Ethereum Gas Fee Rises to 416 Gwei

2024-08-05

Bittime - Ethereum gas fees rises to 416 gwei according to the latest data from Etherscan. What are the causes and impacts? Read this article to find out the full news!

What is Ethereum Gas Fee?

On the Ethereum network, gas fees are fees charged to users for processing transactions or running smart contracts.

Gas fees are calculated in gwei, which is a small unit of Ethereum (ETH). This gas fee is useful to compensate miners who allocate their computing power to process and validate transactions on the blockchain.

Why is Ethereum Gas Fee Rising?

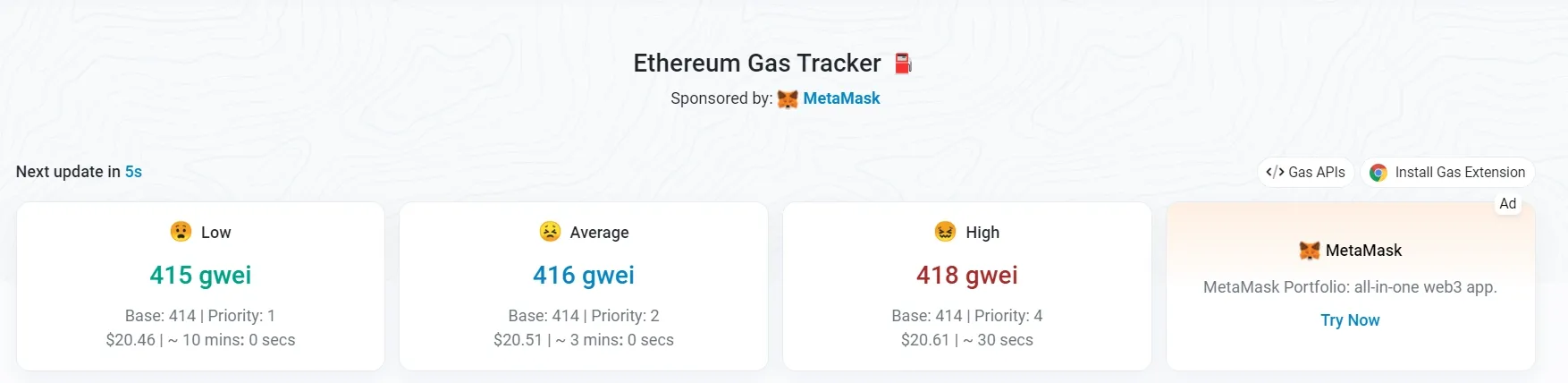

Source: etherscan.io

Gas fee spikes on Ethereum are often caused by increased activity on the network. Here are several factors that can influence the increase in Ethereum gas fees.

- High Transaction Volume: When many people make transactions or use DApp at the same time, demand for processing transactions increases. This causes gas fees to spike as users compete to process their transactions faster.

- Protocol Launch or Update: A new product launch, token airdrop, or major update in the Ethereum protocol could also cause a temporary spike in network activity, ultimately pushing gas fees up.

- DeFi and NFT Activities: Activity in the DeFi and NFT ecosystem could also be the main cause of the increase in gas fees. The popularity of DeFi applications and NFT purchases often increases the number of transactions requiring validation in a short period of time.

The Impact of the Ethereum Gas Fee Surge for Users

Gas fee spikes such as those currently occurring have a direct impact on various types of users on the Ethereum network. Here are some of the impacts for Ethereum users.

- Retail Users: For retail users who want to make simple transactions, such as sending ETH or other tokens, high gas fees can be a barrier. Many users will likely hold off on transactions until gas fees drop back to more reasonable levels.

- DApp Developers and Projects: Developers running applications on top of Ethereum were also impacted. This fee spike could increase their operational costs, especially if their DApp requires intensive on-chain interactions.

- Investor DeFi: For active DeFi investors, high gas fees can reduce their profit margins. Every time they interact with a DeFi protocol, such as staking or yield farming, they have to pay a gas fee, which can erode their investment returns.

With Ethereum's transition towards Ethereum 2.0, where the network will switch from proof-of-work (PoW) to proof-of-stake (PoS), there is hope that gas fees will become more stable and lower.

However, until this transition is complete, Ethereum users should be prepared to face high fluctuations in gas fees, especially during periods of intense network activity.

How to Buy Crypto with Bittime

You can buy and sell crypto assets in an easy and safe way via Bittime. over is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Monitor graphic movement price Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.