What Is Aevo and How Does It Work?

2024-08-23

Bittime – Aevo is a decentralized exchange or DEX that specializes in derivatives, including options and perpetual contracts. This article will discuss Aevo in detail, starting from its definition, tokenomics, to how it works.

Get to Know More About Aevo

Aevo combines the strong security of Ethereum with the speed of off-chain order matching and on-chain settlement. This is because Aevo uses a special Layer 2 solution that uses Celestia for data availability.

The advanced system supports multiple financial products under one margin account, with a trading volume of more than $10 billion since its launch in April 2023.

One of Aevo's most innovative offerings is Pre-Launch Token Futures, which allows traders to speculate on tokens before their official launch, such as Blast and LayerZero.

This feature allows traders and investors to long or short the pre-market assessment of a token before its generation event.

Aevo's unique combination of decentralized flexibility and the efficiency typically found in centralized exchanges positions it as a major force in the sector.

Baca Also: X Empire and Blum Collaboration: Find Easter Eggs in the App!

The Founders of Aevo

Aevo was founded by Julian Koh and Ken Chan, whose vision has received significant support from top crypto investors, including Paradigm, Dragonfly Capital, and Coinbase Ventures.

The development team consists of experts from leading companies and financial institutions such as Coinbase, Kraken, and Goldman Sachs, as well as alumni from top universities such as Stanford, MIT, and Cornell.

This diverse expertise ensures that Aevo remains at the forefront of DeFi innovation.

How Does Aevo Work?

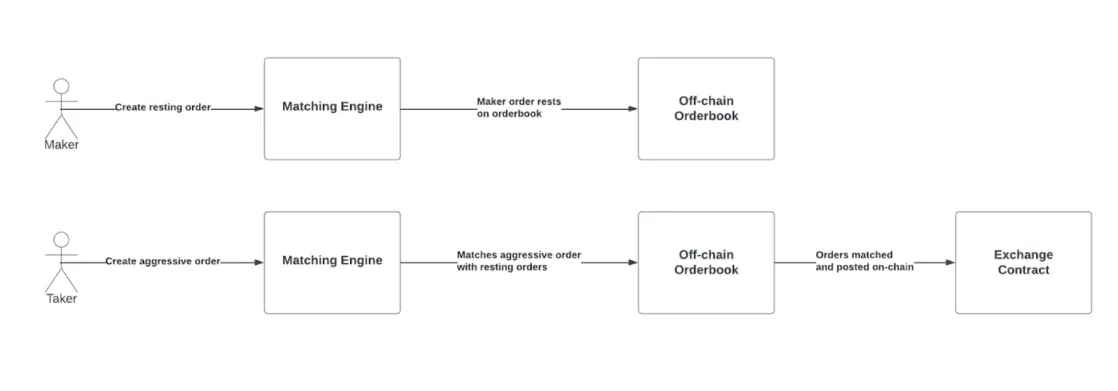

Source: Data Wallet

Aevo leverages a combination of decentralized financial technology (DeFi) and advanced trading frameworks to create a safe and efficient platform for trading derivatives, including crypto options and futures.

Its technical architecture seamlessly integrates off-chain and on-chain components to improve performance and security.

1. Orderbook dan Risk Engine Off-Chain

Aevo uses an off-chain orderbook for fast order matching, preventing blockchain bottlenecks.

The risk engine evaluates orders against portfolio margin to ensure traders maintain adequate collateral, increasing platform security.

2. On-Chain Solutions

Once orders are matched off-chain, they are settled on-chain via Aevo smart contracts.

This method combines the speed of off-chain processing with the transparency and security of blockchain settlement.

3. Layer 2 architecture

Aevo uses a custom Layer 2 rollup based on the OP stack, rolled up to Ethereum. This solution enables high throughput and low latency transactions while leveraging Ethereum's strong security.

4. Liquidasi

Aevo's liquidation process maintains the health of the system and trader positions. If a trader's portfolio fails to meet margin requirements, the liquidation engine gradually reduces positions to restore balance, using insurance funds if necessary.

This technical setup allows Aevo to provide a decentralized trading experience with the performance and efficiency of a centralized exchange, representing a significant advancement in DeFi trading platforms.

Read Also: Catizen Mini Games Center is here, have fun while making money!

How Do Pre Launch Futures Work?

Aevo's Pre-Launch Token Futures allows users to trade the projected value of a token before its official market debut.

This product caters to speculators interested in new projects, offering early access to potential market influencers. Here is a general overview of how these futures work:

- Initial Margin and Leverage: Traders must provide an initial margin of 50%, allowing up to 2x leverage. This feature is important for managing speculative risks associated with pre-launch tokens.

- Maintenance Margin: Set at 48%, this margin requirement ensures traders maintain their positions despite market fluctuations, reducing the risk of sudden liquidation.

- Position Limit: Positions are capped at $50,000 to limit risk and prevent excessive exposure to a single asset.

- Contract Characteristics: These futures do not depend on index prices or funding payments, emphasizing their speculative nature until the token is launched.

- Cost: Contracts are subject to a taker fee of 25 basis points, a maker discount of 10 basis points, and a liquidation fee of 5%, designed to encourage liquidity and effectively manage risk.

- Solution: Settlement occurs in USDC when the token begins trading on external exchanges such as Binance, aligning speculative trading with the market value of the token at launch.

Aevo's Pre-Launch Token Futures offers traders an early opportunity to profit from the new token, highlighting the platform's innovation and leadership in crypto trading.

The Age of Tokenomics

Aevo tokenomics is built around the $AEVO token, a rebranded version of the previous $RBN token, following the RGP-33 governance proposal.

The distribution strategy focuses on increasing platform growth, liquidity and community engagement:

- 16% of $AEVO for Incentives: Aimed at increasing user engagement and liquidity through airdrops and marketing campaigns, managed by the Growth & Marketing Committee.

- 9% for Token Liquidity: To ensure stable liquidity on decentralized and centralized exchanges, it is managed by the Treasury and Revenue Management Committee.

- 5% for Community Growth: Allocated for community events and prizes to encourage active participation, overseen by the Growth & Marketing Committee.

- 16% Suggestion: Set aside for future DAO needs, with 2% allocated annually to Aevo Project Contributors.

With the launch of $AEVO, the incentive campaign will reward holders and stakers, featuring enhanced farming incentives and a structured rewards system to encourage a passionate community.

Staking $AEVO or $RBN grants sAEVO, offering exclusive benefits such as voting rights and access to special initiatives, strengthening Aevo's commitment to decentralized governance and active community engagement.

Read Also: Whales Sell Bitcoin (BTC) For 18.25 Million USD

Conclusion

Aevo stands out as a leading decentralized exchange, offering robust and secure trading for derivatives such as options and perpetual contracts.

With advanced Layer 2 technology and Pre-Launch Token Futures, Aevo provides a unique blend of speed, security and early market access.

Backed by a team of industry veterans and significant support, Aevo is at the forefront of DeFi innovation, making it the top choice for traders looking to capitalize on the future of decentralized finance.

How to Buy Crypto on Bittime

You can buy and sell crypto assets in an easy and safe way via Bittime. Bittime is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Learn How to Buy Crypto on Bittime.

Monitor price chart movements of Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.