How to Take Profit from Crypto Trading So You Don't Lose

2024-12-11

Bittime - In the world of cryptocurrency, terms like "diamond hands" And "HODLing" often becomes a hot topic of conversation.

However, there is one less popular truth: even the most devoted crypto investors need to have an exit strategy.

While buying Bitcoin or your favorite altcoin may seem difficult, knowing when to take profits is the key that separates successful traders from those who are stuck with losses when the market reverses.

Understanding Take Profit in the Crypto Market

Taking profits in the cryptocurrency market means selling some or all of your crypto assets after their value increases.

In contrast to traditional markets that follow more predictable patterns, taking profit in crypto requires a more dynamic approach.

Think of take profits as insurance or collateral against the notorious volatility in crypto.

When Bitcoin can drop 20% overnight, having a clear take profit strategy is not only wise, but also essential for the survival of your portfolio.

Challenges in Taking Profit in Crypto Trading

What differentiates strategic take profit from panic selling? It's all about intention and planning.

While panicked traders may sell their assets at the first sign of market instability, a strategic take profit involves a predetermined exit point based on certain criteria, such as:

- Achieved price target (e.g. Bitcoin reaches a new ATH)

- Technical indicators that show warning signals

- The risk level becomes too high

- The need to balance the portfolio

- Changes in market cycle positions

Common Triggers for Crypto Profit Takeaways

Technical Analysis Indicators

The crypto market relies heavily on technical analysis. When the Relative Strength Index (RSI) is above 70, experienced traders usually start selling some of their assets.

Additionally, as the price approaches a key resistance level, taking some profits can protect against a potential rejection.

Market Cycle Indicator

Changes in Bitcoin dominance often signal major transitions in the market. When BTC dominance drops sharply, this usually indicates peak altcoin season—a good opportunity to take profits for altcoin holders.

Special Events of a Crypto Project

A smart take profit strategy considers tokenomics events such as:

- End of cliff vesting period for initial investors

- Big token opening approach

- Governance changes that affect token utility

- Network updates that typically trigger a “sell the news” reaction

Developing Your Take Profit Strategy

The key to successful profit taking in crypto is not just knowing when to sell—it's also having a systematic approach that removes emotion from decision-making.

Here's how to build a strategy that suits your situation:

1. Percentage Based Approach

One of the simplest strategies is to set a predetermined percentage target. For example:

1. Sell 10% of holdings when price rises 25%

2. Sell another 20% when profit reaches 50%

3. Sell 30% when profit reaches 100%

4. Save the remaining 40% for long-term potential

2. DCA-Out Strategy

Like Dollar Cost Averaging (DCA) used for buying, this strategy is also effective for selling.

Instead of trying to time the perfect exit, consider selling a small portion of your holdings periodically during a bull market.

This approach helps reduce the psychological stress of trying to predict market tops.

3. Take Profit with Hybrid Model

More experienced traders often combine several approaches:

- Using technical analysis to determine a larger exit time

- Make regular small sales during periods of extreme greed

- Selling based on major events of a crypto project

How to Find the Best Time to Entry and Exit Crypto Trading

It is important to note that there is no best time for entry and exit from the crypto market.

Traders must have a trading strategy to navigate the market and predict the best times to enter and exit.

Read too How to Know When to Buy and When to Sell in the Crypto Market

Apart from using the strategies discussed previously, traders must also implement proper risk management and manage their emotions.

This means setting clear profit targets and stop-loss orders, diversifying your portfolio, and avoiding trading decisions driven by emotions.

Additionally, it is important to remember that market conditions can change quickly, so traders must remain flexible and ready to adjust their strategies as needed.

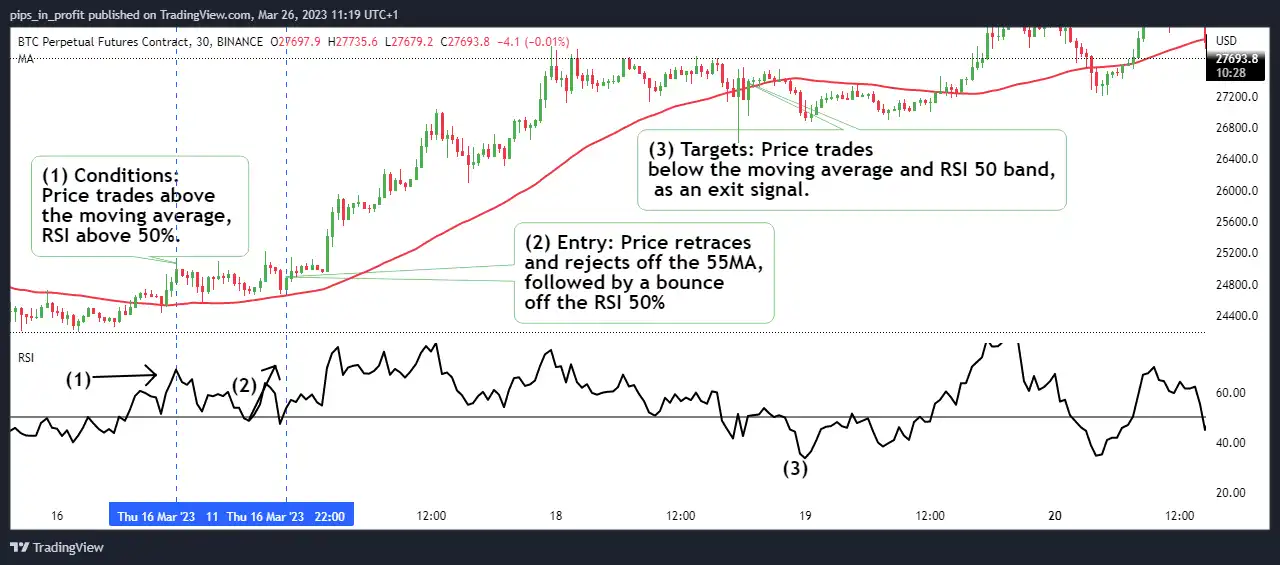

Take Profit with RSI+MA trend continuation strategy

Source: TradingView/Saqib Iqbal

Popular Short Term Trading Strategies in Cryptocurrencies

Short-term trading in the cryptocurrency market requires a different set of strategies compared to long-term investing.

Each strategy has risks and rewards, and traders should consider their goals and risk tolerance before adopting a particular strategy.

Proper risk management and emotional control are essential to avoid impulsive decisions that can lead to losses.

Here are some of the most popular strategies traders use to profit from short-term price movements in the crypto market:

1. Strategi High-Frequency Trading (HFT)

This strategy uses advanced algorithms to analyze market data and execute trades quickly.

HFT traders aim to profit from small price fluctuations within seconds or milliseconds.

To use this strategy, traders need access to a high-speed trading platform and a low-latency connection to the market.

It is important to note that this strategy is not beginner friendly as it is very risky and can cost money to set up.

2. Day Trading Strategy

Day trading involves buying and selling cryptocurrency within a single trading day.

Day traders aim to profit from small price movements in a day.

For this strategy, traders must monitor news and market events closely and use technical analysis to identify entry and exit points.

1. Range Trading: This strategy involves identifying key support and resistance levels, buying when prices are low and selling when prices are high within those ranges. This is very effective in sideways markets.

Range Trading

Source: TradingView: Saqib Iqbal

2. Moving Average Trading: This strategy uses a moving average indicator to look for buying opportunities when the price is above the MA and selling opportunities when the price is below the MA.

3. RSI Trading: RSI is a momentum indicator that estimates the strength of prices at a certain time. When the RSI is above 70%, the market is considered overbought, and when it is below 30%, it is considered oversold.

Trading RSI + MA

Source: TradingView/Saqib Iqbal

3. News Based Trading Strategy

News-based trading involves using news and market events to make trading decisions.

Traders use this strategy to take advantage of sudden price movements that occur due to news announcements.

Traders must stay updated with market news and events and act quickly to enter and exit trades.

Common Crypto Profit Taking Mistakes and How to Avoid Them

Market crypto can be a cruel teacher, and many traders learn from costly mistakes.

Understanding these common pitfalls can help you avoid mistakes on your take profit journey. Here are some mistakes in taking profit in crypto trading:

1. All or Nothing Mentality

One of the biggest mistakes is thinking in absolutes. Instead of selling the entire position at once, practice partial take profits to reduce risk while still maintaining profit potential.

2. Emotions Beat Strategy

The crypto market is designed to play on your emotions.

Euphoria when prices rise and panic when prices fall can destroy the best take profit plans.

Stick to a predetermined strategy, especially when emotions run high.

3. Ignoring Market Context

There is no stand-alone take profit strategy. Traders often make the mistake of implementing bear market strategies during bull markets.

Make sure your strategy is flexible enough to adapt to various market phases.

Read too Bitcoin Fear and Greed Index: Understanding and How to Use It

Building your Personal Take Profit Framework

After understanding the theory, triggers, strategies and common pitfalls of taking profit, it's time to build your personal framework.

Here are the steps to create and implement a take profit strategy that suits your situation:

1. Determine your Crypto Investment Goals

Be honest about what you want to achieve with your investment.

Are you investing for long-term wealth accumulation, generating regular income from trading, or speculating on short-term price movements?

2. Create your personal transaction guidebook

Document your take profit rules based on research and risk tolerance.

Include specific price targets for various assets, technical indicators you will monitor, and position size limits.

3. Implement and Monitor Your Crypto Assets

Start small to test your approach and note what works and what doesn't.

Conduct regular reviews to adjust strategies based on the results obtained.

4. Develop your Infrastructure

Prepare the necessary tools and accounts to support your strategy, perhaps such as several exchange accounts to minimize redundancy and a tax recording system.

Conclusion

Take profit in crypto it's not about perfect timing—it's about protecting and growing your capital consistently in a highly volatile market.

Remember to start with a clear plan, use multiple take profit triggers, and stay disciplined with your strategy.

By applying these principles, you will be better prepared to take advantage of opportunities in the crypto market in the future.

FAQ

What is the Initial Capital for Crypto Trading?

Initial capital for crypto trading varies depending on individual strategies and preferences. However, many beginner traders start with capital of around $100 to $500.

This allows them to learn and adapt to the market without taking big risks. It is important to only use money you can afford to lose.

But don't worry, at Bittime itself you can deposit with just 10,000 rupiah, at least you can be exposed to how the crypto market works

When Should You Take Crypto Profits?

You should take profit when the crypto asset price has reached a predetermined profit target, or when technical indicators show that the market may reverse.

In addition, if there is news or an event that can significantly influence prices, it can also be a good moment to take profits.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Reference

Brian Kurian, How to Take Profits in Cryptocurrency: Step-by-Step Strategy Guide, Accessed December 11, 2024

Saqib Iqbal, How to Take Profits in Crypto Trading? Short-Term Trading Strategies, Accessed December 11, 2024

Author: IN

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.