BlackRock Highlights Bitcoin as a Safeguard against Economic Crisis

2024-09-20

Bittime - BlackRock released a white paper highlighting Bitcoin as a hedge against monetary and geopolitical risks. Bitcoin prices jumped 6%, buoyed by potential further adoption as a hedge against the economic crisis. For more details, see this article!

BlackRock Releases Bitcoin

After the world's largest asset manager issued a white paper emphasizing the digital asset's possibilities as a hedge against monetary and geopolitical risks, the price of Bitcoin rose nearly 6%. BlackRock releases Bitcoin BTC.

Bitcoin as a Protections against Economic Crisis

Nearly an hour after Bitcoin started rising from its daily low of $59,354. Balchunas shared BlackRock's report at 16:21 UTC.

According to data from Cointelegraph, Bitcoin has risen more than 5.7% and regained $62,600 for the first time in more than three weeks.

Some analysts are predicting a three-month rally to $92,000, which may start in October, based on historical chart patterns and Bitcoin's average monthly returns for the fourth quarter of the year.

BlackRock's Highlight Bitcoin

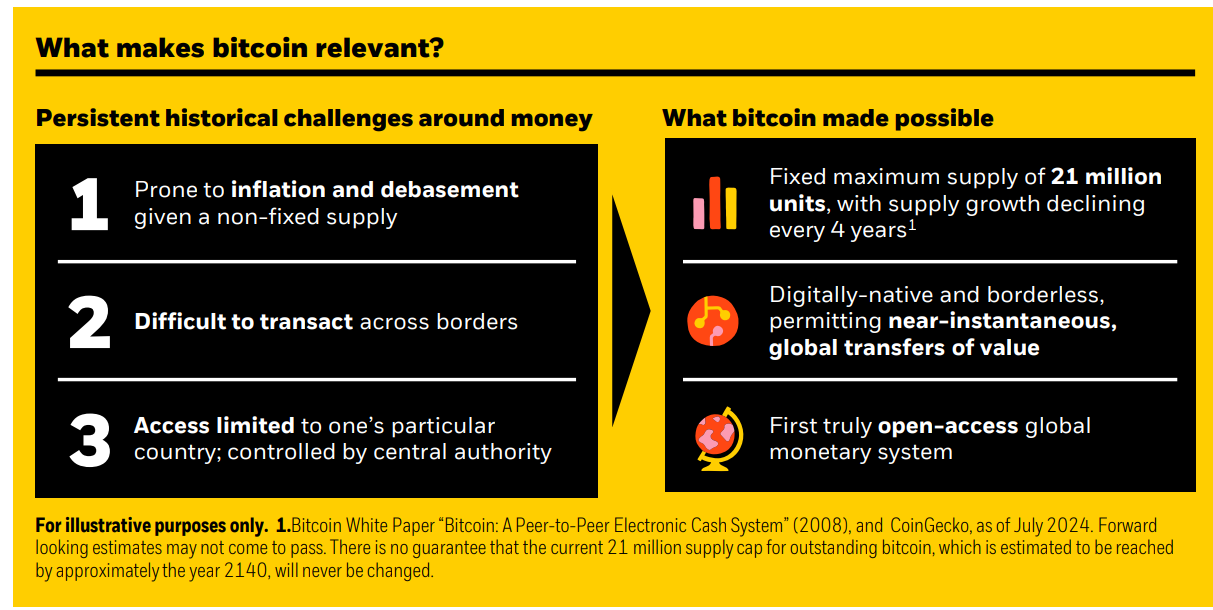

According to BlackRock's white paper, not only the crypto asset but Bitcoin's decentralized and permissionless nature makes it the world's first truly open access monetary system.

Asset managers also praise Bitcoin for not relying on a centralized system or having no counterparty risk.

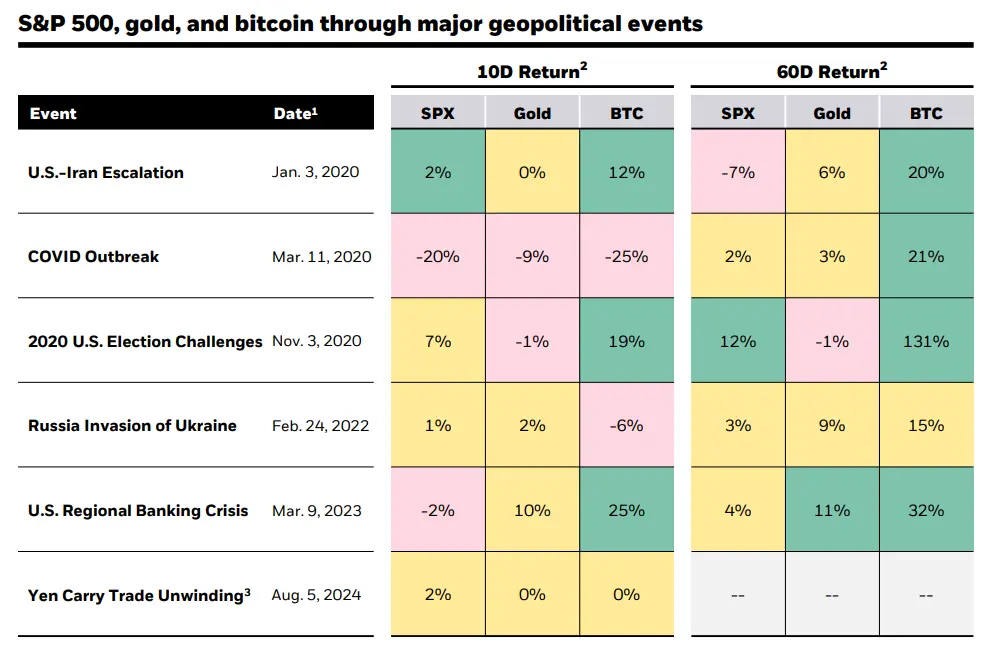

The asset management giant shared a chart showing how Bitcoin's growth outpaced the price of gold and the S&P 500 during geopolitical events to demonstrate Bitcoin's resilience.

Macroeconomic Driving Bitcoin Adoption's Path

BlackRock's white paper states macroeconomic concerns will drive Bitcoin's adoption path. The world's largest issuer of Bitcoin exchange-traded funds (ETFs), BlackRock holds more than $21.4 billion in Bitcoin and controls more than 38% of the Bitcoin ETF market.

Read Also: BTC Rebounds to $65,000 Price Soon!

Conclusion

BlackRock, the world's largest asset manager, released a white paper highlighting Bitcoin's benefits as a hedge against monetary and geopolitical risks.

The book shows Bitcoin's potential as a hedge against economic crises. With its decentralized and permissionless nature, Bitcoin is considered an open monetary system that does not depend on centralized parties.

During geopolitical events, Bitcoin's growth outperforms gold and the S&P 500 further strengthens its resilience as an asset.

BlackRock continues to dominate the Bitcoin ETF market, with holdings of more than $21.4 billion and a 38% global market share.

How to Buy Crypto on Bittime

Want to trade, sell, buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.