What Is Bitcoin Dominance and Its Impact on the Crypto Market?

2024-11-06

Bittime - What is Bitcoin Dominance and How Does it Impact the Crypto Market? Understanding Bitcoin Dominance Bitcoin dominance is the percentage of Bitcoin's market dominance compared to altcoins in the crypto market.

This ratio shows the size of Bitcoin's market share compared to the total crypto market value.

Bitcoin dominance charts are often used as an indicator to analyze market trends, such as predicting altseason or the potential for a significant increase in Bitcoin price.

Also read Bitcoin Price Reaches New ATH, Breaks $75,000!

Why is Bitcoin Dominance Important?

As the first and most popular crypto asset, Bitcoin has a huge influence on the entire crypto ecosystem.

The rise or fall of Bitcoin dominance can provide insight into the direction of the crypto market.

When Bitcoin Dominance Declines

This could be a signal that investors are starting to shift to altcoins.

On the other hand, when Bitcoin dominance increases

The market may be in a bullish phase for Bitcoin.

Also read the Latest Bitcoin (BTC) to IDR Price

History of Bitcoin Dominance

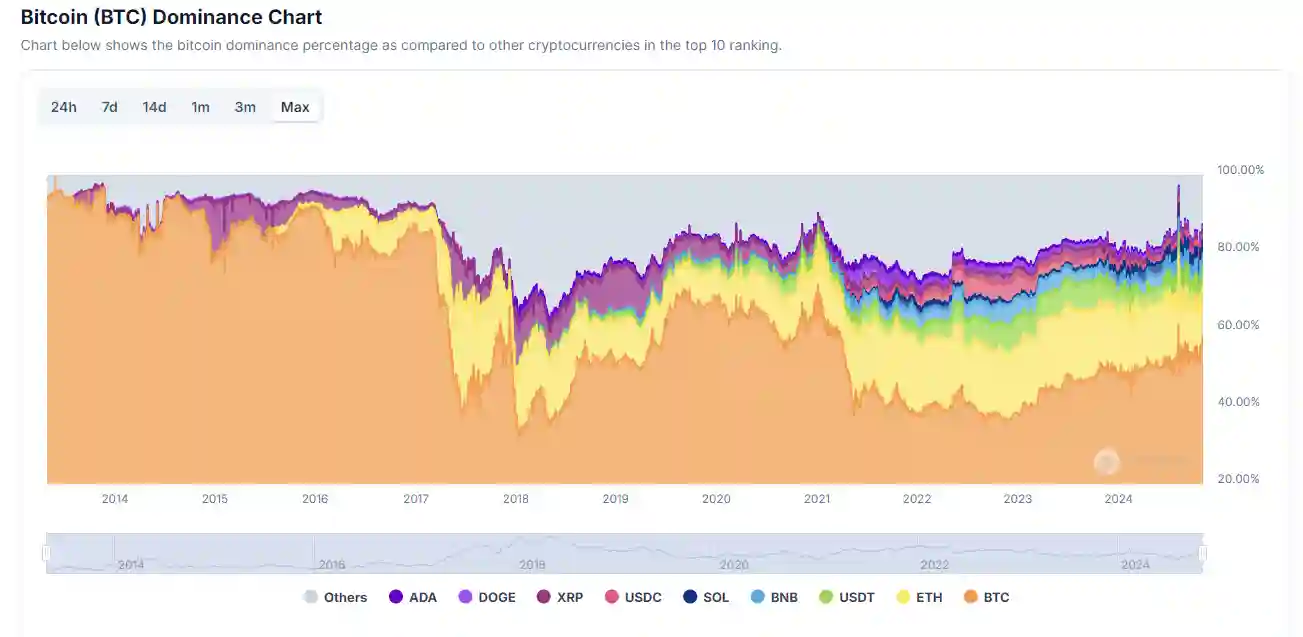

Prior to 2017, Bitcoin dominance was often above 80%, even reaching 95%.

However, after the ICO (Initial Coin Offering) trend in 2017, many altcoins started to attract investors' attention, reducing Bitcoin's dominance.

The presence of altcoins such as Ethereum (ETH) with smart contract features has accelerated the decline in Bitcoin's dominance.

Over time, the Bitcoin dominance chart has become an important analytical tool for investors to understand market sentiment towards altcoins and Bitcoin.

3 Factors That Affect Bitcoin Dominance

Some of the major factors influencing Bitcoin's dominance in the crypto market include:

1. Market Trends and New Narratives

The presence of altcoins with innovative technology can attract investors' attention, thereby reducing Bitcoin's dominance.

2. Popularity of Stablecoins

Stablecoins like USDT and USDC are gaining popularity because they offer stability. High demand for stablecoins often puts pressure on Bitcoin's dominance.

3. New Coin Launch

The introduction of new coins with great potential could cause a shift in investment from Bitcoin to altcoins, reducing Bitcoin's market dominance.

How to Read Bitcoin Dominance Charts

The Bitcoin dominance chart reflects the movement of Bitcoin dominance over time.

To see Bitcoin's dominance since its inception, users can access charts on sites like CoinGecko.

Example of Bitcoin Dominance Chart from Coingecko

Users can also customize the display by removing other altcoin data to focus more on Bitcoin's dominance.

This chart provides an overview of altcoin season when Bitcoin dominance drops drastically, or the potential bullishness in Bitcoin when Bitcoin dominance and price increase simultaneously.

Also read Bittime: Buy Bitcoin & Crypto

Using Bitcoin Dominance Charts to Identify Altcoin Seasons

Observing the Bitcoin dominance chart allows investors to identify altcoin seasons and monitor Bitcoin prices. Some commonly observed scenarios are:

Bullish potential on Bitcoin as Bitcoin dominance and price increases.

Possible altcoin season when Bitcoin price rises, but its dominance decreases.

Signs of an altcoin bear market are when Bitcoin price drops but dominance increases.

The "Real" Bitcoin Dominance Index

Some analysts prefer to use the “Real Bitcoin Dominance Index,” which only takes into account proof-of-work (PoW)-based coins like Litecoin and Monero.

The index aims to provide a more accurate picture of Bitcoin's dominance among decentralized crypto assets, excluding stablecoins or coins that are not considered to be in direct competition with Bitcoin.

Conclusion

Bitcoin dominance can be a useful tool for understanding the direction of the crypto market.

However, investors are advised to use Bitcoin dominance along with other indicators to get a more comprehensive picture of the market.

It is important to note that the Bitcoin dominance chart cannot be used as a single indicator as other factors such as stablecoin volatility also play a role.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Reference:

*https://www.coingecko.com/learn/what-is-btc-dominance*

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.