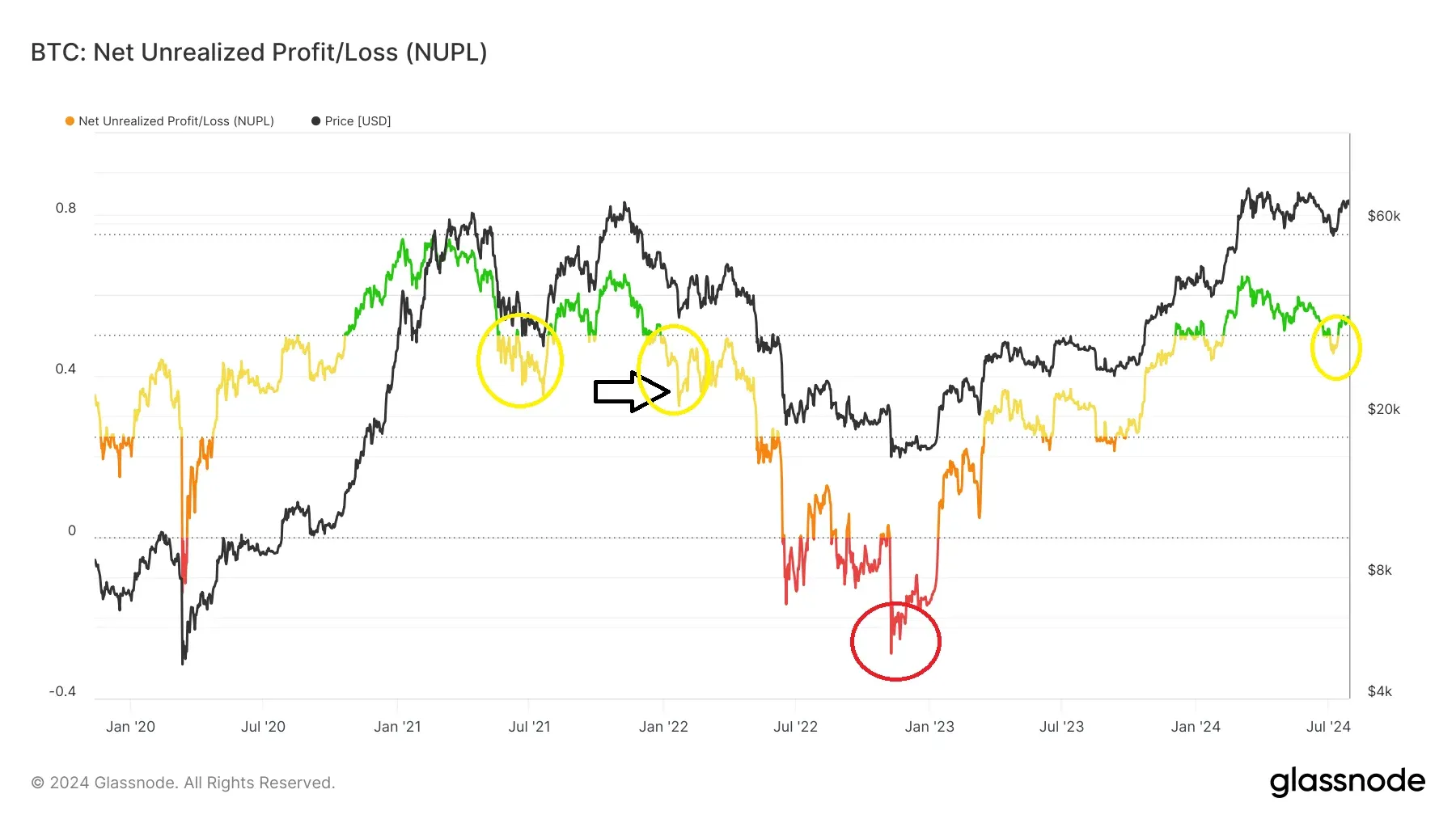

The NUPL indicator reached the Euphoria (blue) category last January 2017, but did not reach it in 2020, reaching only 0.748. NUPL fell below 50 to the emergency level (yellow) in both market cycles, and then returned to above 50 and then fell again, thus confirming the bearish trend.

Read Also: Bitcoin Price Prediction 2024 According to Experts

Bitcoin Price Analysis with NUPL

According to previous history, the NUPL indicator will reach a high above 70 and then fall below 50 to confirm a bearish trend. This shows that the crypto market cycle has not yet reached its peak, it is very likely to reach its next high.

LTH-NUPL supports the decision. The price has surged well into the Euphoria stage (blue), which was above 0.82 in the previous two market cycles. It hasn't even crossed 0.75 in the current market cycle.

Conclusion

A positive value of NUPL indicates market profitability, while a negative value indicates a loss. This is an on-chain metric that shows whether the crypto market is in a state of profit or loss. In the previous market cycle, NUPL reached the Euphoria category in January 2017, but did not reach it in 2020, reaching only 0.748. NUPL usually falls below 50 to the anxiety stage and then rises again, indicating a bearish trend.

Typically, the NUPL indicator peaks above 70 before dropping below 50 to indicate a bearish trend. According to LTH-NUPL data, Bitcoin price has not yet reached the Euphoria stage, which was seen in the previous two market cycles. Overall, this analysis shows that the current market cycle peak has not yet occurred and will likely occur in the future.

How to Buy Crypto on Bittime

You can buy and sell crypto assets easily and safely via Bittime. Bittime is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also ensure you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application. Study Complete Guide How to Buy Crypto on Bittime.

Monitor graphic movement of Bitcoin (BTC) price, Ethereum (ETH), Solana (SOL), and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.