Bitcoin Faces Risk of Further Decline, Bear Market?

2024-07-11

Bittime - CryptoQuant released a report showing that Bitcoin (BTC) is at a “tipping point”, with several on-chain indicators indicating the risk of further declines. Meanwhile, “whales” or large Bitcoin holders experienced the fastest accumulation rates in the past year.

Bitcoin Downtrend

Since hitting a new high in March, Bitcoin price has been on a downward trend, hitting a two-month low of $53,500 on July 5. Despite briefly recovering above $57,000, the German government's Bitcoin sale and Mt. Gox remains a threat to BTC.

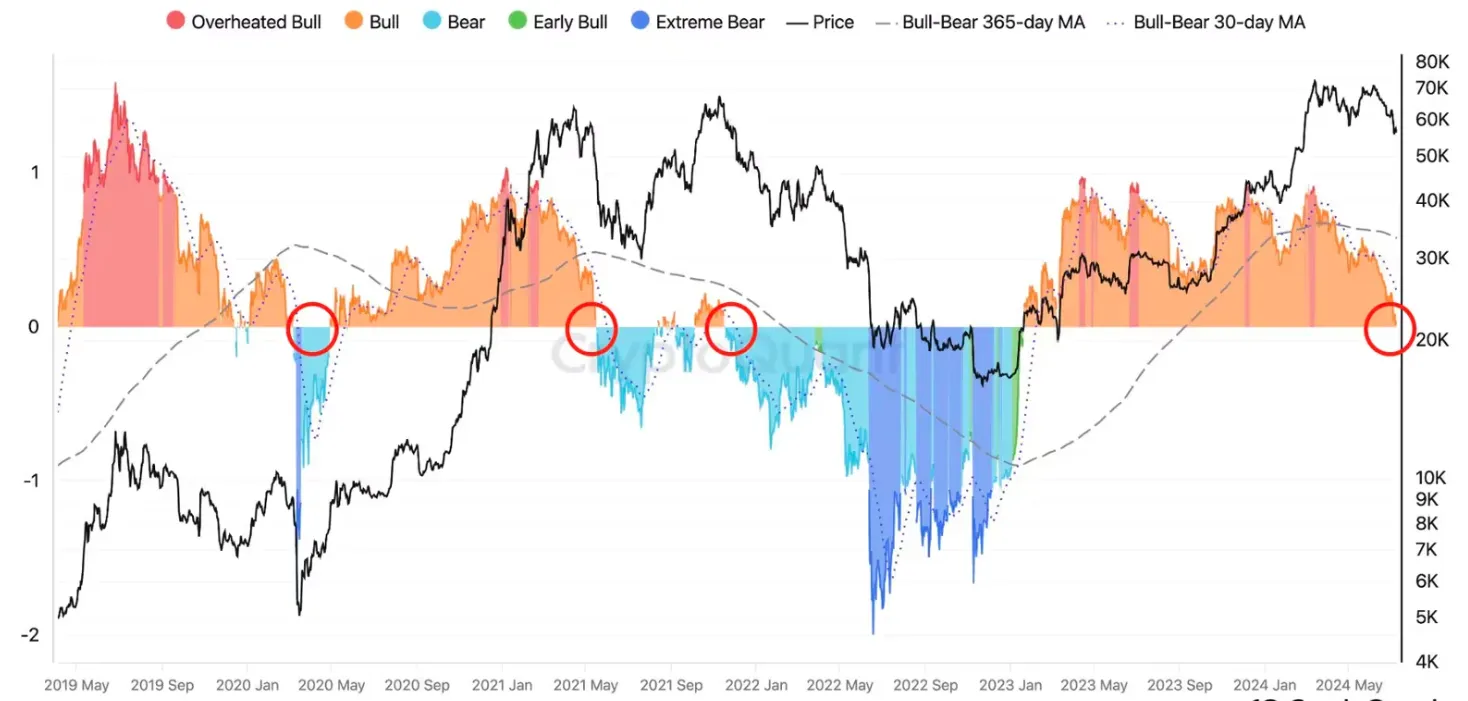

CryptoQuant revealed that Bitcoin's profit and loss (P&L) index is hovering near the 365-day moving average (MA). If this index falls below this line, Bitcoin may experience a major correction. Additionally, Bitcoin's bull-bear market cycle indicator is also approaching a key level, and if the price continues to fall, it could turn into a bear market.

Source: cointelegraph.com

Accumulation By Whales and Institutional Investors

Despite Bitcoin's price decline, whales actively accumulated Bitcoin during this downturn, increasing their holdings by 6.3% in the past month.

Additionally, institutional investors also started pouring their funds into spot Bitcoin ETFs in early July, indicating increased demand for BTC.

From a technical perspective, Bitcoin faces short-term resistance at $59,000, which is supported by the 200-day simple moving average (SMA). The bulls need to turn it back into support to avoid further losses.

Important Indicators and Technical Analysis

Report CryptoQuant shows that Bitcoin's profit and loss (P&L) indicator is near the 365-day moving average (MA). The on-chain data provider explains that if the index falls below its 365-day average, Bitcoin could begin a major correction as seen in previous drops. Bitcoin's bull-bear market cycle indicator is also approaching critical levels and has the potential to turn into a bear market if prices continue to fall.

The chart below shows that the indicator is currently behaving similarly to how it did in March 2020, May 2021, and November 2021. A drop below the neutral line would mean that the market has moved into a bear phase, signaling further declines.

Source: cointelegraph.com

According to CryptoQuant, these two metrics indicate that Bitcoin is at a level where a local bottom could form or a major correction occurs like in 2021.

Additionally, Tether's (USDT) market capitalization growth has stalled, indicating that a rally may be difficult as historical recoveries are often caused by increased liquidity of stablecoins. The growth of the USDT market is often considered the main driver of the bull market.

Increasing Demand Among Whales

Meanwhile, Bitcoin whales have been aggressively accumulating as the latest dip gave large holders the opportunity to buy more on the dip, increasing their holdings by 6.3% in the past month, the fastest rate since April 2023.

CryptoQuant said that this shows increasing demand for Bitcoin at lower levels. This was supported by increased fund flows into US-based spot Bitcoin ETFs.

Data from SoSo Value shows that even though BTC prices fell to a four-month low on July 5, institutional investors poured $143.1 million into spot Bitcoin ETFs that day.

This was followed by net inflows of $294.9 million and $216.4 million on July 8 and July 9, respectively. This institutional support has offset selling pressure while simultaneously demonstrating BTC's acceptance in the financial mainstream.

How to Buy Crypto with Bittime

You can buy and sell crypto assets in an easy and safe way through Bittime. over is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Monitor graphic movement price Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.