Getting to know Goldfinch Coin (GFI) and its Tokenomics

2024-08-19

Bittime - The world of decentralized finance (DeFi) is emerging with innovation, continually looking for ways to expand financial inclusion. Goldfinch (GFI) is emerging as a major player in this arena.

GFI aims to bridge the gap for borrowers who are creditworthy but do not have access to traditional financial services. Let's dig deeper into what Goldfinch offers and how it works.

What are Goldfinches?

Goldfinch is a decentralized credit protocol built on the Ethereum blockchain. The main goal is to facilitate access to unsecured loans for unbanked borrowers in the DeFi ecosystem.

This protocol uses a unique two-sided market model, connecting borrowers with a network of liquidity providers (backers) willing to offer credit.

Key Features Goldfinch (GFI): Opening Credit Opportunities

Goldfinch's key feature lies in its ability to open up credit opportunities for borrowers who may have difficulty obtaining loans through traditional channels.

Goldfinch assesses creditworthiness through on-chain data and partnerships with decentralized autonomous organizations (DAOs) that act as sponsors. These sponsors guarantee the creditworthiness of borrowers within their respective communities, allowing them to access loans from liquidity pools.

GFI Token: Underpinning the Protocol

GFI serves as the native utility token of the Goldfinch protocol. It plays an important role in the ecosystem by providing incentives to various participants:

- Backer: Backers who contribute capital to liquidity pools earn interest on their loans and receive GFI rewards for their participation.

- Borrower: Borrowers who repay their loans on time earn GFI incentives, encouraging responsible lending behavior.

- Senior Pool Participants: Senior pool participants are a special class of backers who provide the first layer of capital for a loan. They receive higher interest rates on their loans and also earn GFI rewards.

- Auditor: GFI incentivizes auditors, who are responsible for assessing the creditworthiness of potential borrowers.

GFI Tokenomics Distribution and Value Capture

Goldfinch has a well-defined tokenomics model to ensure long-term sustainability:

- Total Supply: 10 billion GFI tokens have been created, with a predetermined distribution schedule.

- Distribution: Most of the GFI tokens are allocated to the community, backers, auditors and core team. This distribution model encourages participation and aligns the interests of various stakeholders.

- Value Capture: GFI's utility comes from its role in providing incentives to participants, governing the protocol, and potentially capturing a portion of future protocol fees.

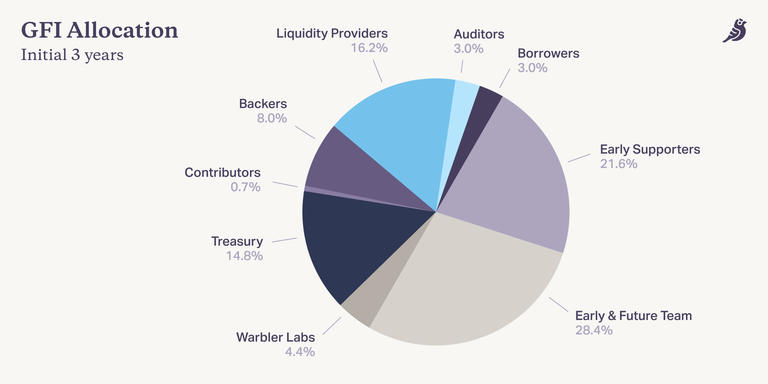

GFI Token Distribution

Goldfinch has a limited total supply of 10 billion GFI tokens. Following are the distribution details:

Liquidity Providers (16.2%)

- 4.2%: Initial Liquidity Provider Program, incentives for early participants.

- 4.0%: Retroactive Distribution to 5,157 liquidity providers (excluding US).

- 8.0%: Senior Pool Liquidity Mining.

Backers (8.0%)

- 3.0%: For Flight Academy participants.

- 2.0%: Backer Pool Liquidity Mining.

- 3.0%: Staking Backer.

Auditors & Borrowers (6.0%)

- 3.0%: For auditors.

- 3.0%: For borrowers.

Other

- Contributors (0.65%): For significant contributors.

- Community Treasury (14.8%): For community management.

- Early and Future Team (28.4%): For early and future teams.

- Warbler Labs (4.4%): For Warbler Labs.

- *Early Supporters (21.6%)*: For early supporters.

This tokenomics model aims to balance the interests of various stakeholders, promoting long-term sustainability and growth for Goldfinch Protocol.

Conclusion

Goldfinch presents a compelling solution to expand access to financial services in the DeFi landscape.

By leveraging a two-sided market and the GFI token as its utility token, the protocol aims to connect unbanked borrowers with willing lenders, thereby creating a more inclusive financial ecosystem.

As the DeFi space continues to evolve, Goldfinch's innovative approach has the potential to revolutionize credit accessibility for individuals and communities around the world.

How to Buy Crypto on Bittime

You can buy and sell crypto assets in an easy and safe way via Bittime. Bittime is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Learn How to Buy Crypto on Bittime.

Monitor price chart movements of Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.