Crypto Market Crash! The Aftermath of Jump Trading Selling Aggressively?

2024-08-07

Bittime – The majority of the crypto market has been reddened recently due to the activity of one user who carried out aggressive sales. Sales even reached more than $400 million.

The following is a more detailed explanation.

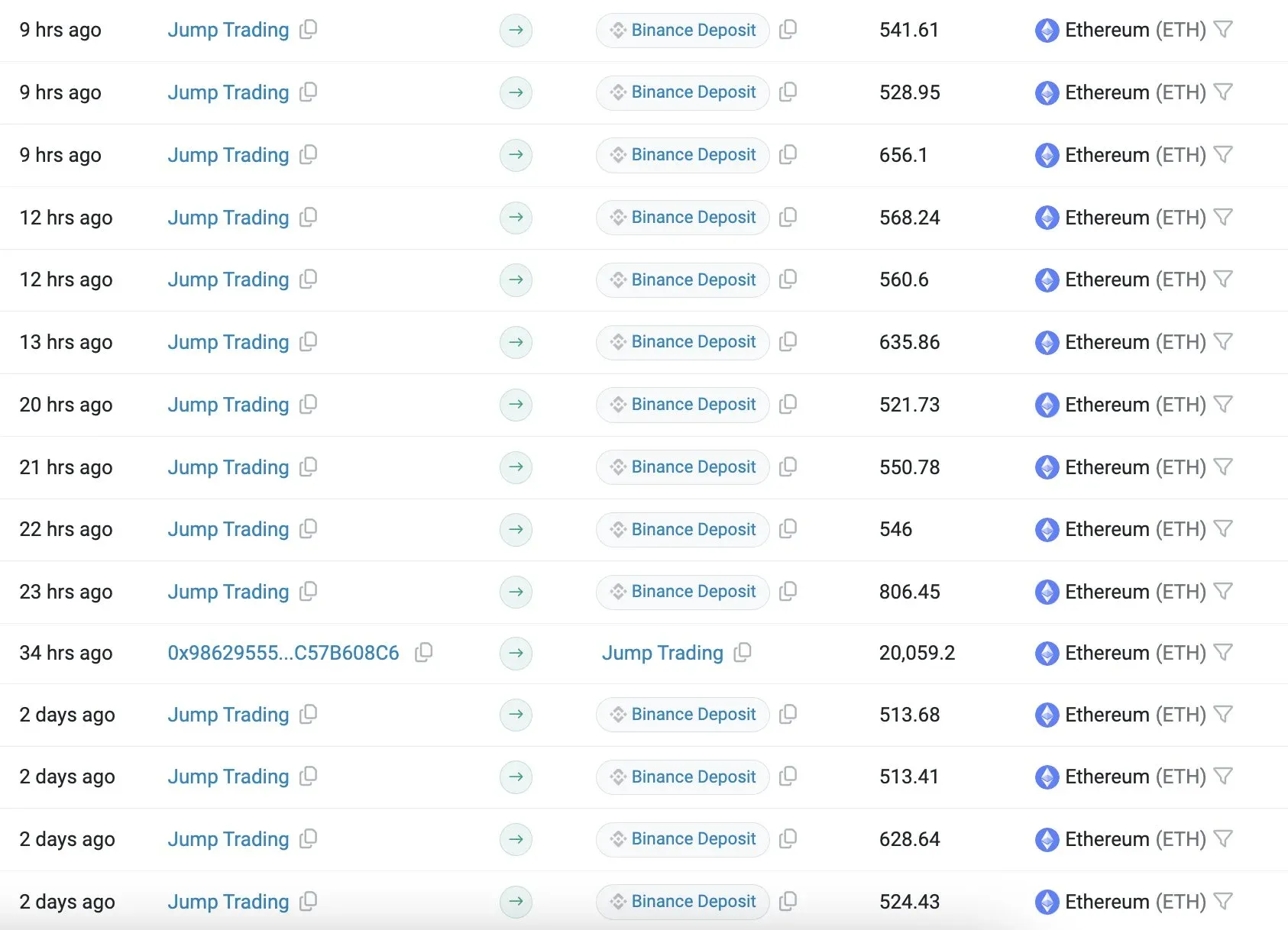

Massive Sale by Jump Trading

Sumber: lookonchain/X

The cryptocurrency market has experienced a sharp decline recently. A report from QCP Group, a leading digital asset trading company from Singapore, attributed the decline to aggressive selling by Jump Trading.

The massive sell-off by Jump Trading has sent shockwaves throughout the crypto ecosystem, causing double-digit price drops in major digital assets such as Bitcoin and Ethereum.

Read Also: Telegram Games Increasingly Popular, Active Users Soar 20x!

Massive Ethereum Movement by Jump Trading

Blockchain analysis platform Spot On Chain also detected the transfer of 17,576 ETH worth $46.78 million by Jump Trading to various exchanges over the weekend.

The company's recent activity includes converting 83,091 wstETH (worth $341 million) into 97,600 stETH and withdrawing 86,059 stETH (worth $274 million) from Lido Finance. As a result, there was a net addition of 72,213 ETH, equivalent to $231 million, to exchanges.

Despite the massive transfer, Jump Trading still maintains significant crypto holdings. Data from Arkham Intelligence shows the company holds about 37,604 wstETH and 3,214 RETH, worth about $110 million.

Additionally, other wallets associated with Jump Trading hold approximately $585 million in cryptocurrency, primarily in stablecoins such as USDC and USDT.

Impact of Jump Trading Activities

The impact of Jump Trading actions is huge. Blockchain analyst Lookonchain reports that the market has dropped more than 33% since the company started its selloff on July 24.

The sale drew criticism from within the crypto community, with Adam Cochran, Managing Partner at Cinneamhain Ventures, stating that the liquidation of Jump Trading's crypto holdings "in a thin market on Sunday afternoon perfectly illustrates why their crypto operations are in disarray."

Macroeconomic Factors Worsen the Situation

Although Jump Trading actions contribute greatly to market declines, macroeconomic factors also exacerbate volatility.

Weak US labor market data released on Friday raised concerns about a potential recession. The job addition figure was only 114,000 in July, far below expectations of 175,000.

The sale of around 50% of Apple shares by Warren Buffett's Berkshire Hathaway also added to market concerns. This step is considered an effort to hedge against a potential market decline.

Additionally, the Bank of Japan's decision to raise its key interest rate for the second time since 2007 sent shockwaves through global financial markets. The Nikkei index experienced its biggest decline in two days in history.

Read Also: 5 Crypto Assets Worth Buying During a Market Crash

DeFi Shows Resilience

Despite market stress, some decentralized finance (DeFi) protocols are showing resilience and even making profits.

Aave, a leading DeFi lending platform, reported substantial earnings during a period of falling prices. Stani Kulechov, founder of Aave, revealed that the protocol made $6 million overnight due to market pressure.

These revenues primarily come from decentralized liquidations, demonstrating the platform's role in maintaining market stability across its 14 active markets across Layer 1 and Layer 2 networks.

The market drop triggered massive liquidations, with more than $1 billion liquidated in the crypto derivatives market and an additional $350 million in DeFi protocols, according to data from Parsec Finance.

Aave experienced several large liquidations, including a $7.4 million wrapped ether (WETH) position that generated $802,000 in revenue for the protocol.

How to Buy Crypto on Bittime

You can buy and sell crypto assets easily and safely via Bittime. Bittime is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also ensure you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application. Study Complete Guide How to Buy Crypto on Bittime.

Monitor graphic movement of Bitcoin (BTC) price, Ethereum (ETH), Solana (SOL), and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.