Fear and Greed Index Drops, Lowest Point in 18 Months!

2024-06-25

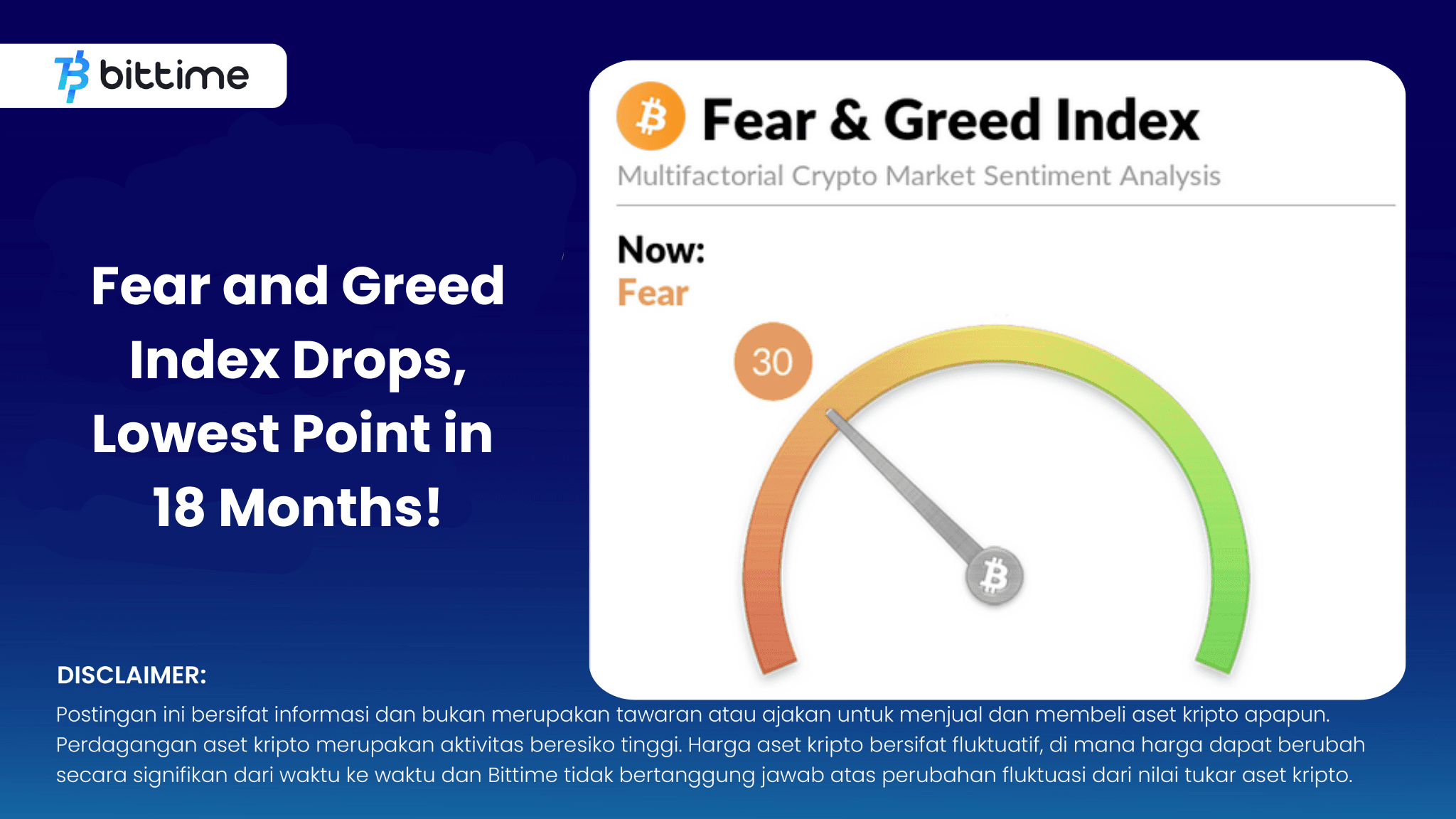

Bittime - The Fear and Greed Index, which measures market sentiment for Bitcoin and cryptocurrencies as a whole, has hit its lowest score in almost 18 months. On June 24, the index entered the Fear zone, marking one of the largest daily declines in recent years.

What is the Fear and Greed Index?

The Fear and Greed Index is a tool used to measure market sentiment, especially cryptocurrency. This index provides an idea of whether the market is in a state of Fear or Greed, often reflecting price trends and trading activity. The index score ranges from 0 to 100, where a low value indicates extreme fear and a high value indicates extreme greed.

Fear and Greed Rating Factor

The index considers several factors in its assessment:

1. Market Volatility (25%): Measures Bitcoin price fluctuations and sharp movements in recent times.

2. Trading Volume (25%): Observe Bitcoin trading volume on various exchanges.

3. Bitcoin Dominance (10%): Measures Bitcoin's market share compared to the total cryptocurrency market capitalization.

4. Train (10%): Analyze Google search trends and social media activity related to Bitcoin.

5. Survey (15%): Although this metric is currently discontinued, surveys of market participants are also used to measure sentiment.

Crypto Market Sentiment Declines

On June 24, the index fell to 21 points, entering the Fear zone. This is a significant decrease from the previous week, where the score was at 74, which falls into the Greed zone. This decline shows a drastic change in market sentiment in a short period of time.

The last time the index was in the fear zone was about 7 weeks ago, on May 3 to be precise. However, a score below 30 has not been recorded since January 11, 2023, when Bitcoin was trading at $17,200, 2 months after the crash of crypto exchange FTX.

Factors Causing the Fear and Greed Index to Fall

Several factors have influence recent negative market sentiment:

1. Outflows dari Bitcoin Exchange-Traded Funds (ETF): Over the last 10 trading days, more than $1 billion has flown out of spot Bitcoin ETFs.

2. News Mt. Gox: News that Mt. Gox may be preparing to sell $8.5 billion worth of Bitcoin to its creditors has sparked concerns among market players.

3. Bitcoin sales by Germany: The German government also started selling some of their Bitcoin reserves.

4. Sales by Bitcoin Miners: Bitcoin miners have been selling more Bitcoins than usual, coupled with a significant drop in network hashrate.

Nonetheless, an executive at cryptocurrency investment firm Galaxy Digital believes that the market may be overreacting slightly to concerns regarding Mt. Gox.

Impact on Bitcoin Price

At the time the index recorded this decline, Bitcoin price was around $60,300, having hit a 7-week low on June 24. This price decline reflects negative market sentiment and investors' concerns about various news circulating.

Fear sentiment often leads to heavy selling, i.e. investors tend to sell their assets to avoid further losses. On the other hand, Greed sentiment usually triggers massive buying, that is, investors buy assets in the hope that prices will continue to rise.

This drastic change in the Fear and Greed index shows how quickly market sentiment can change, as well influence investment decisions of market players.

How to Buy Crypto with Bittime

You can buy and sell crypto assets in an easy and safe way via Bittime. Bittime is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Monitor graphic movement Bitcoin (BTC), Ethereum (ETH), Solana (SOL) price and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.