Bitcoin Predictions Based on Bitcoin Power Law

2024-08-27

Bittime - Amid the threat of a global recession, war in the Middle East, increasing cases of MPOX, and the risk of the collapse of the Japanese Carry Trade, crypto investors' attention is increasingly focused on Bitcoin.

One of the main questions that arises is: Is now a good time to buy Bitcoin? Or at least, is Bitcoin currently in the DCA (Dollar Cost Averaging) zone?

To answer this question, we will review technical analysis, macro, and on-chain data using two main tools: Bitcoin Power Law and Bitcoin Cycle Repeat.

Fundstrat's Rule of 10 Days

Before discussing any further, it is important to understand the concept Fundstrat's Rule of 10 Days. This rule states that in a 365 day year, there are only 10 days where Bitcoin experiences a significant price increase.

For example, in 2017, Bitcoin rose 353% in just those 10 days. If you miss these 10 days, you can lose all the profits earned in a year.

In 2023, if you miss these 10 best days, your ROI will only be 25%, compared to a potential 105% if you don't miss them.

Hence, strategy DCA (Dollar Cost Averaging) is the recommended solution to deal with this uncertainty.

Read also: Solve the Daily Cipher Hamster Kombat August 27 Today

Bitcoin and Purchasing Power: Is It Already an All-Time High?

Even though Bitcoin's price briefly touched $73,750, it's important not to be fooled by this dollar figure. In fact, Bitcoin has not reached a new all-time high since 2021 if calculated based on the dollar's purchasing power which has decreased.

At the price peak in 2024, one Bitcoin will be equivalent to only 0.77 kg of gold, far below the 1.2 kg of gold at the all-time high of 2021.

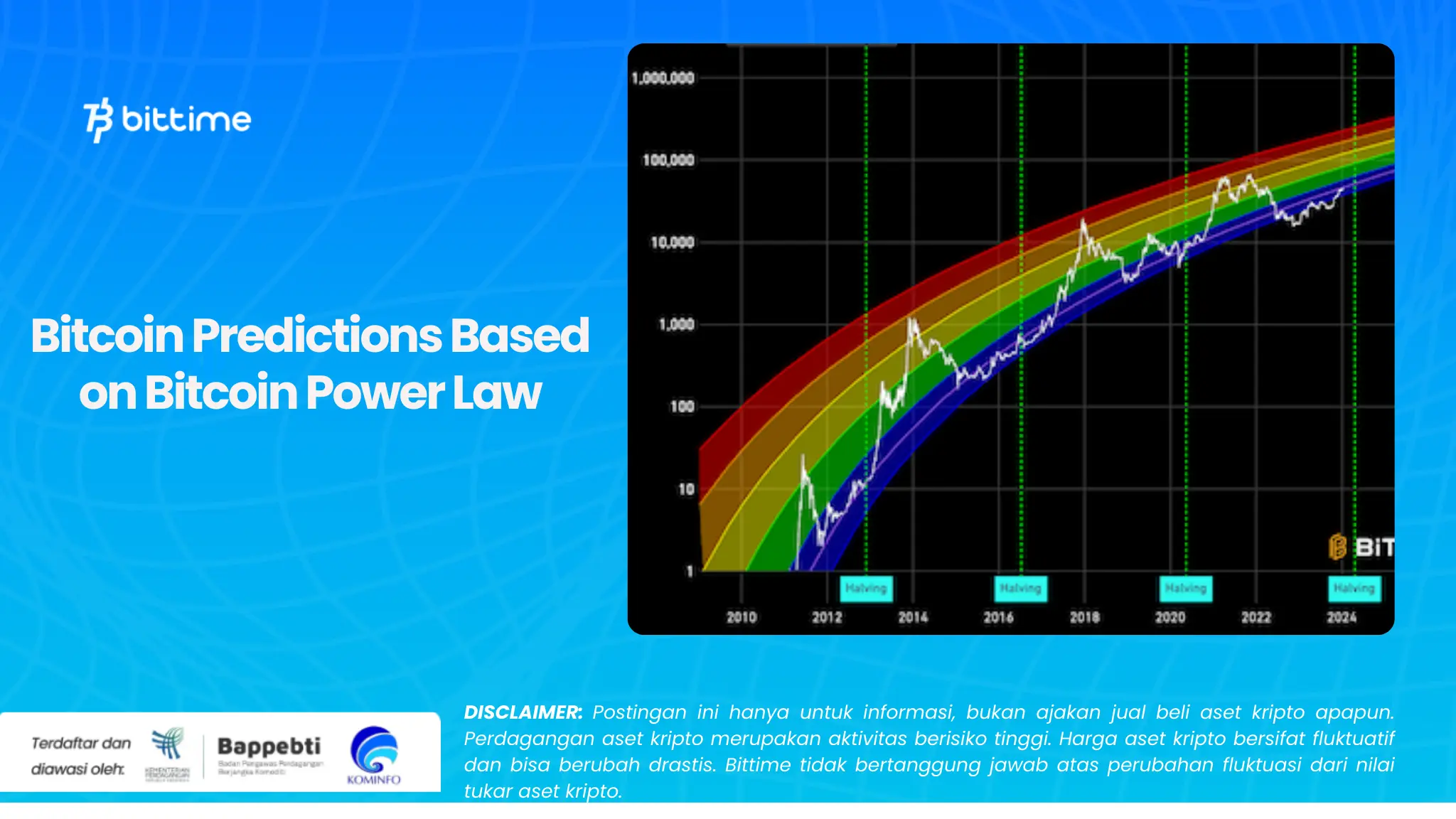

Price Prediction Based on Bitcoin Power Law and Bitcoin Cycle Repeat

Bitcoin Power Law is a tool that has been proven to be accurate in predicting Bitcoin prices. Based on this model, Bitcoin is predicted to reach over $100,000 in 2025 with a peak resistance above $400,000.

Meanwhile, Bitcoin Cycle Repeat predicts Bitcoin prices will reach over $300,000 in March 2025 and $429,000 in 2028.

However, Bitcoin Cycle Repeat is considered less accurate because it only repeats Bitcoin price movements from the previous 700 days. Although history often repeats itself, these patterns are not always exactly the same.

On-Chain Analysis: Is Now a Good Time to Buy?

Even though Bitcoin's price has quadrupled since its cycle bottom, is there still potential for a more significant increase? Based on on-chain analysis, here are some important indicators:

- Reserve Risk: This indicator shows that long-term holders still have high confidence and are not selling their Bitcoins. Based on this data, we are still in the buy zone.

- Inter-Exchange Flow Pulse: The increase in Bitcoin inflow to Coinbase is often associated with increased demand from whales in the United States. Currently, the bull market signal has just become active again.

- Sell Side Risk Ratio: With the appearance of a blue dot on this indicator, there is a good opportunity to do DCA even though it is not at the lowest price.

- Multiple girls: Even though there is no top signal yet, this indicator shows that the bull run is still not over. This might be a good time to do a DCA.

- AHR999 Index: Based on this index, we are still in the DCA zone. If the blue line is below the green line, it indicates an opportunity to buy at the low point.

- M2 Growth: M2 growth, reflecting increased global liquidity, is also a factor driving Bitcoin's price increase.

Beware of Recessions and Rate Cuts

Despite high optimism regarding Bitcoin price increases, it is important to remain cautious about the potential for a recession.

History shows that interest rate cuts by the Fed are often followed by a recession within the next 1-2 years. If a recession occurs, high-risk assets such as altcoins will probably be impacted the most.

Conclusion

Although Bitcoin has not yet reached a new all-time high if calculated based on purchasing power, strategy DCA remains the best choice in facing market uncertainty.

Analysis based on the Bitcoin Power Law and other on-chain indicators shows that there is still potential for significant price increases in the next few years.

For those of you who are not yet full Bitcoin holders, this might be the right time to start accumulating.

Although we cannot predict the future with certainty, holding Bitcoin for the long term is still a promising strategy.

How to Buy Crypto on Bittime

You can buy and sell crypto assets easily and safely via Bittime. Bittime is one of Indonesia's best crypto applications, officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also ensure you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application. Study Complete Guide How to Buy Crypto on Bittime.

Monitor graphic movement of Bitcoin (BTC) price, Ethereum (ETH), Solana (SOL), and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.