Bitcoin Rises Draw $321 Million Crypto Inflow After Interest Rates Drop

2024-09-24

Bittime - Discover how a 50 basis point cut in interest rates by the FOMC on September 18, 2024 triggered crypto fund flows, with Bitcoin recording an inflow of $321 million and BTC investment products attracting $284 million.

Meanwhile, Ethereum experienced outflows for five consecutive weeks. Read more about the impact of monetary policy on digital asset markets!

Impact of Lower Interest Rates

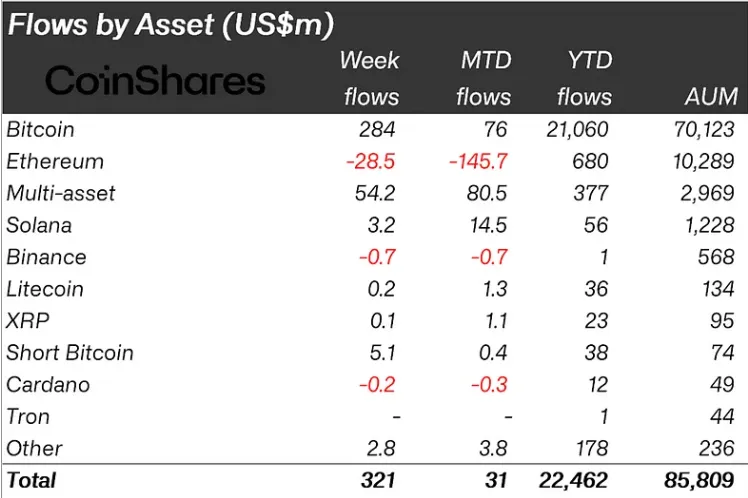

In its latest weekly digital asset fund flows report, released on September 23, CoinShares stated that the Federal Open Market Committee's (FOMC) decision to cut interest rates by 50 basis points (bp) was a factor that may have contributed to this increase.

Bitcoin Rise Pull $321 Million Inflows

According to a CoinShares report, Bitcoin (BTC)-based investment products were the main focus last week, with $284 million in inflows.

Recent BTC price changes led to greater inflows into short Bitcoin investment products, which generated a total of $5.1 million.

The digital asset reached $321 million for the second week in a row from September 15 to September 21, 2024.

Ethereum Outflows Report

In contrast, CoinShares stated that Ethereum, like Ether, continues to be an outlier. ETH-based investment products have experienced outflows for five consecutive weeks, reaching $29 million last week.

Read Also: Bitcoin Prices Rise After Federal Reserve Cut Interest Rates

Interest Rates Reductions Announcement

Last September 18, the US Federal Reserve issued a FOMC statement, officially announcing the Board of Governors' decision to approve a 50bp interest rate cut.

This is the first decline in US borrowing costs since March 2020, when the Federal Reserve cut interest rates as a result of the COVID-19 outbreak.

According to CoinShares, the crypto market responded to the interest rate drop with a 9% increase in total assets under management and a slight 9% increase in total investment products from $9.5 billion the previous week.

Conclusion

The FOMC rate cut by 50 basis points on September 18, 2024 triggered a second consecutive week of fund flows into digital asset markets.

Bitcoin recorded an inflow of $321 million. While Bitcoin-based investment products generated $284 million.

Ethereum generated $29 million. The number of assets under management in the crypto market increased by 9% as a result of this drop in interest rates.

How to Buy Crypto on Bittime

Want to trade, sell, buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.