What is a Blow Off Top when Trading Crypto and What Are Examples?

2024-11-24

Bittime - Crypto does have a lot of terms that can be difficult to understand, especially for those who have just started trading crypto.

When you are one of them crypto trading beginnerBefore playing crypto, you should first understand every technical term that exists in the crypto world.

One of the terms you need to understand is 'blow off top'. What is 'blow off top', how is it identified, and what is an example of?

What is a Blow Off Top?

What is a blow off top? If explained simply, 'blow off top' is a term that describes a condition when an asset experiences a sharp increase in terms of volatility, volume and price changes, but is accompanied by an equally sharp decline.

Actually there are various definitions of what a blow off top is, but the essence is as stated previously.

Refer to the website quantifiedstrategies.com, blow off top is an important warning for traders, because it refers to the occurrence of a significant price increase in an asset which is accompanied by a sharp price decrease.

Read Also: The Importance of Learning Financial Literacy Before Playing Crypto

The blow off top phenomenon is also often associated as a sign of the end of a previously strong upward trend in an asset.

When a blow off top occurs, usually excessive demand and buying euphoria dominate the market, as a result triggering a price spike that is not in accordance with the asset's intrinsic value.

Understanding the Blow Off Top Phenomenon in Crypto

You could say that blow off top is an economic phenomenon with complex and chaotic characteristics.

Characterized by sharp upward price spikes, minimal retracement, and peak profits that occur just before a sharp decline.

One thing is certain, the blow off top phenomenon is closely related to the crypto market, because the crypto market basically has an extreme level of volatility.

The main factor that causes the blow off top phenomenon is investors' uncontrolled appetite for an asset when the related asset receives positive attention in the market.

Read Also: Financial Literacy in the Crypto Context

The meaning of a positive spotlight in the market is when certain assets are in a positive news channel, so it could be said that the blow off top also includes the implications of external situations.

Blow Off Top usually occurs over a relatively long period of time, namely for weeks, starting from the rising process.

Signs of Blow Off Top

Interestingly, the blow off top phenomenon can only be observed from a chart that has completely represented sharp and simultaneous price increases and decreases.

However, this does not mean that the blow off top phenomenon does not have certain indications.

Here are some signs that a blow off top will occur on the chart:

1. Exponential price increase

2. Trading volume increases sharply

3. Overbought

4. Massive sudden selling action

The following is a description of each of the indicators mentioned above.

1. Exponential price increase

Before the blow off top occurs, an asset that was previously at a low price suddenly experiences an increase without any significant correction.

The increase in asset prices could be triggered by positive news regarding related assets, market euphoria, or even massive buying.

Read Also: 5 Crypto Faucets You Must Monitor Now!

2. Trading volume increase rapidly

Not only did asset prices suddenly rise, the trading volume of assets that would experience a blow off top also increased sharply.

The sharper the increase in the asset, the sign that the asset is getting closer to its highest peak.

3. Overbought

Another indicator that can signal the impending or imminent occurrence of a blow off top is the RSI (Relative Strength Index) indicator which shows overbought conditions.

Usually an RSI that is above 70 or 80 indicates that the current price is too high compared to its value.

4. Sudden selling action

After the massive buying action occurred, there was a sudden massive selling action.

This resulted in the asset experiencing a significant decline in price, and indicated that the asset had experienced a blow off top phenomenon.

Case Study of Blow Off Top on Crypto

After understanding what a blow off top is and the signs of the blow off top phenomenon, now let's look at examples of the blow off top phenomenon in crypto.

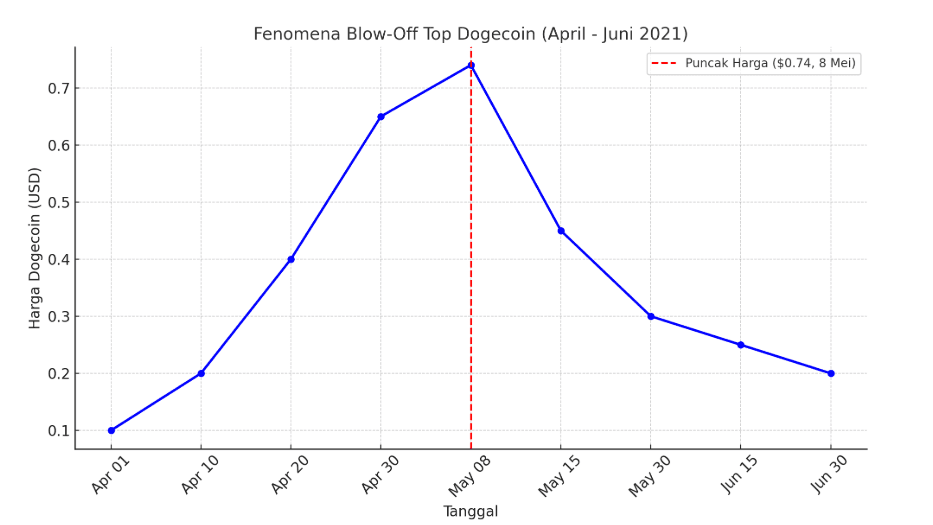

One example of the blow off top phenomenon in crypto which is quite popular and historic can be seen in the history of Dogecoin (DOGE).

Blow Off Top Case on DOGE

Dogecoin, which was originally created as a meme coin with no serious utility goals, is experiencing a surgeThe price is spectacular due to a combination of social media influence, online communities and promotions by famous figures such as Elon Musk.

In early 2021, Dogecoin was valued at approx $0.004, then communities on platforms like Reddit started promoting Dogecoin as the “people's cryptocurrency.”

Read Also: Convert 1 DOGE to IDR

As time went by, movements emerged to encourage it DOGE price to $1, which is gaining increasing public attention.

Another factor supporting DOGE's rise at the time was Elon Musk's continued support through tweets that were often humorous but effective in building market euphoria.

Instead it reached $1, after reaching its highest price around $0.74, In early May 2021 Dogecoin actually started to decline sharply.

Profit-taking by big investors, coupled with the end of the hype following Musk's appearance, led to a rapid price decline.

Within a few weeks, Dogecoin dropped to the bottom $0.30, and pat the end of 2021, the price of DOGE continues to move in a stable downward trend.

Final Note

Blow off top is closely related to phenomena that occur around assets, as well as the psychological aspects of investors who tend to FOMO.

The blow off top phenomenon is very easy to find in the crypto market, and a clear example besides DOGE is BTC price which in its early days was very volatile.

Investors who are not aware of the importance of understanding blow off tops can fall into a misguided understanding of rising asset prices which are considered promising but which in fact result in losses.

That's a review of what a blow off top is when trading crypto as well as real case examples.

Get important information about crypto only on the bittime blog. Hope it is useful.

FAQ

1. What is a Blow Off Top?

'Blow off top' is a term that describes a condition when an asset experiences a sharp increase in terms of volatility, volume or price changes, but is accompanied by an equally sharp decline.

2. How long does it take for Blow Off Top to occur?

Blow Off Top usually occurs over a relatively long period of time, namely for weeks, starting from the rising process.

3. What are the signs of Blow Off Top?

Here are some signs that a blow off top will occur on the chart:

1. Exponential price increase

2. Trading volume increases sharply

3. Overbought

4. Massive sudden selling action

How to Buy Crypto on Bittime

Want to trade, sell, buy Bitcoin and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with CoFTRA, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your knowledge in the world of crypto.

Reference

Duane Leem, https://www.warriortrading.com/, How To Identify A Blow-Off Top, accessed November 24, 2024

Quantified Trading, https://www.quantifiedstrategies.com/, Blow Off Top: Definition, What does this pattern mean?, accessed November 24, 2024.

Author: FL

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.