Bitcoin Investors Withdraw $331 Million from BlackRock IBIT ETF

2025-01-03

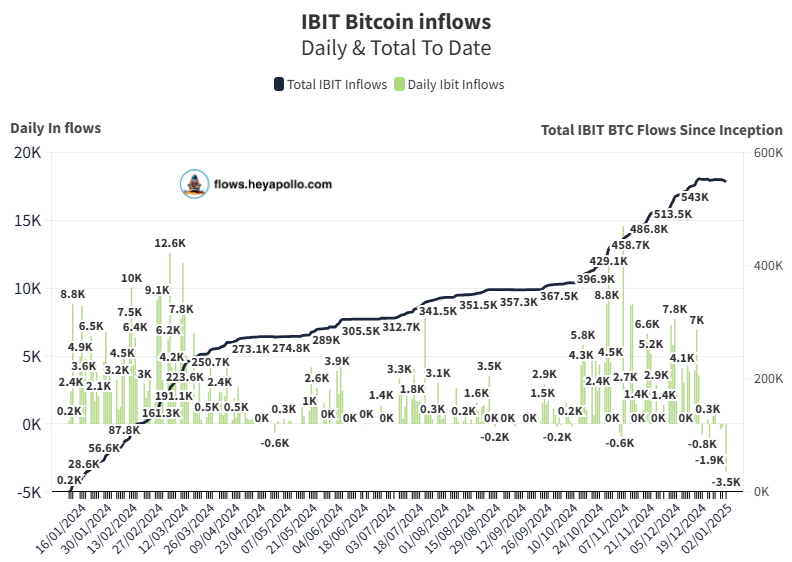

Bittime - Investor Bitcoin recently attracted $331 million in funding from BlackRock's iShares Bitcoin Trust (IBIT), recorded the largest daily withdrawal since its launch. The drawdown occurred on January 2, after US markets reopened following the New Year holiday.

Record Withdrawals of Bitcoin Funds from ETFs

Data from Farside Investors shows that BlackRock IBIT saw withdrawals of $332.6 million on the day, topping the previous record set on December 24 of $188.7 million. This also marks three consecutive days of withdrawals for this Bitcoin investment product, which is a new record.

BlackRock ETF outflows accelerate. Source: Thomas Driver

In the past week, total withdrawals from IBIT reached $392.6 million. While this drawdown is significant, some analysts argue that it may just be a temporary fluctuation. BlackRock IBIT remained in third place for inflows among all exchange-traded funds in the U.S. in 2024, with total inflows reaching $37.2 billion, according to data from Bloomberg.

Read too Explanation of Halal or Haram Bitcoin: MUI Says and Investment and Trading Laws!

Comparison of Bitcoin ETFs with Other Coin ETFs

The Vanguard 500 Index Fund led the way with $116 billion in inflows, followed by the iShares Core S&P 500 ETF with $89 billion. Adam Back, a Bitcoin pioneer, commented that perhaps by 2025, Bitcoin ETFs will take the top spot with more inflows and higher prices.

Although BlackRock IBIT experienced withdrawals, several other funds such as Bitwise, Fidelity, and Ark 21Shares actually recorded positive inflows, amounting to $48.3 million, $36.2 million, and $16.5 million, respectively. Grayscale's Bitcoin Mini Trust also saw small inflows of $6.9 million, although its larger GBTC fund saw withdrawals of $23.1 million.

Read too Everything Happening to Bitcoin Through 2024: BTC ETFs, Trump, and the All-Time High

Future Predictions: BTC Combined ETF and ETH ETF

Total withdrawals on the day reached $242 million, indicating that BlackRock IBIT offset inflows from its competitors. On the same day, Nate Geraci, president of ETF Store, provided several predictions for crypto ETFs in 2025. These predictions include the launch of a hybrid ETF for Bitcoin and Ether, ETH spot ETF options trading, as well as the approval of a Solana spot ETF.

Conclusion

Although BlackRock IBIT experienced significant withdrawals, the Bitcoin ETF market as a whole shows potential for future growth. With positive predictions and strong inflows into other funds, investors remain optimistic about developments in the sector.

FAQ about Withdrawing BlackRock IBIT ETF Funds

1. What caused the $331 million withdrawal from BlackRock IBIT?

This withdrawal of funds occurred after the US market reopened after the New Year holiday, and was an investor reaction to volatile Bitcoin market conditions. It also recorded the largest daily withdrawal since the launch of IBIT.

2. How many total withdrawals did BlackRock IBIT experience in the last week?

In the past week, BlackRock IBIT experienced total withdrawals of $392.6 million, indicating a significant withdrawal trend from this investment product.

3. How does BlackRock IBIT perform compared to other ETFs?

Despite the drawdown, BlackRock IBIT remains in third place for inflows among all ETFs in the US in 2024, with total inflows reaching $37.2 billion. This shows that despite the recall, interest in this product is still high.

4. What are the predictions for Bitcoin ETFs in the future?

Several analysts, including Nate Geraci, predict that there will be the launch of a combined ETF for Bitcoin and Ether, as well as the approval of a Solana spot ETF in 2025. This indicates positive growth potential for the crypto ETF sector in the future.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Reference

Martin Young, Bitcoin investors pull $333M from BlackRock IBIT ETF in record outflow, Accessed December 3, 2024

Author: IN

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.