Doji Candlestick: Definition, Types, and How to Read It

2024-09-17

Bittime - Crypto traders are always looking for clues to understand the direction of market movements. One tool that is often used is technical analysis, and among the various patterns that exist, the Doji Candlestick.

What is a Doji Candlestick? What are the types and how to read them? Curious about the answer? Keep reading this article to find out!

What is a Doji Candlestick?

Imagine you are watching a tug of war match. Both teams are equally strong, so the rope barely moves. That is a simple description of the Doji Candlestick in the world of trading.

Doji is a candlestick pattern that forms when the opening and closing prices of an asset are almost the same or even identical. On a graph, this is displayed as a thin horizontal line (or even dots) with a vertical axis above and/or below it.

These axes, also known as “shades” or “tails”, depict the range of highs and lows during that trading period.

The presence of a Doji indicates a balance of power between buyers (bulls) and sellers (bears). This is a moment where the market seems to be holding its breath, hesitant to move in any direction. For observant traders, Doji can be an important signal for a potential change in trend or upcoming consolidation.

Read also: What Is W-coin: How to Play and Partnerships

What are the Types of Doji Candlesticks?

Just as in the culinary world there are various variations of cuisine, Doji also comes in several different "flavors". Each has a unique form and meaning:

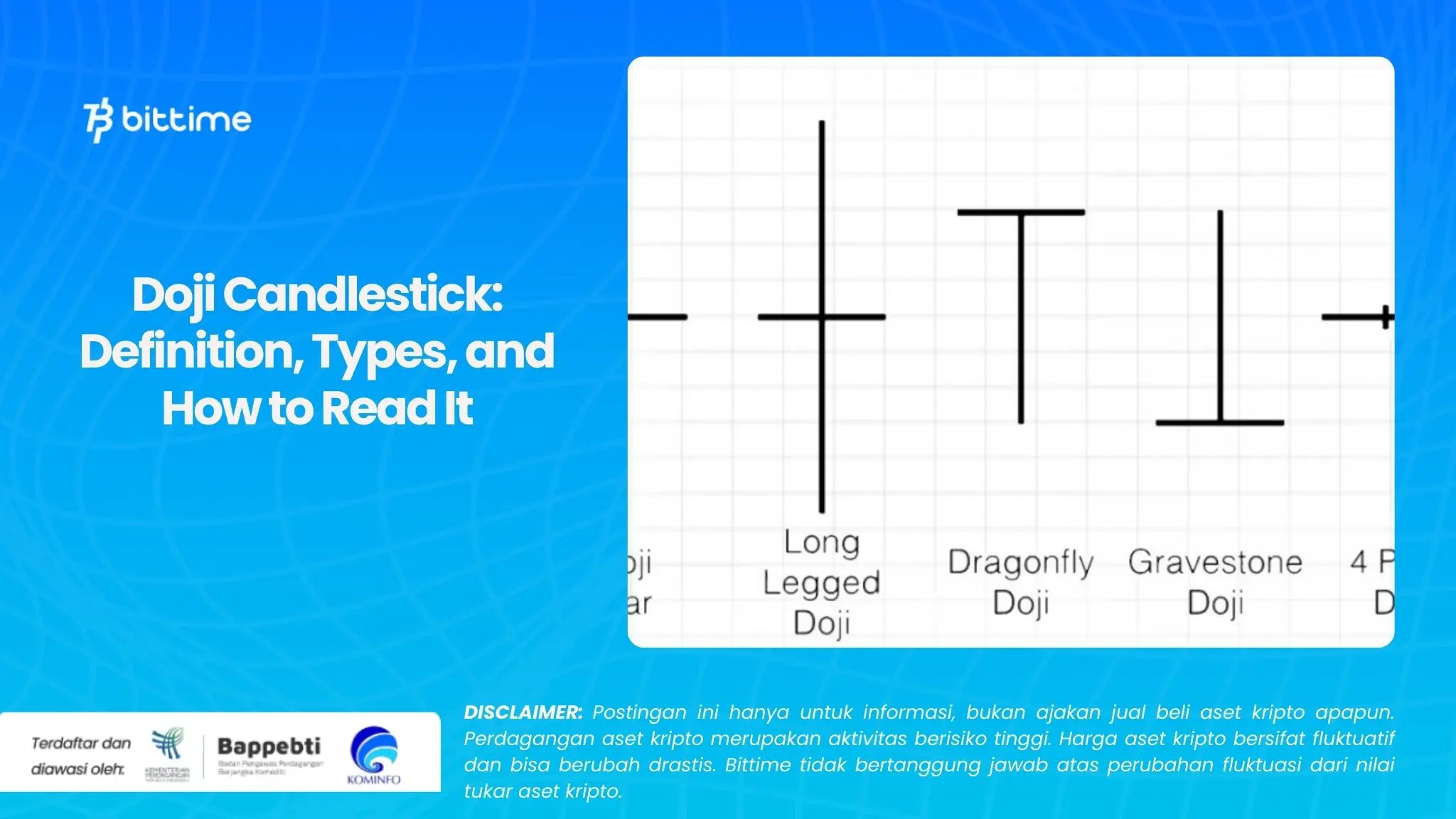

1. Doji Standard

This is a classic form, where the opening and closing prices are exactly the same, creating a perfect horizontal line. Think of this like an equal sign (=) on your graph.

2. Gravestone Doji

This pattern has a long upper wick with no lower wick. Visualize this like an upside down 'T'.

Typically, this is a bearish signal that appears at the top of an uptrend, indicating that buyers initially pushed the price up, but sellers took over towards the close.

Read also: Tutorial for Playing Catizen Airdrop Listed on Binance

3. Dragonfly Doji

The opposite of Tombstone, this pattern has a long lower wick with no upper wick. The shape resembles the letter 'T'.

Often this is a bullish signal that appears at the bottom of a downtrend, indicating that sellers initially pushed down the price, but buyers managed to push it back up.

4. Long-Legged Doji

This pattern has long top and bottom wicks, creating a shape like a plus sign (+). This describes extreme volatility during a trading session, with prices moving long distances up and down before finally returning to the starting point.

How to Read Doji Candlestick

Reading Doji is not just about seeing its shape, but also understanding the context in which it appears. It's like reading someone's facial expressions - you need to consider the surrounding situation to truly understand their meaning.

1. In Uptrend

If a Doji appears after a long series of bullish candlesticks, this could be a signal that buyer momentum is starting to weaken. Traders may see this as an opportunity to take profits or prepare for a short position.

2. In Downtrend

Conversely, a Doji that appears after a series of bearish candlesticks could signal that sellers are running out of steam. This may be an early signal for an upward trend reversal.

3. As Part of a Larger Pattern

Doji are often an important component in more complex candlestick patterns. For example:

- Morning Star: A Doji that appears after a bearish candlestick and is followed by a bullish candlestick can form this pattern, signaling the potential for a strong upward reversal.

- Evening Star: In contrast, a Doji that appears after a bullish candlestick and is followed by a bearish candlestick can form this pattern, indicating a potential downward shift.

Read also: Tutorial on Playing Airdrop Catizen Listed on Binance

4. Consider Volume

Always pay attention to trading volume when Doji appears. Doji on high volume are generally more significant than those appearing on low volume.

5. Confirmation

Don't rush into making decisions based on Doji alone. Wait for confirmation from the next candlestick to strengthen the signal you see.

Conclusion

The Doji Candlestick, with its many variations, is a powerful tool in technical traders. It gives us insight into critical moments in the market when the power of buyers and sellers is in a delicate balance.

However, like all technical analysis tools, Doji is not a crystal ball that can predict the future with certainty.

Wise traders will use Doji as one indicator in a broader trading strategy, not as a stand-alone signal. Combine Doji readings with long-term trend analysis, other technical indicators, and of course, a solid understanding of the fundamentals of the assets you trade.

This is a review of the Doji Candlestick which has been summarized by Bittime. Continue following the latest updates from Bittime to find out other interesting articles!

How to Buy Crypto on Bittime

You can buy and sell crypto assets in an easy and safe way via Bittime. Bittime is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Learn How to Buy Crypto on Bittime.

Monitor price chart movements of Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.