Latest Bitcoin Dominance News: Touch 56% What Does This Mean For The Market?

2024-08-22

Bittime - Bitcoin (BTC) continues to dominate the cryptocurrency market, accounting for more than half of the global crypto market capitalization of $2.1 trillion.

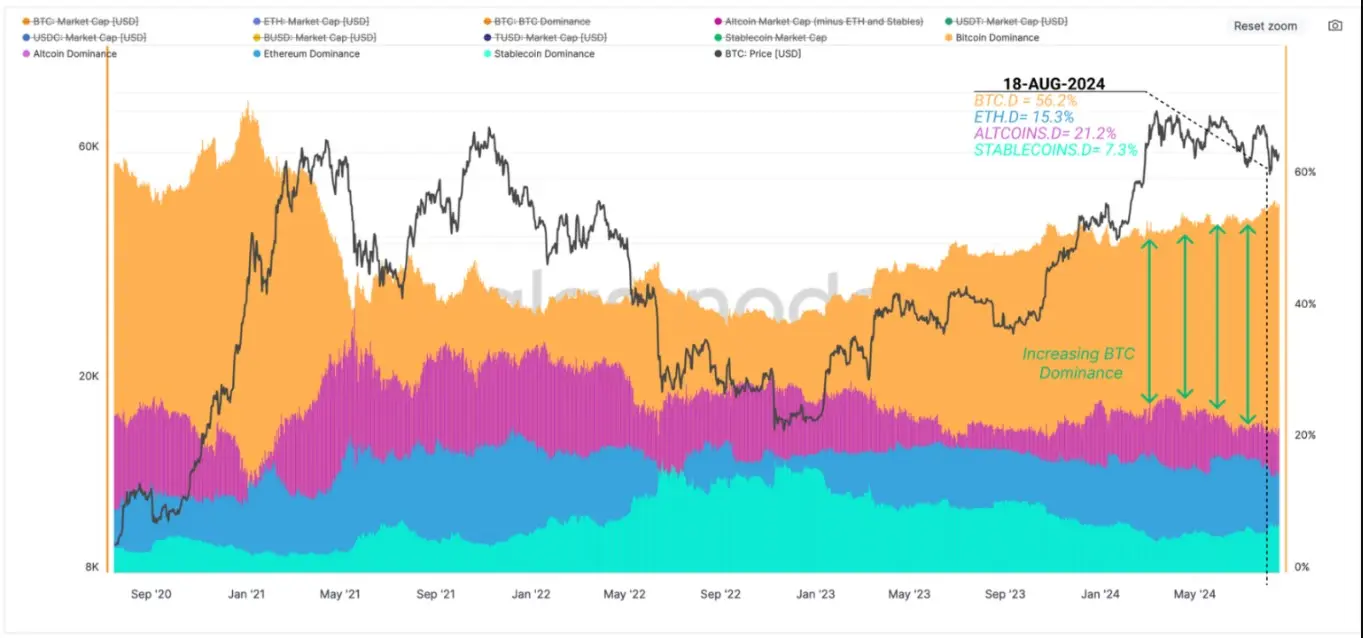

According to on-chain analysis platform Glassnode, since the crypto market hit a cycle low in November 2022, BTC dominance has grown from 38% to 56%.

On the other hand, Ethereum (ETH) dominance has remained relatively flat in the past two years while altcoins have also lost 6.5% of their market share.

Long-Term Holders Drive Bitcoin Dominance

Source: AMBCrypto

According to Glassnode, Bitcoin's growth comes amid increased capital inflows towards the asset as long-term holders show diamond hands.

Balso: Analysts Question the 21 Million Bitcoin (BTC) Supply, Can It Really Be Changed?

The supply of Bitcoin among these traders has increased significantly. The report notes that most of these traders became long-term holders after purchasing BTC near its March all-time high.

"Despite the bumpy and choppy price action, Long Term Holders' resolve remains firm, with a clear preference to HODL and acquire coins," Glassnode said.

These holders are sitting on profits of around $138 million per day. This increases sell-side risks, but profit-taking activity has cooled.

This observation is further strengthened by the data CryptoQuant which shows that after intense profit-taking activity by whales in May and July, the Exchange Whale Ratio is now falling.

Additionally, buyers appear to be absorbing the sold coins, explaining why Bitcoin price has ranged in recent months since dropping from its ATH.

Balso: BTC Rebounds to $65,000 Price Coming Soon!

Short Holders Cause $50K Drop

Glassnode also argued that an “overreaction” by short-term holders triggered Bitcoin's drop below $50,000 earlier this month.

The Market Value to Realized Value (MVRV) ratio of short-term holders is below 1, indicating that these investors are sitting on unrealized losses. This ratio has been below the balance point in the last 30 days.

Unlike long-term holders, short-term Bitcoin holders are much more reactive to price movements, with their responses behind local tops or bottoms according to Glassnode. This is what happened on August 5 when BTC fell to a multi-month low of $49,000.

If these investors remain at a loss below $59,000 for an extended period of time, analysts say this will increase the likelihood of market panic and severe bearish momentum.

A look at leverage trading shows a slight shift to the bullish side. The long/short ratio on Coinglass shows a gradual increase in long positions since August 18.

How to Buy Crypto on Bittime

You can buy and sell crypto assets easily and safely via Bittime. Bittime is one of Indonesia's best crypto applications, officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also ensure you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application. Study Complete Guide How to Buy Crypto on Bittime.

Monitor graphic movement of Bitcoin (BTC) price, Ethereum (ETH), Solana (SOL), and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.