Bitcoin Holders Start Selling BTC at Top Price

2024-11-11

Bittime - Bitcoin holders start selling BTC at the peak price. Long-term Bitcoin holders, known as Long-term Holders (LTH), have started selling their BTC as the Bitcoin price hit its recent all-time high.

Also read Bitcoin Price Prediction According to Experts: Could Reach $97K per BTC

Bitcoin Hits New ATH on November 6, 2024

On November 6, the price of BTC soared past $75,000, and continued to rise to hit $76,990 the following day.

This significant price movement prompted some long-term holders to take profits.

This LTH activity is often an important signal in Bitcoin market cycle analysis, indicating what stage of the cycle Bitcoin's price may currently be at.

By looking at the sales patterns of long-term holders, investors can gain insight into potential future trends.

Also read: Who Owns the Most Bitcoins and Profits the Most from BTC All Time High?

Indikator Long Term Holder Net Position Change

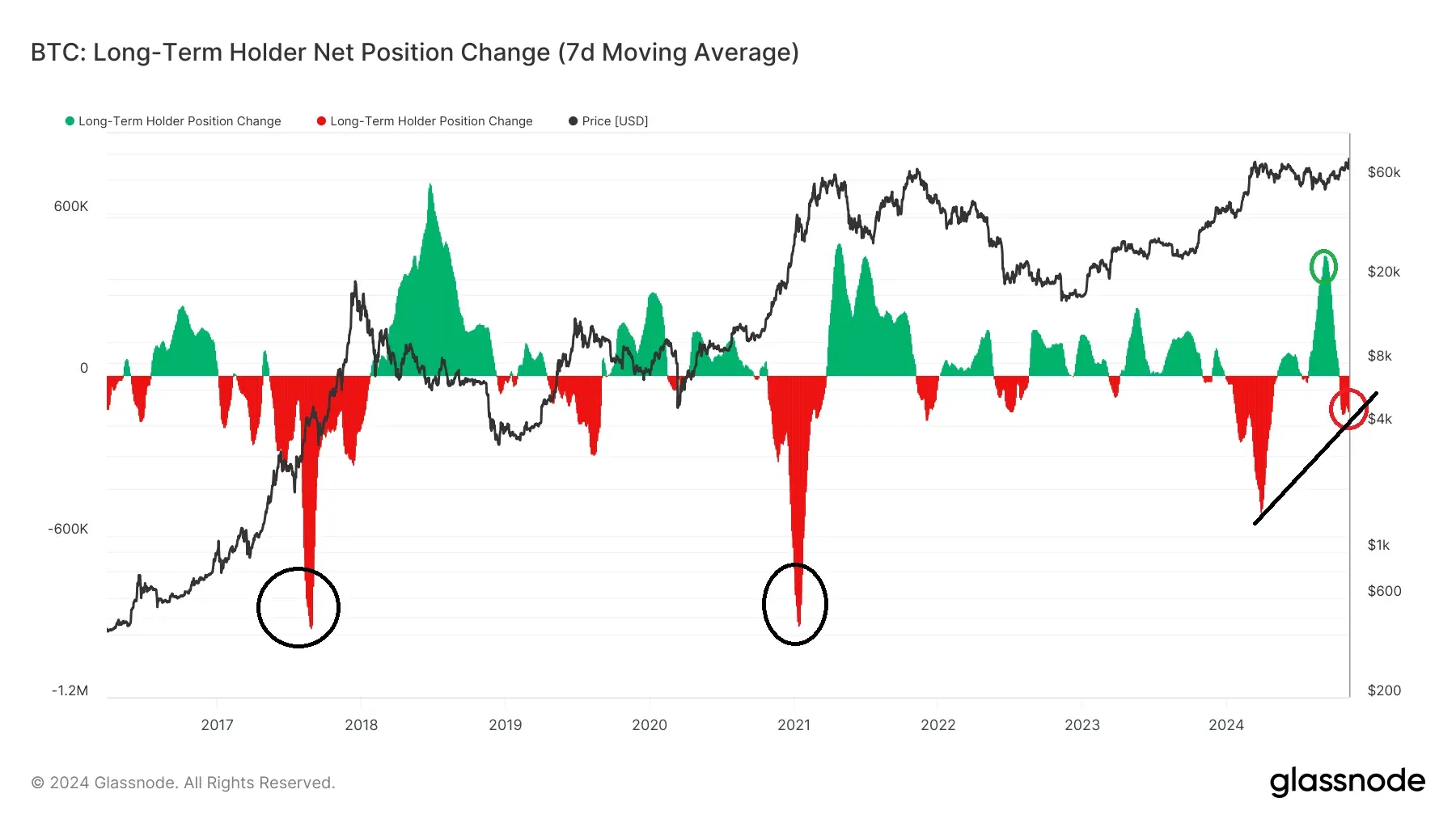

An important indicator that tracks the behavior of long-term holders is the Long-Term Holder Net Position Change.

This indicator measures the change in the supply of Bitcoin held by LTHs over the last 30 days.

Recent data shows that long-term holders started accumulating Bitcoin in August and September when prices were around $52,000, and started selling after BTC prices surpassed previous record highs.

However, the amount of Bitcoin sold by long-term holders is still at a lower level compared to the market peak in April, when LTHs were selling around 500,000 BTC per day.

Also read Bitcoin (BTC) Price

Long Term Holder is still in the Early Stage of Profit Taking

Currently, the daily selling volume of LTHs is hovering around 150,000 BTC, indicating that they are still in the early stages of profit-taking.

Indikator Market-Value-to-Realized-Value (MVRV) dan Net Unrealized Profit/Loss (NUPL)

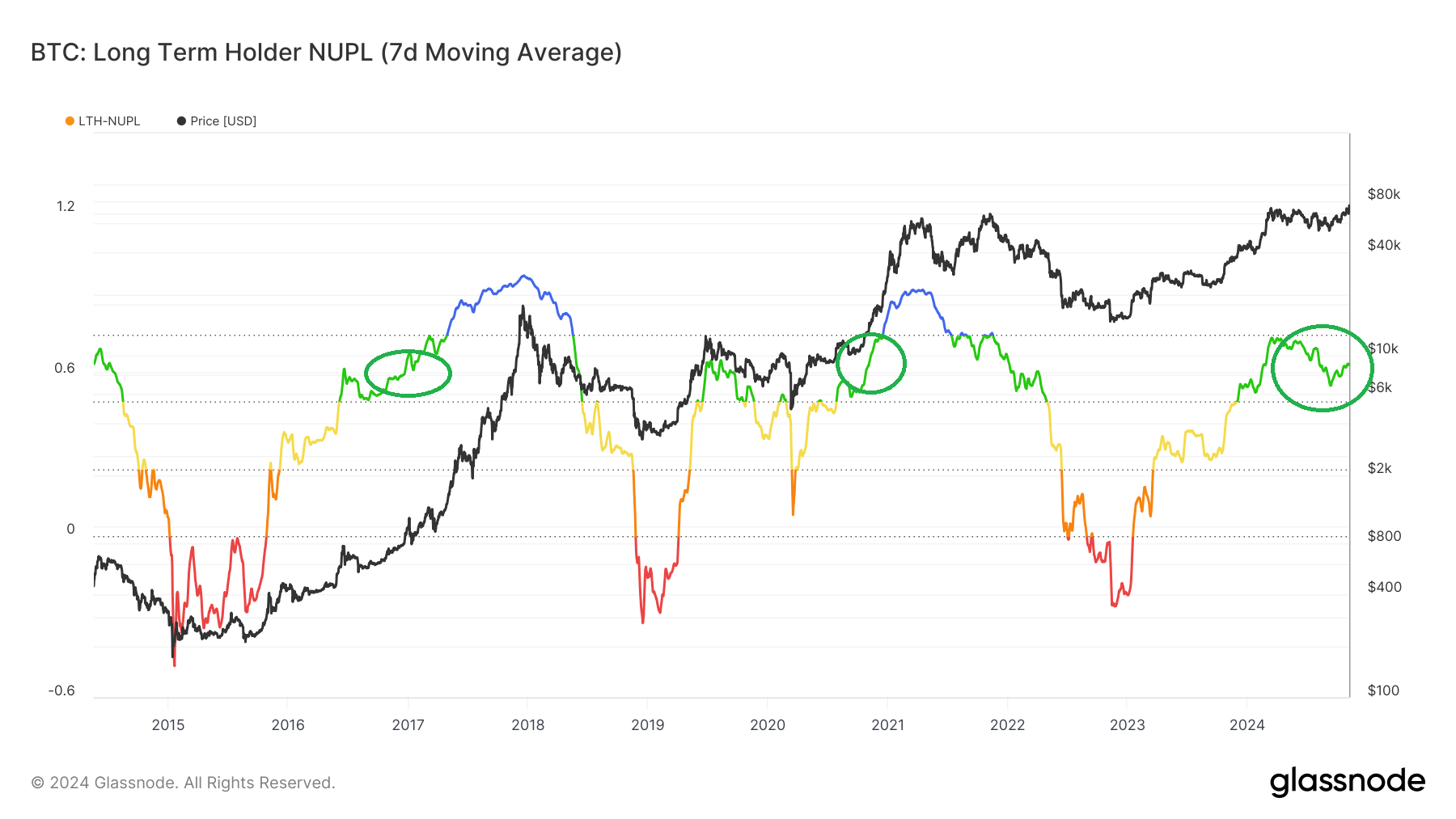

Furthermore, two additional indicators, Market-Value-to-Realized-Value (MVRV) and Net Unrealized Profit/Loss (NUPL), also suggest that Bitcoin's bull cycle still has room to continue its uptrend.

The MVRV indicator specifically for LTHs measures the ratio between the market value and the realized value of Bitcoin held by long-term holders.

Currently, the indicator is at 2.5, well below the peak levels of 20 and 12 in the previous cycle.

This suggests that Bitcoin has not yet reached the overbought zone as it did at the peak of the previous market cycle.

Bitcoin's NUPL Indicator

The NUPL indicator, which measures market sentiment based on unrealized gains or losses, recorded a high of 0.72 this cycle and is currently at 0.63.

In the previous cycle, NUPL reached the euphoria zone above 0.75 before a major correction. Currently, the level is still below that number, indicating that Bitcoin's upside potential is not yet completely exhausted.

Thus, although some long-term holders have started selling their BTC, data shows that the number is still relatively small compared to previous peak cycles.

Conclusion

Indicators like MVRV and NUPL suggest that Bitcoin still has room for further upside.

A potential BTC price peak can be seen if the MVRV and NUPL indicators reach critical levels, while the daily LTH sales volume consistently exceeds 500,000 BTC.

Reference:

*https://www.ccn.com/analysis/crypto/bitcoin-long-term-holders-lth-profits-growth*

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.