What Are The Bubble Pops in Crypto?

2024-11-23

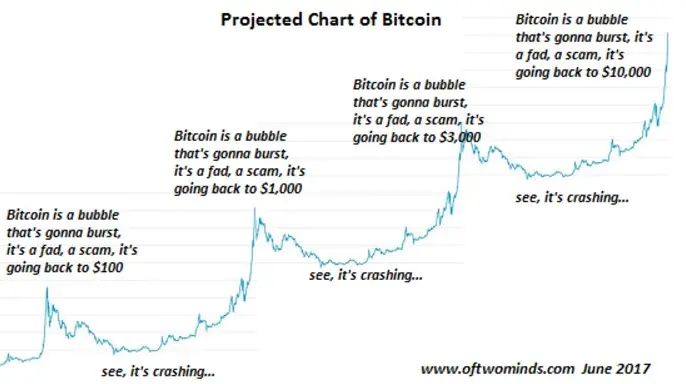

Bittime - One phenomenon that is widely discussed in the crypto world is "The Bubble Pops". This term refers to a situation where the value of an asset, which previously experienced a drastic increase, suddenly experiences a sharp decrease. Follow this article to discuss what The Bubble Pops are in crypto.

This condition often occurs in speculative assets such as crypto, NFT, or meme stocks. But what does it actually mean? "bubble pops", and how does this phenomenon occur in the world of cryptocurrency? To understand this, we need to dig deeper into its background and impact.

Bubble Phenomenon in Cryptocurrency

Source: Blockzeit

When the cryptocurrency market peaked in November 2021, the total crypto market capitalization reached fantastic figures $3.1 trillion USD. However, in just a few months, this figure plummeted by more than half, leaving a capitalization of $1.3 trillion USD.

This sharp decline reflects how the speculative bubble in the crypto world could burst at any time, leaving many investors in huge losses.

Term "bubble" itself refers to a situation where the price of a particular asset soars far beyond its fundamental value due to excessive speculation.

When investors realize that the price of the asset cannot be maintained, mass panic occurs which causes a drastic price drop or so-called "bubble pops".

An example is Earth Moon, a stablecoin designed to maintain a fixed value against the US dollar. However, when confidence in its stability mechanisms wavered, Terra Luna collapsed, becoming a symbol of the collapse of even supposedly stable crypto markets.

Read also: Viral, This Boy Screams Pull QUANT Token, $30,000 Coin

Why Do Bubble Pops Happen in Crypto?

Source: steemit

The bubble pops phenomenon is not something that just happens. There are several factors that influence the formation of speculative bubbles in the crypto market, including:

1. Cheap Money Policy

After the 2008 financial crisis, central banks around the world, including the US Federal Reserve, implemented cheap money policies such as lowering interest rates to near zero and quantitative easing (QE).

This policy encourages investors to pursue riskier assets such as crypto and meme stocks.

2. Excessive Speculation

2021 was marked by a surge in the popularity of cryptocurrencies, NFTs, and meme stocks. Social media, celebrities, and big companies like Tesla are supporting this trend, creating an unhealthy market euphoria.

3. Cheap Money Policy Withdrawals

When global inflation begins to rise in 2022, central banks begin to withdraw cheap money policies. Interest rates were raised, and the QE program was stopped. This step triggered a drastic decline in speculative assets, including crypto.

Read also: What Are HAROLD Coins?

The Impact of The Bubble Pops on Investors

When bubble pops occur, investors face several serious consequences:

1. Major Financial Losses

Investors who exit the market too late often suffer huge losses. Asset value declines of up to 80-90% are not uncommon in this scenario.

2. Crisis of Faith

Crypto market crashes often lead to a crisis of confidence, both among individual and institutional investors.

3. Potential Economic Recession

While a popping crypto bubble may not directly impact the global economy, underlying conditions such as high inflation and tight monetary policy could trigger a recession.

What Can Be Learned from the Bubble Pops Phenomenon?

One major lesson from The Bubble Pops is the importance of understanding market risk. Crypto, like other speculative assets, is highly dependent on market sentiment. Investors should always conduct in-depth research before investing and avoid decisions driven by euphoria alone.

For those who remain believers in the long-term potential of blockchain technology and cryptocurrencies, diversification and risk management strategies are key to surviving market fluctuations.

Read also: 5 Cryptos That Are Better Than Ethereum According to Altcoin Daily, There's XRP!

Conclusion

Phenomenon The Bubble Pops is a stark reminder of the enormous risks inherent in the world of speculative investments like crypto. Although blockchain technology offers great potential for the future, investors should remain alert for signs of market bubbles and prepare strategies to deal with them.

By understanding this phenomenon more deeply, you can become a wiser investor and be ready to face unexpected market dynamics.

FAQ Tentang The Bubble Pops

1. What does "The Bubble Pops" mean?

This term is used to describe a situation where a previously very successful condition or asset suddenly fails or loses value significantly.

2. What happens if an economic bubble bursts?

When economic bubbles burst, asset prices plummet, leading to the collapse of unsustainable investment schemes. This is often followed by a loss of investor confidence and can trigger a financial crisis.

3. Is the bubble in crypto the same as bubbles in other sectors?

Yes, the principle is similar. However, crypto market volatility is often higher than other sectors, making bubbles in this market more quickly form and burst.

4. How can investors avoid losses when bubbles pop?

Investors can avoid major losses by implementing strategies such as portfolio diversification, take profit periodically, and avoid investment decisions based on momentary trends.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Reference:

- Stheme, Steemit articles, Accessed November 23, 2024

- CBS News, CBS News article, Accessed November 23, 2024

- Akademi Crypto, YouTube Akademi Crypto, Accessed November 23, 2024

- MIT Technology Crypto, Artikel MIT Technology Crypto, Accessed November 23, 2024

- Counterfire, Article Counterfire, Accessed November 23, 2024

Author: Y

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.