What is SmarDex (SDEX), Definition, Main Features, and Tokenomics

2024-08-19

Bittime – SmarDex is an innovative Decentralized Exchange (DEX) platform, offering a more efficient and profitable crypto trading experience.

DEX itself is a cryptocurrency exchange that operates without a centralized intermediary, giving its users greater control.

SmarDex not only works as a DEX, but also as an Automated Market Maker (AMM). AMM uses a mathematical formula to determine the price of crypto assets.

Through this approach, users can trade directly with smart contracts, without the need for matching between sellers and buyers.

Main Features of SmarDex

Following are the main features of SmartDex that you can understand in more detail.

1. Swapping Token

You can easily and efficiently exchange crypto tokens via the SmarDex swap feature.

SmarDex has a Hybrid Aggregator that will analyze and combine the best trading routes across various DeFi platforms to ensure you get the best exchange rate.

2. Provides Liquidity

You can contribute to the smooth operation of SmarDex by adding token pairs into the SmarDex Volatility Vault (VV).

In return, you will receive a Volatility Vault Liquidity Providing Token (LP token), the amount of which depends on your liquidity contribution to the total Volatility Vault liquidity.

Apart from that, you can also take advantage of the power of LP tokens through staking.

3. Staking

By staking SDEX tokens on the SmarDex platform, you are actively supporting the network and increasing its security.

As a reward for this contribution, you will get a prize in the form of SDEX tokens.

Read Also: Goldfinch (GFI) Price Prediction: Is This a Good Time to Invest?

Why Choose SmarDex?

Here are some reasons why SmartDex is so popular:

1. Innovative Solutions for Impermanent Loss

Impermanent Loss is a risk that traditional DEX users often face. SmarDex offers an innovative solution to overcome this problem through its Volatility Vault which is specifically designed to minimize the risk of Impermanent Loss.

In fact, SmarDex not only reduces this risk, but also has the potential to generate profits known as Impermanent Gains.

2. Superior Performance

SmarDex offers much lower trading fees compared to other DEXs, including the popular Uniswap. With more efficient costs, you can get bigger profits.

3. Attractive Returns

SmarDex offers investment return opportunities that are among the best on the market, thanks to protocol fees, rewards for liquidity providers, and extremely high APRs for farming.

4. Strong Security

SmarDex prioritizes security by implementing various measures, including audits from well-known security agencies, a bug bounty program with large rewards, a sophisticated monitoring system, and the use of exclusive patent-protected technology.

5. High Growth Potential

In a short period of time, SmarDex has shown phenomenal growth, with daily volumes reaching millions of dollars across multiple networks.

According to CoinMarketCap, SmarDex is currently among the top 400 protocols, making it a bright new star in the DeFi space.

Tokenomics SmarDex

SmarDex uses a fixed supply incentive system that increases the purchasing power and value of each “residual” token.

1. SDEX

SDEX is the main token used by the SmarDex protocol to reward its users.

By participating in staking or farming, users generate passive income while contributing to the power of the network.

The protocol also offers additional rewards through various programs, especially community rewards, to encourage engagement and support ecosystem growth.

SmarDex officially launched on March 9, 2023, marking the beginning of a new passive income opportunity for crypto enthusiasts.

2. SDEX Initial Distribution

SDEX supply is 10,000,000,000 tokens. There will never be additional tokens because it is technically impossible to mint SDEX.

Since the spread on other chains, we even made it disinflationary, as part of the collected fees is now burned.

For more information about our fee structure, see the 'Fees Explained' section further on this page. Here are the initial distribution details:

- 50% Volatility Vault (Liquidity Pool): SmarDex set up an SDEX/USDT Volatility Vault, initially filled with 5 billion SDEX units and supplemented with an additional 500,000 USDT, resulting in a total Volatility Vault value of 1 million USD.

- 37.5% Long Term Yield Distribution: Long-Term Yield Distribution for Farming, Staking, and Ecosystem Expansion

- 12.5% Yield Period Increase: To encourage participation, a Yield Improvement period was implemented during the launch of SmarDex, lasting 4 weeks.

Read Also: Over 1.8 Million Meme Coins Have Been Launched on Pump.fun

3. Total SDEX Supply

The only way to 'mine' SDEX tokens is through long-term reward distribution, which includes farming, staking, and other methods designed to expand the ecosystem, such as community rewards.

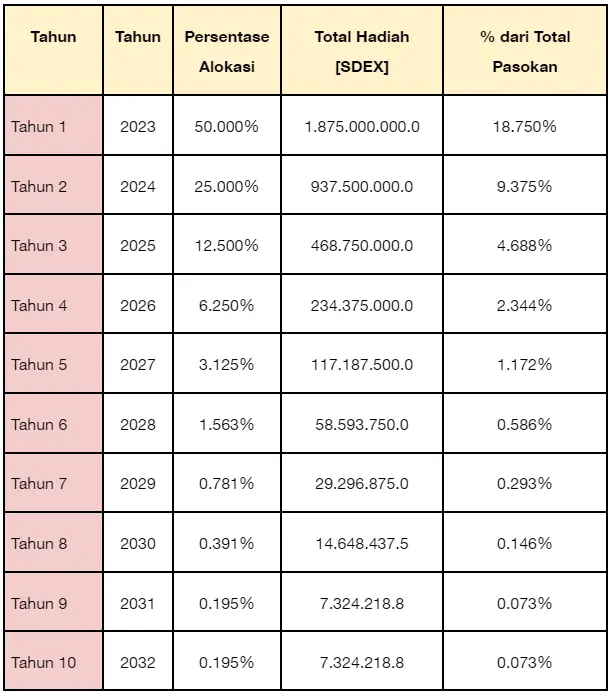

These various avenues for obtaining SDEX aim to finance users who actively adopt and contribute to the growth of the ecosystem. These rewards will be distributed over 10 years after launch.

4. Total SDEX Supply Over Time

The distribution of SDEX tokens between farming campaigns, staking, and expanding the ecosystem through mechanisms such as community rewards is critical to maintaining balance and meeting market demand.

To do this, we use a 'multiplier', which determines the share of SDEX allocated to each campaign. Imagine we have a fixed amount of SDEX to distribute, similar to a pie to be divided.

The multiplier represents the number of slices allocated to each campaign. For example, if one campaign has a multiplier of 2 and another has 1, this means the first campaign will receive twice the amount of SDEX as the second.

This method allows for flexible and responsive distribution, adapted to changing crypto market dynamics.

Currently, among the distributed SDEX, a portion is allocated to farming campaigns, another portion to staking campaigns, and a little under half is allocated to community rewards.

Please note that on our site SmarDex.io, the multiplier is already included in the Annual Percentage Rate (APR) displayed for each campaign.

Explanation of Fees

On each swap, SmarDex charges a fee. Starting from Q3 2023, there will be no set standard fees. Each Volatility Vaults will have a variable fee, which is set by an algorithm.

This algorithm is scheduled to be publicly disclosed via the DAO, with the aim of optimizing returns for Liquidity Providers (LPs).

A complete list of pairs across all chains and associated fees can be found in the Fees section.

These fees are directly used to buy back SDEX tokens, followed by redistribution. This entire cycle is automated through smart contracts, ensuring efficiency and reliability.

On the Ethereum chain, fees are immediately channeled into buying back SDEX tokens. These tokens are then allocated to Liquidity Providers and to participants in staking.

On other chains (Polygon, Arbitrum, BSC, Base), fees are applied similarly to buy back SDEX tokens instantly. Of this, a portion is allocated to LPs, while the remaining portion is directed towards burning SDEX tokens.

This burning process is also carried out automatically via a smart contract.

Combustion Mechanism

As explained above, since the deployment of our protocol on the new chain, we have established a burning mechanism to balance the inflationary nature of SDEX.

During each transaction on these chains (Polygon, Arbitrum, BSC, Base), a portion of the fees is immediately converted into SDEX and then destroyed.

In practice, this means these SDEX tokens are sent to null addresses, effectively removing them from circulation.

This process not only serves to reduce the total supply of SDEX but also introduces disinflationary characteristics to the token, thereby affecting its overall economic dynamics. You can find more info in the burning section.

It is important to emphasize that all of these processes are automated via smart contracts and not carried out manually by us. This ensures efficiency and transparency in the SDEX token burning mechanism.

Read Also: Pixelverse Launching Phase 3! There are Gems, Affiliate Programs, and Revenue Sharing

Fees Charged to Users

Starting Q3 2023, there will be no more default fees. Each pool has variable fees, managed by governance via an algorithm that will be published in the DAO, to optimize performance for LPs.

Conclusion

SmarDex is an innovative DEX that offers various advantages, such as a solution for Impermanent Loss, low trading costs, high profit potential, strong security, and large growth potential.

With all its features and advantages, SmarDex is an attractive choice for crypto players who are looking for an efficient, profitable and safe trading platform.

How to Buy Crypto on Bittime

You can buy and sell crypto assets in an easy and safe way via Bittime. Bittime is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Learn How to Buy Crypto on Bittime.

Monitor price chart movements of Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.