Demand for Bitcoin ETFs Increases Dramatically

2025-01-08

Bittime - Bitcoin now faces the risk of increasingly limited supply. This phenomenon emerged in line with the increasing demand for Bitcoin Exchange Traded Funds (ETF) Spot in the United States.

The demand for Bitcoin ETFs has resulted in a huge imbalance between supply and demand. In December 2024, the amount of Bitcoin purchased via Spot ETFs was more than triple the amount produced by Bitcoin miners in the same period, indicating a threat to market stability.

Bitcoin Spot ETF Significant Increase in Demand

December 2024 was recorded as a particularly extraordinary period for Bitcoin Spot ETFs in the US, with accumulation reaching more than 51,500 BTC. Meanwhile, Bitcoin miners were only able to produce 13,850 BTC during the same month, based on data from Blockchain.com.

This shows that the Bitcoin Spot ETF purchased almost four times the amount of BTC generated by miners. This situation exacerbates tensions between soaring demand and limited supply.

According to reports, demand for Bitcoin ETFs in December 2024 will increase rapidly, even exceeding the existing supply by 272%. This extraordinary surge in demand has raised concerns about a "supply shock" in Bitcoin.

A number of analysts predict that this incident could occur in the near future. One of them is Lark Davis, a crypto analyst who warned in early December that a “major supply shock is likely.”

Read also: Bitcoin Price Returns to $100K Again, To The Moon or Dropping Again?

This prediction is based on the significant accumulation of BTC by the Bitcoin ETF in the US, which at one point was recorded as having purchased 21,423 BTC, while miners were only able to produce 3,150 BTC in the same period.

High Concentration of Bitcoin Inflows by December 2024

Source: NEWSEBTC

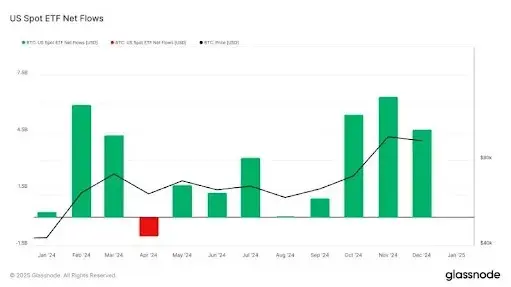

Data revealed by Glassnode shows that total Bitcoin inflows via Spot ETFs in December 2024 reached $4.63 billion (around IDR 74.7 trillion). This amount is almost double the 2024 monthly average of $2.77 billion (around IDR 44.7 trillion).

The surge was mainly concentrated in the first half of December, while the second half saw outflows, with the exception of December 26.

This phenomenon is parallel to Bitcoin price movements which experienced a significant increase at the beginning of the month. This crypto asset reached its all-time high price (ATH) above $108,000 (around IDR 1.74 billion) on December 17.

This is driven by bull market euphoria and peaking demand. However, after the peak, Bitcoin prices experienced a sharp decline, which coincided with significant outflows from Bitcoin Spot ETFs, as reported by Glassnode.

Read also: Robert Kiyosaki Predicts Bitcoin Price to Rise to $175K to $300K

Bitcoin ETF Impact on Bitcoin Price and Supply

Although demand for Bitcoin Spot ETFs in December 2024 was record as extraordinary, the latest data shows that this accumulation trend continues into January 2025.

On January 3, 2025, investors bought more than $900 million (around IDR 14.5 trillion) worth of Bitcoin via the Bitcoin Spot ETF. A few days later, Bitcoin ETFs in the US again acquired around 9,500 BTC, which is worth more than $966 million (around IDR 15.6 trillion) based on current market prices.

If this trend continues, Bitcoin Spot ETFs have the potential to accumulate a large proportion of the total Bitcoin supply in circulation. Currently, the US Bitcoin ETF holds around 1,311,579 BTC which is worth around $139 billion (around IDR 2.24 trillion), or around 6.24% of the total existing Bitcoin supply, which stands at 19.8 million BTC.

Some analysts estimate that in a larger bull market phase, Bitcoin Spot ETFs could account for between 10-20% of the total Bitcoin supply, further increasing the risk of a supply shortage in the market.

FAQs About Bitcoin ETFs

1. What is a Bitcoin ETF?

A Bitcoin ETF (Exchange-Traded Fund) is a financial product that tracks the performance of Bitcoin, allowing investors to gain exposure to the cryptocurrency without having to purchase or manage Bitcoin itself.

2. How do Bitcoin ETFs work?

Bitcoin ETFs function by holding Bitcoin or Bitcoin futures contracts as the underlying asset. The value of this ETF will reflect Bitcoin price movements, so investors can profit from Bitcoin price fluctuations.

3. Why are Bitcoin ETFs attractive to novice investors?

Investing directly in Bitcoin can seem intimidating, especially for individuals who are new to the world of cryptocurrency. Bitcoin ETFs offer a simpler way to invest.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Reference

Cointelegraph, Bitcoin ETFs scooped up almost 3X more BTC than produced in December, accessed January 8, 2025.

NEWSBTC, Bitcoin At Risk Of Supply Shock As ETF Issues Buy More BTC Than Was Produced In December, accessed January 8, 2025.

Author: Y

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.