What is Elliott Wave Theory?

2024-07-26

Bittime - Elliott Wave Theory is a technical analysis theory used to predict market price movements based on wave patterns. This theory was developed by Ralph Nelson Elliott in the 1930s. Elliott realized that financial markets do not move randomly, but follow predictable recurring patterns. The following is an explanation of the basics of Elliott Wave Theory and how this theory is applied in market analysis.

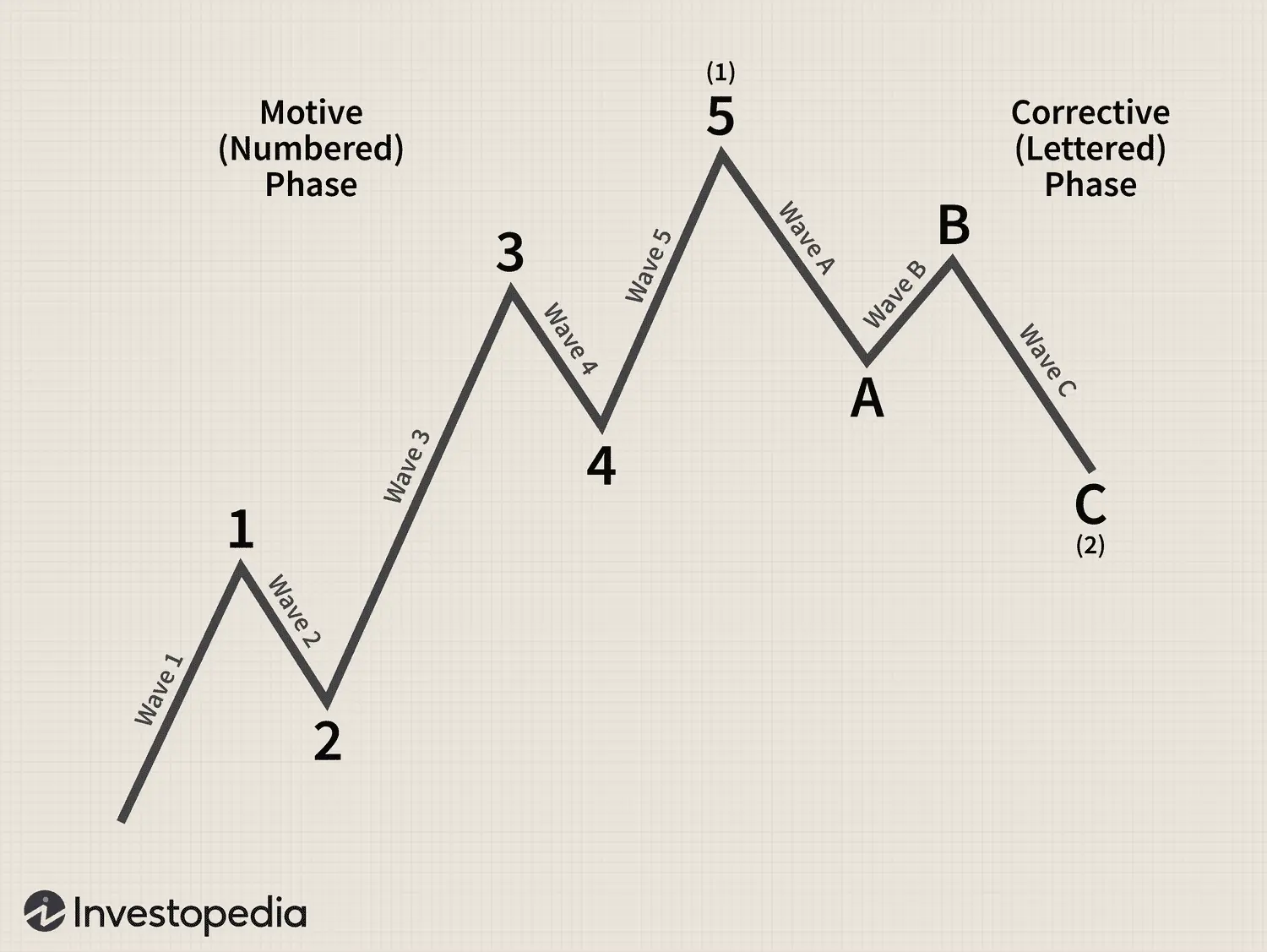

Source: Investopedia

Elliott Wave Theory Basics

Elliott Wave Theory is based on the concept that market prices move in recognizable patterns, known as “waves.” According to this theory, market movements can be divided into two main phases: impulse waves and corrective waves.

Impulse Wave

Impulse waves are price movements that follow the direction of the main trend. This wave consists of five smaller waves, namely three waves that move in the same direction as the main trend (waves 1, 3, and 5) and two waves that move in the opposite direction as temporary corrections (waves 2 and 4).

Corrective Wave

Corrective waves are price movements that move in the opposite direction to the main trend. This wave consists of three smaller waves, namely two waves that move in the opposite direction to the main trend (waves A and C) and one wave that moves in the same direction as the main trend as a temporary correction (wave B).

Check Today's Crypto Market:

Principles of Elliott Wave Theory

Some basic principles that need to be considered in Elliott Wave Theory include:

Five-Three Wave Principle

According to this theory, price movements in a complete cycle consist of five impulse waves and three corrective waves.

Fractalitas

Elliott wave patterns are fractal, meaning they can be found on various time scales. Larger waves can be broken up into smaller waves with the same pattern.

Alternation

Corrective waves tend to alternate between simple and complex patterns. If wave 2 is a sharp correction, then wave 4 tends to be a flat correction, and vice versa.

Using Elliott Wave Theory in Market Analysis

Traders use Elliott Wave Theory to identify wave patterns and predict future price movements. Here are some commonly taken steps:

- Identify Key Trends: Determine the direction of the main trend of price movements.

- Impulse Wave Identification: Look for five impulse waves that move in the same direction as the main trend.

- Identify Corrective Waves: Look for three corrective waves moving in the opposite direction to the main trend.

- Use Tools: Use tools such as Fibonacci retracement to measure potential turning points and wave lengths.

Advantages and Limitations

Elliott Wave Theory offers traders a number of advantages, including the ability to identify price movement patterns and potential turning points. However, this theory also has limitations, such as the subjective nature of wave identification and the difficulty in applying it to markets that do not have clear patterns.

Also Read How To Buy Crypto:

Conclusion

Elliott Wave Theory is a technical analysis tool that is useful for predicting market price movements based on wave patterns. By understanding the basic principles and how to apply them, traders can improve their ability to identify profitable trading opportunities. Nevertheless, it is important to combine this theory with other analytical tools and always consider risk factors in every trading decision.

How to Buy Crypto on Bittime

You can buy and sell crypto assets easily and safely via Bittime. Bittime is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also ensure you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application. Study Complete Guide How to Buy Crypto on Bittime.

Monitor graphic movement of Bitcoin (BTC) price, Ethereum (ETH), Solana (SOL), and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.