Central Bank Cuts Interest Rates, Rupiah Strengthens!

2024-08-08

Bittime – This morning begun with good news with the increasingly convincing strengthening of the rupiah against the dollar. When this article was written on August 8, the rupiah was tracking at IDR 15,953/dollar.

What is the reason for this strengthening of the rupiah and what is the impact on the crypto market? The following is a complete explanation.

Rupiah in the Last Week

This week, the rupiah provided good news. Yesterday, August 7, the rupiah was recorded to have strengthened by +0.80% and was at IDR 16,035 per US dollar. This data is quoted from Bloomberg in real time as of last Wednesday.

Data from Bank Indonesia, namely the Jakarta Interbank Spot Dollar Rate or Jisdor, closed the rupiah at IDR 16,100 per US dollar, which means it is moving stronger by +0.51%.

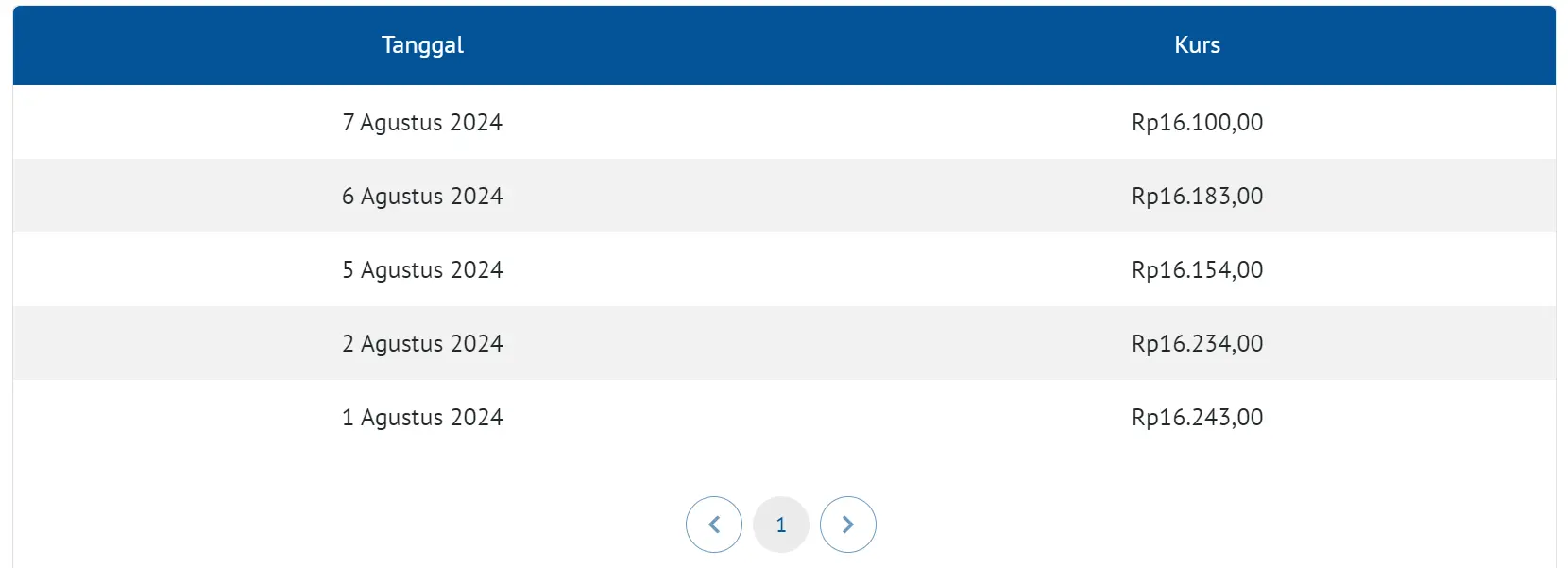

Source: bi.go.id

Quoted from Jisdor, the rupiah has sharpened its fangs in the last week. The movement of the rupiah from 1 to 7 August slowly strengthened. It was recorded that only in the interval from 5 to 6 did it move down by IDR 29 from IDR 16,154 to IDR 16,183 per US dollar.

This decrease is of course a very small figure compared to the difference in strengthening which reached IDR 83 on August 6 to August 7.

Read Also: Bitcoin Correction, RSI and MACD Indicators Show Potential to Buy Bitcoin?

Reasons for Rupiah Strengthening Against USD

The reason why the rupiah is strengthening against the USD is because interest rates are falling. Quoted from CNBC, a few days ago when labor market data was released, a sharp decline caused interest rates to increase. As a result, the rupiah exchange rate against the dollar strengthened.

In line with this, a week ago the Chair of the Fed, Jerome Powell, also said he would lower interest rates in September. And this is a positive signal for the world financial ecosystem, including Indonesia.

The value of the rupiah is becoming increasingly wary because last July it was recorded that foreign exchange reserves exceeded $5.23 billion. These foreign exchange reserves increased due to inflows from shares and bonds to the issuance of global sukuk, including from SRBI.

The value of foreign exchange reserves can be used to support import/export financing and government foreign payments.

Investors are increasingly confident in the value of Indonesia because quoted from Kontan, the strengthening of the value of the rupiah was recorded as the highest increase in the Asian region.

Read Also: BlackRock Eyes New Options for Spot Ethereum ETF Investments

IDR Position Against USDT

Sumber: CoinGecko

The UDR position against USDT is no less convincing. Currently, with the UDST-IDR exchange rate, the value of the rupiah is at IDR15,918 per USDT. In fact, the strengthening of the rupiah against USDT is very convincing because the strengthening movement has been significant in the last week.

Conclusion

That is the explanation regarding the increasingly strengthening value of the rupiah against the US dollar. This news is of course encouraging after the rupiah fell since the beginning of last year.

The strengthening of the rupiah against the US dollar is also a positive signal for the rupiah's position in the crypto ecosystem. Evidently, the position of IDR to USDT has also strengthened along with its position against the US dollar.

So, for those of you who want to check kurs IDR to USDT or vice versa, the converter from Bittime will be very helpful. This feature is carried out in real time so that the data obtained will not be missed.

Bittime also provides USDT purchasing services in a fashion OTC or Over the Counter trading. This OTC trading will allow you to trade crypto assets directly without involving an exchange.

That way, the offers made can be more flexible with larger transaction volumes.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.