What is Osmosis (OSMO)? Innovative Cross-Chain DeFi

2024-08-20

Bittime - Osmosis (OSMO) is present as a cross-chain DeFi center that promises convenience and innovation in digital asset transactions. However, what is Osmosis (OSMO) actually? Come on, take a look at this article!

What is Osmosis (OSMO)?

Osmosis is an application-specific blockchain (appchain) designed as the primary decentralized exchange (DEX) in the Cosmos ecosystem. The platform is a liquidity center and primary trading venue for multiple independent blockchains connected via the Inter-Blockchain Communication (IBC) protocol.

Think of Osmosis as a bridge between different blockchain islands. With more than 50 blockchains already connected and dozens more in development, Osmosis is the gateway for new users, developers and protocols into the “Internet of Blockchains”.

How Does Osmosis (OSMO) Work?

Osmosis uses an automated market maker (AMM) model. It allows users to perform coin swaps and access liquidity pools for various tokens from various blockchains.

Not just limited to the Cosmos ecosystem, Osmosis also supports exchanges and liquidity pools for non-Cosmos tokens such as Ethereum, Solana, Avalanche, Polkadot, and Bitcoin.

The asset exchange process on Osmosis is very similar to a typical centralized exchange (CEX). Users simply select the asset pair they want to exchange, enter the desired amount, and make the transaction. The difference is, all of this is done in a decentralized manner, without a centralized intermediary.

Also read: Orderly Network Launches ORDER Token and Airdrop on August 26!

What is Unique about Osmosis (OSMO)?

Osmosis has several advantages that make it stand out among other DeFi protocols:

Customizable liquidity pools:

Unlike other DEXs that only offer pools of two tokens with equal ratios, Osmosis allows liquidity providers to create pools with multiple tokens and varying ratios.

High flexibility:

Market players such as arbitrageurs and liquidity providers can adjust parameters such as price slippage and transaction costs according to their needs.

Seamless user experience:

Osmosis offers CEX-like ease of use without sacrificing the benefits of decentralized finance such as self-storage, minimal-trust transactions, and privacy.

Key Features of Osmosis (OSMO)

There are several key features in this platform. Well, here it is bSome superior features of Osmosis that are worth knowing:

Cross-chain interoperability:

Osmosis is designed for asset exchange between IBC-compatible blockchains and plans to expand reach to non-IBC blockchains via custom bridges.

Staking superfluid:

This innovative feature allows users to use OSMO tokens for staking and liquidity simultaneously, maximizing rewards without compromising network security or liquidity.

Integrated dApps ecosystem:

Osmosis has a suite of decentralized applications that are tightly integrated with its AMM and IBC routing capabilities, offering a variety of additional DeFi services.

Also read: How to Get Monad Airdrop: Complete Guide

What is OSMO Token?

OSMO is the native token and governance token of the Osmosis protocol. The main functions include:

Payment of transaction fees on the Osmosis network.

Rewards for validators who verify transactions.

Staking to get a share of validator earnings.

Voting rights in the development and parameters of the Osmosis protocol.

Tokenomics Token OSMO

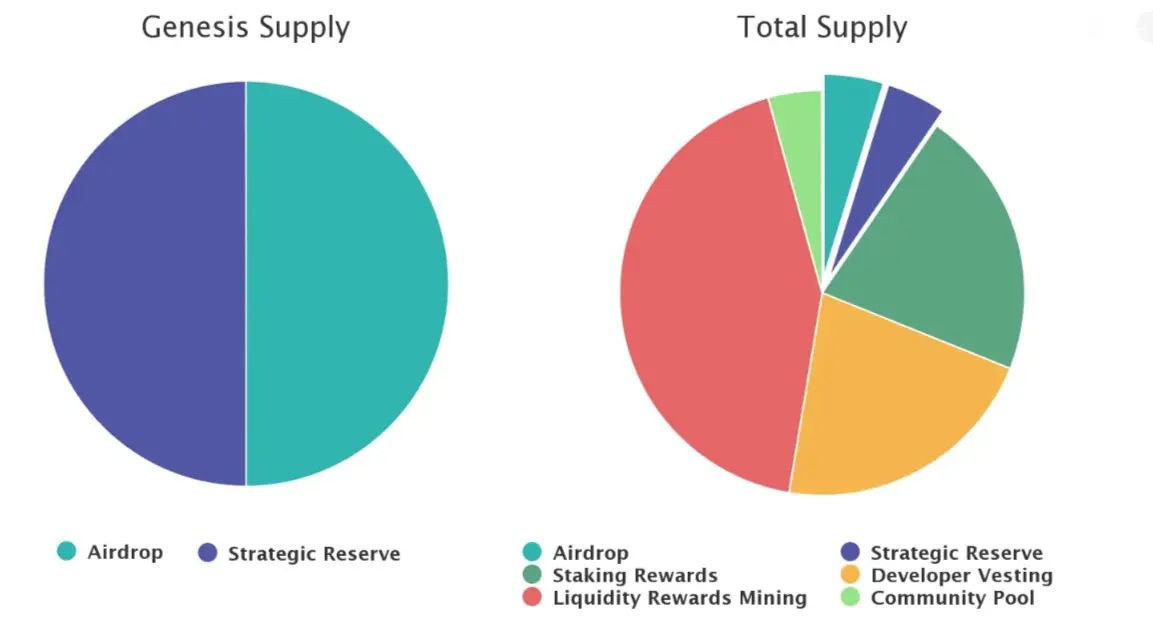

OSMO's total supply is 1 billion tokens. At the start of the launch, 100 million OSMO was released and divided equally between airdrop recipients and strategic reserves. Currently, according to CoinGecko data, there are around 657 million OSMOs circulating on the market.

The overall distribution of OSMO tokens is as follows:

Mining Rewards Liquidity: 40.5%

Developer Vesting: 22.5%

Rewards Staking: 22,5%

Community Pool: 4.5%

Strategic Reserves: 5%

Airdrop: 5%

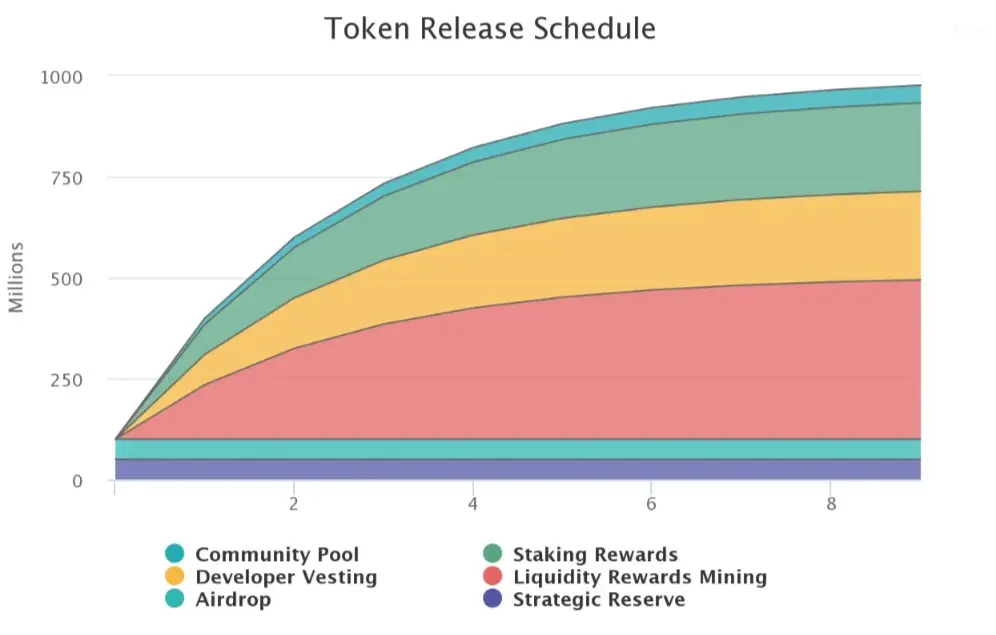

OSMO Token Release Schedule

Osmosis uses a “thirdening” schedule for new token releases, where token issuance is cut by one-third each year. Here are the details:

First year: 300 million tokens

Second year: 200 million tokens

Third year: 133 million tokens

And so on, until it reaches the maximum supply of 1 billion OSMO

Conclusion

Osmosis (OSMO) offers an innovative and easy-to-use cross-chain DeFi solution. With its unique features such as customizable liquidity pools and superfluid staking, Osmosis has the potential to become a key player in the development of interconnected blockchain ecosystems.

That is a review of what Osmosis (OSMO) from Bittime is. Don't miss the latest articles here, because we will provide the latest news updates and the latest crypto market developments. So, keep watching, OK!

How to Buy Crypto on Bittime

You can buy and sell crypto assets in an easy and safe way via Bittime. Bittime is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Learn How to Buy Crypto on Bittime.

Monitor price chart movements of Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.