Understand What is Timing the Market in Crypto

2024-11-24

Bittime - In crypto, there are many terms that can be difficult for people to understand crypto trading beginner. One of these terms is 'timing the market'.

In this article, let's briefly review what timing the market is and how it relates to investment strategies in crypto assets.

Understanding What Timing the Market is

In the overall economic context, according to Britannica, timing the market or market timing is an action to anticipate the lowest and highest prices for buying and selling assets.

The term timing the market by Britannica seems to be considered similar to the term market timing, so the explanation is the same.

So, how does the term 'timing the market' apply to the world of cryptocurrency? What is timing the market in crypto?

Read Also: 30 Crypto Slang Terms You Must Know

If explained in a simpler explanation, timing the market is an attempt to examine market timing through a crypto investment strategy which involves buying/selling decisions on an asset by predicting market price movements.

The implementation of timing the market is to buy assets whose prices are low, then sell them when the assets are at high prices.

Timing The Market Strategy

As explained in the explanation of what timing the market is above, timing the market or market timing is closely related to investment strategies in the form of predictions.

Through observing the price movement of an asset, predictions are built with the assumption of buying assets when the price is low and selling them when the asset price is high.

Investors compile certain calculated entries in the market, then make predictions about how prices will move in the future.

Read Also: The Importance of Learning Financial Literacy Before Playing Crypto

Usually the timing the market strategy targets profits in the short term while avoiding potential losses that could occur.

As an investment strategy, whether or not timing the market is effective depends on the investor's skill in consistently predicting asset market declines and peaks.

Then, with this predictive information capital, investors can determine the right time to enter and exit asset price movements in the market.

Forecasting Asset Prices

The skill to predict the market movement of an asset is a skill that requires experience capital, so it is difficult to do it without prior experience.

Even experienced investors may not be able to calculate and predict the condition of certain assets in a market, let alone those who are just learning.

Investors with relatively a lot of experience and the ability to predict the market usually estimate the market regularly and assess where the market is going.

Read Also: Financial Literacy in the Crypto Context

They also actively follow trends and news related to specific assets that can influence investment trajectories.

Investors who use timing the market methods and strategies usually have a good understanding of technical analysis and can use their knowledge and experience to make informed decisions.

Case Example of Timing The Market

One day, hangry XRP are in numbers $0.75, then sOne investor predicts that the price of XRP will next increase to $1 in the coming days thanks to an important event.

Armed with this belief, he bought XRP worth $750, or equivalent to 1000 XRP.

A few days later, his prediction proved correct, and the price rose to $1. Investors also sold everything 1000 XRP his property, making a profit of $250.

Every investment decision is always accompanied by a certain level of risk.

Read Also: How To Buy XRP (XRP) | XRP to IDR | XRP to USDT

In the scenario above, when investors decide to buy more XRP, the potential profits will be greater.

However, if prices actually fall during that period, the losses suffered will also increase proportionally.

The timing the market strategy aims to optimize profits. Although it offers the potential for high returns, this strategy also carries commensurate risks.

Advantages and Disadvantages of Timing The Market

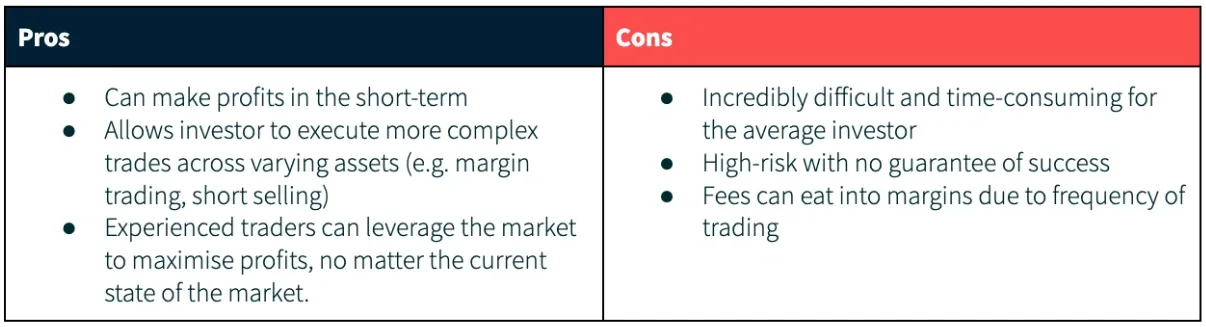

Timing the market does seem to be an investment strategy that seems easy.

However, in practice, it takes experience and in-depth knowledge to implement a timing the market strategy.

As additional information, the following are the advantages and disadvantages of implementing the timing the market strategy.

Advantages of Timing The Market

1. Short Term Profit Potential

The timing the market strategy allows investors to make profits in a short time, especially in a volatile market like cryptocurrency.

Fast price movements can be exploited to obtain maximum results.

2. Flexibility in Complex Trading

Simultaneously with the implementation of timing the market, iinvestors can freely use a variety of more complicated trading strategies, such as margin trading or short selling.

Thus allowing them to take advantage even in declining market conditions.

3. Maximizing Market Potential for Experienced Traders

Traders who have in-depth knowledge and experience can take advantage of every market condition, whether rising, falling or stagnant, to gain optimal profits.

Read Also: Crypto Asset Converter & Calculator

Disadvantegs of Timing The Market

1. Difficult and Time-Consuming for the Average Investor

The timing the market strategy requires in-depth analysis, intensive market observation, and the ability to make quick decisions.

This can be a big challenge for novice investors or those who don't have enough time.

2. High Risk with no Guarantee of Success

Timing the market has a very high level of risk because predictions are not always accurate.

If the market moves contrary to expectations, investors can experience large losses.

3. Costs That Reduce Profits

Remember stiming the market strategy involves intense trading, transaction costs such as platform fees and taxes can eat up a large portion of profits, especially if the profit margin is not large enough.

So it could be said that implementing timing the market will also result in the emergence of external costs which will actually erode profits.

Final Note

Strategy timing the market very useful for experienced traders who are able to take advantage of market fluctuations.

However, for beginners or average crypto investors, this strategy can be a big challenge as it requires skill, time and good risk management.

Additionally, it is important to consider additional costs that could impact long-term profitability.

FAQ

1. What is timing the market?

Timing the market or market timing is an action to anticipate the lowest and highest prices for buying and selling assets.

2. How do I know when to sell and buy crypto assets?

The implementation of timing the market is to buy assets whose prices are low, then sell them when the assets are at high prices.

3. What causes crypto prices to rise?

One day, the price of XRP is at $0.75, then an investor predicts that the price of XRP will further increase to $1 in the next few days thanks to important event.

How to Buy Crypto on Bittime

Want to trade, sell, buy Bitcoin and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with CoFTRA, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your knowledge in the world of crypto.

Reference

Britannica.com, Should I try to time the market? Tops, bottoms, and trends, accessed November 24, 2024

Caleb & Brown, Timing the Market vs. Time in the Market - Crypto Investing Strategies, accessed November 24, 2024

Author: FL

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.