How to Know When to Buy and When to Sell in the Crypto Market

2024-11-27

Bittime - In the world of crypto investing, knowing when to buy and sell is key to achieving maximum profits. Here Kalimasada shares knowledge about how to know when to buy and when to sell in the crypto market.

This article will discuss important strategies and technical analysis to help you make the right decisions in this volatile market.

The Importance of Knowing When to Buy and Sell in the Crypto Market

Knowing when to buy and when to sell is important, just like getting into college.

Getting in can be easy, but getting out can sometimes be difficult. If not realized, this will not be a profit.

Knowing when to buy and sell is very important in the crypto market.

College Analogy in the Crypto Market

The analogy is, when we enter a college, we have to know when is the right time to graduate.

Likewise in the crypto market, we have to know when is the right time to enter and exit.

If we don't have a clear strategy, we can miss opportunities to make a profit.

Known Crypto Market Cycles

The fact that coins in the crypto market always change every cycle is very interesting.

If we look at the historical snapshot, many coins no longer exist. Only Bitcoin, Litecoin, and Ripple still exist.

The question that arises is, what guarantees that the altcoins that are in the top 10 now will continue to exist in the future?

Bitcoin is here to stay, but other coins may not.

Changes in Coin List in Each Cycle

Every market cycle, we see changes in the list of popular coins. For example, in 2013, many coins are now no longer in existence.

Only Bitcoin and several other coins that still exist. This shows that the crypto market is very dynamic and always changing.

The Sustainability of Altcoins in Every Cycle

Then, the same question arises: what guarantees altcoins The top 10 now in 2024 will still exist in 2044?

Here Kalimasada dares to bet, in 2044, Bitcoin will still exist, but Solana doesn't know what ranking it will be in or what other coins, such as BNB And XRP, maybe it's not in the top 10 anymore.

Why? Because perhaps newer chains will emerge, altcoins with even more sophisticated technology.

That's why the composition of the list always rotates from year to year.

Some come, some go.

Market Development and Blockchain World

Blockchain development is accelerating, and adoption in every country is increasing.

The number of altcoins is also increasing, making the market more competitive.

Investors, both retail and institutional, have more sophisticated strategies to gain profits.

Global Adoption of Crypto Markets

Data from Statista shows that blockchain adoption in various countries is increasing.

This creates new opportunities for investors to participate in this growing market.

However, with the increasing number of altcoins, competition in the market is also getting tougher.

Market Competition in the Crypto Market

This highly competitive nature means that investors, whether retail investors like us or institutional level investors such as hedge funds or venture capital, have much higher competence.

They have a more advanced strategy so they can gain as much profit as possible in the market.

How to Take Profit in the Crypto Market

Let's look at Cardano, for example. If we buy at the bottom and don't take profit, we will return to the entry price.

Let's look at Cardano, for example.

If we buy below here, then in 2021 it will be above, if we don't take any profit at all, we will return to the entry price.

So, it's the same as us just being cheerleaders when this market goes up.

Because of the nature of the crypto market, I don't like to say Pump and Dump, but I say Boom and Bust.

So, if you have made a very significant profit, please consider taking profit.

Take the profits, realize the profits, withdraw the money to your personal bank account, and buy something to reward yourself.

The character of the crypto market means that we have to take profits when we have made significant profits.

Otherwise, we could experience major losses, as happened with Terra Luna.

The Importance of Take Profit in the Crypto Market

Taking profits is an important step in investing.

If we don't take profit, we risk losing all the profits we have earned. This is a valuable lesson that every investor should remember.

Difficulties in Scalping in Crypto Markets

Many people ask if the crypto market is right for them. Compounding in the crypto market is much more difficult than in stocks.

If we buy blue chip stocks, we can expect to earn exponential profits.

However, in crypto, once-champion altcoins may not last long.

Data and Opportunities in the Crypto Market

If we can rotate investments appropriately, we can get higher gains than market standards. There is a risk that maybe the network no longer exists, or maybe there is a new altcoin that is even more sophisticated.

That's why if friends buy the right shares, blue chips domestically or abroad, there is a spin which makes the gain exponential.

But in crypto, this is sometimes broken. If you don't take profit at the top of the cycle then you can rotate it, so you have to be careful. Like it or not, you have to take profit.

Here we must be able to choose the right narrative and timing for entry and exit.

Narrative Skipping in Crypto Markets

What does it mean to jump? narrative? Dari special computing, loncat ke AI, loncat ke RWA, loncat ke privacy, CBDC, cyber security.

But are you tired of jumping around?

You must be tired, because this doesn't last forever.

When friends speculate on altcoins, this is what I have to explain to my friends clearly and openly.

It is very impossible if you want to hold altcoins forever.

I said that's not a good idea.

Every narrative always has its own age, yes, it has its own age of existence.

One particular narrative cannot last for 2 years, 4 years, or maybe 14 years, and so on.

Because the technology of every existing narrative is always developing.

Trading Based on Coin Narrative Historical Data in the Crypto Market

Trading based on narrative historical data in the crypto market, Based on historical narrative data in the crypto market, it usually only pumps for around 2 months and the rest is a dump.

Examples: Metaverse Coin 2 months, Chinese narrative Coin 2 months, DeFi which is the longest 4 months, Solana narrative BRC Coin 2 and also 3 months.

So, friends, you have to understand that you have to actively rotate the money you have, the capital you have, the portfolio you have from one narrative to another.

So, you not only have to choose the right narrative, but also choose the right coin and also the right time to exit.

This is what makes crypto much more difficult, much more competitive.

Risks and Profits in Crypto Markets

So, always balance the risk and the level of profit that you might get.

One thing I often hear from pro players in the market is that beating or timing the market, yes beating the market and timing the market are basically almost the same. It was almost as difficult as competing in the Olympics.

In a crazy world like this, sometimes friends also have to choose between being Mister Perfect, the person who perfectly timing everything, or just being Mr. Perfect. Average.

Yes, at least I can beat the index, yes, beat inflation. Yes, that's enough, I'm happy with the gains I have.

Rotating Investments in Crypto Markets

Rotating investments from one coin to another based on market trends is an effective strategy.

This allows us to take advantage of price movements and gain maximum profits.

5 Ways How to Get a Good Entry in the Crypto Market

To get a good entry, use a large time frame.

This helps us get a more valid analysis.

In addition, split entry into several parts to reduce risk.

1. Use a Large Time Frame

Here I will explain what elements technically support entry, yes support the possibility of making a purchase.

So, friends, you can use order blocks, especially in large time frames.

2. Split Entry

If we want to allocate funds, it is better to divide them into several entries. This helps us avoid major losses if prices fall.

Here I will explain why it is very important to know the right entry, yes or the right time to make a purchase.

This is a phenomenon where the market will not rise perpendicularly. So, the expectation is that people will go from this point to this point, straight to the moon.

Even though there will always be something called a correction or retracement.

Prices go up, down, then up again. OK, that's why it's very important not to enter when the price has gone up.

Wait for retracement, wait for correction, then friends build position.

Enter here to be able to manifest profits when this price rises.

Why? Because if this is the first drop from a psychological perspective, then you won't be calm.

OK, wow why is it minus? This is my portfolio, I should have just entered here.

So what? After I entered, I only saw green. No, I went in, what I saw was red.

This has a big influence on your friends' psychology. And sometimes, a more precise entry can make us get more coins.

If the price here is two, this will drop 50% first, so it's better to buy here first. Yes, buy one. So what? Yes, friends, you can get more profit.

If you have more coins, if you have 100 dollars, then buy two, here you only have 50.

But if you buy one here, friends have 100 coins.

That's from the perspective of why it's so important to know when to make a purchase.

Here I will explain what elements technically support entry, yes support the possibility of making a purchase. So, friends, you can use order blocks, especially in large time frames.

3. Order Blocks and Indicators

I always recommend friends to use order block.

Even if you can't identify the order block, you can use the indicators on the various trading platforms that you have.

So, roughly speaking, the order block is the place where these large institutions make purchases.

Every time this candle makes a large body like this, here what is called an efficiency or gap is formed, and then the price will have a chance to approach the gap before it increases.

OK, friends, you can pay attention to the daily bullish order block or weekly bullish order block on various trading platforms and also the indicators that you have.

Building position around those areas, because there is no guarantee, so the order block here bounces.

It could be that he bounced it on the order block below it. That's why never rally on one entry, because it's very impossible.

Again, timing the market is almost impossible. OK, and here, friends, you can build an entry round order block, because this is the area that market makers, smart money, big institutions pay attention to when placing their orders.

So, as small fish, we have to follow what the smart money is doing.

Yes, smart money, they are smarter than us, yes smarter than us. So we have to follow what they are doing so that we don't suffer losses.

We are small fish swimming with the whales, don't let the whales eat them.

4. Utilizing Liquidity Heatmap

So, next, friends, you can use the liquidity heatmap. What is a liquidity heatmap? So I have explained to my friends that every hour, every 10 minutes, there is always a liquidated position.

So how do these smart money earn profits? Liquidate positions from other smart money.

So, by paying attention to the areas where the smart money is most liquidated, where we can place positions or bets around those areas. Why?

Because there is a term called short squeeze, yes long squeeze, where the price moves in the opposite direction. Yes, right, because there are liquidated positions.

So friends, you can use this as an illustration to place an order or purchase position.

When to buy by paying attention to where the largest liquidation positions of these big players are.

OK, now because we understand that this market is a place full of manipulation, therefore when we pay attention to a certain trading phase, yes or a certain trading pattern, we can also pay attention to what is called the grab.

5. Areas of Manipulation in the Market

There are situations where this smart money traps retail first. Yes, what I said earlier, yes, liquidate a lot of positions down here.

Because the smart money, yes, if they trade, enter here, yes this will definitely stop losses, liquidation here.

This was all taken first, then reclaimed in the previous area.

Because most likely, the positions here have all been liquidated by other smart money who have much larger positions.

Actually it's the same, yes, the concept of the grab then manipulation zone or stop hunt. You can call it whatever, yes here is also manipulation.

This is a Power of Three formation or PO3 formation, where prices often accumulate here, ranging like they do now, then the market drops.

OK, this is where the market forms an area of manipulation.

People when this drops think that this is the end.

Oke, this coin will not going up again.

But what happened? Prices experience what is called an increase.

And this increase, yes, is called distribution.

OK, accumulated distribution manipulation.

Accumulation here is chopping around first, yes manipulating the drop, and then he visaping up to the top.

This also often happens in the market, yes Power of Three, PO3 formation.

Friends, you can pay attention too.

So usually, this manipulation area is the most appropriate place to make an entry.

OK, friends, you have already paid attention to various technical elements before entering or making a purchase.

6 Times When to Sell Purchased Crypto Assets

After buying, the question is when to sell. If we don't sell, our position will not be profitable. It is important to know when to exit.

1. Using Forecast Projection

Forecast projection helps us identify potential price movements based on previous movements. This can help us determine when to exit.

Also do Top Identification We can use the diagonal line to identify potential price tops. Vertical lines can help us see the duration of price movements.

2. Psychological Resistance

Sometimes, market players sell in certain areas, such as round numbers. This could be a psychological resistance that needs to be considered.

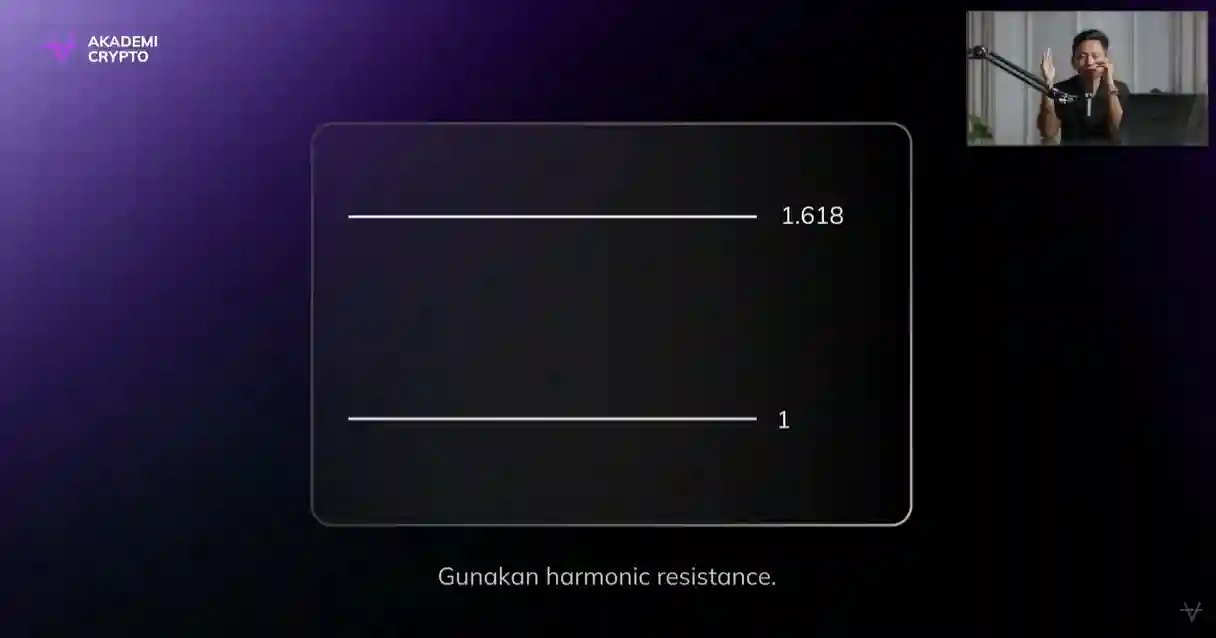

3. Harmonic Resistance

Then when this price breaks above a certain psychological resistance, yes, there is something called harmonic resistance. Yes, or price. Yes, usually it breaks in the 1618, 2618, 3618 area. This can be used as a target, yes a target to take profit or sell when this price is in the harmonic resistance area.

4. Bearish Order Block

Bearish order blocks are visible on smaller time frames. This is an area where prices tend to fall. Paying attention to these areas can help us in decision making.

5. Shrink the Time Frame for Exit in the Crypto Market

OK, this is the opposite of buying. If you want to buy, increase the time frame so you know which is the best area to buy. But if you want to sell, it's actually the opposite.

Yes, reduce the time frame. So what? In small time frames there are always signs, whether it's spiking sales volume on H4, or for example a bearish candle on M15.

OK, you see the shooting star on M15, and so on. OK, if you reduce the time frame, you can identify the potential for sales.

Yes, friends, you can use this as identification to do something called exiting or closing a position, making a sale.

6. Split Exit

Then yes split the exit into several. Previously there was an entry grid, now there is also an exit grid. For example, in a certain supply area, certain sales area, certain resistance. Yes, friends, share the sales.

For example, the first grid asset is 25%, then the second is 50%, 75% and 100%.

So, if you hit fourth position, you are 100% out of position. Yes, so there's no such thing as, "Okay, I'll exit at the top."

No. Identify when you need to make a sale, and that's enough.

Then, yes I prefer these friends to be aggressive in purchasing in the beginning. And finally, you can sell everything or have nothing at all.

I always believe that the character of the crypto market is that it is fast.

Yes, the narrative is only two to 4 months long.

Buy Times and Sell Times in Crypto Markets

So, in my opinion, it doesn't make sense if you buy more than 1 month. The maximum accumulation is 1 month.

Suppose you accumulate, yes, three times. Yes, buy it. Yes, in 1 month, yes buy, buy, buy, buy.

The hope is that next month, my friends will be able to do it moonbag strategy.

Then in the following month, there can be a projection to sell everything. So, be aggressive at the beginning, so be less aggressive at the end. Don't do the opposite.

Yes, at the beginning it wasn't too aggressive, then at the end you added more purchases.

But this is already in the top.

Yes, the price has gone parabolic, the narrative is about to end.

Closing Thought

With all this information, the hope is that we can better understand when to buy and when to sell in the crypto market.

The following is a sharing of knowledge and experience in the crypto market by Kalimasada from the Crypto Academy.

FAQs on Knowing When to Buy and When to Sell in the Crypto Market

When is it Best to Sell Crypto Coins?

It is best to sell crypto coins when the price has increased significantly, ideally when the price has doubled.

In addition, if the asset does not show progress or experiences a continuous decline, release it immediately to avoid greater losses.

If you plan to invest in other more profitable assets, consider selling as well.

How to Know When to Buy Crypto?

The best time to buy crypto is on Mondays, when demand usually decreases.

Avoid buying on payday, as demand tends to increase.

You can also buy when prices decline, using a dollar-cost averaging strategy to minimize risk.

When are Crypto Trading Hours?

The crypto market operates 24 hours a day, 7 days a week. This means you can trade at any time, without time limits.

However, some traders prefer to make transactions at certain hours, such as when the market experiences high volatility, usually at night or on weekends.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Reference

Youtube Akademi Crypto, When is the Right Time to Buy Crypto, Accessed November 27, 2024

Author: IN

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.