Latest Bitcoin Price Prediction March 27 2025

2025-03-26

Bittime - Bitcoin continues to be an attractive digital asset with fluctuating price movements every day. Today's Bitcoin price predictions and analysis provide important insights for investors to understand current market trends.

Driven by market sentiment, global news, and technical indicators, Bitcoin presents both great opportunities and risks for anyone involved in the world of crypto.

In this article, we will discuss the latest predictions, technical analysis, and the main factors that influence Bitcoin price movements, so that you are always ready to face market changes.

Bitcoin Price Performance Today

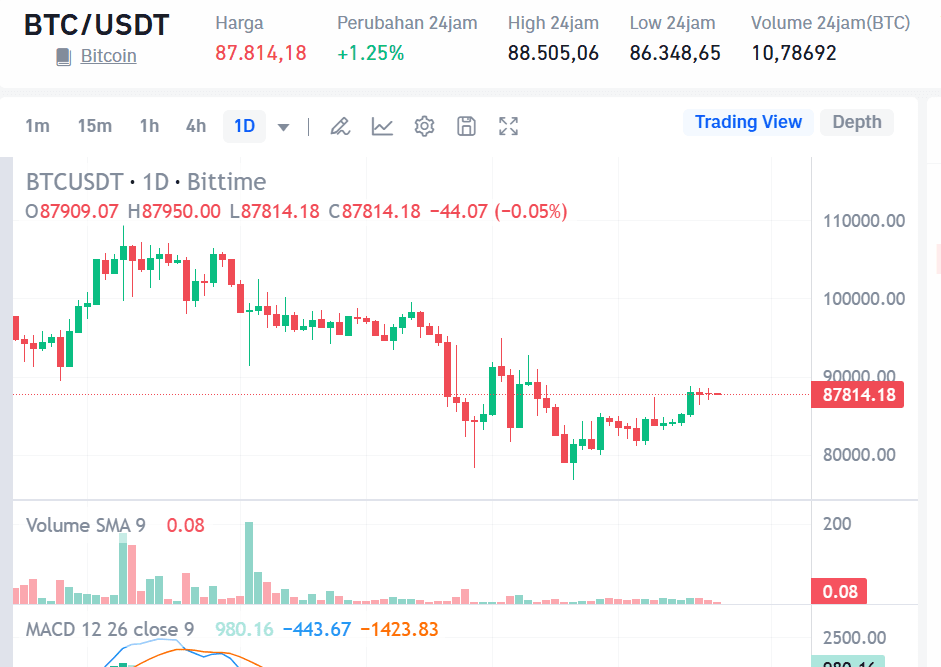

Bitcoin price is currently (03/26/2025) trading in a range $87,814,18 take notes increase 1.25% in Last 24 hours. The market is showing volatility with daily lows at $86,348,65 and highest in $88,505,06. Bitcoin's total market capitalization stands at approx $1,742,316,760,502.47 up 1.17% Last 24 Hours.

Price BTC to USDT via Market Bittime

Historical Bitcoin Price Movements

Bitcoin has experienced significant growth over the past year, with a notable increase of approx 141,83% since January 2024, when the price is approx $42.461. This cryptocurrency hit an all-time high in $109.588 before Donald Trump's inauguration on January 20, 2025. This surge reflects bullish market sentiment, driven by expectations of pro-crypto policies from the new administration.

Bitcoin Price Analysis Today March 26 2025

This decline occurred despite accumulation by large investors or 'whales', who bought more than 22,000 BTC in the last three days, indicating long-term confidence in Bitcoin.

However, selling pressure continues to dominate the market, fueled by concerns regarding US Bitcoin reserves and macroeconomic uncertainty.

Technical indicators such as the Relative Strength Index (RSI) suggest that Bitcoin is approaching oversold conditions, which could signal a potential rebound if selling pressure subsides.

Currently, the main resistance level is at $88.000 USD. If Bitcoin is able to break through this level, the uptrend is expected to continue towards $95.000 USD. Conversely, if the price falls below $85.000 USD, further correction is possible. Investors are advised to remain vigilant and consider investment strategies that suit their respective risk profiles.

Read too Bitcoin (BTC) Price Prediction: Comprehensive Analysis

OK, here is the Bitcoin price prediction for March 27, 2025, focusing on the price range at the conclusion:

Bitcoin Price Prediction March 27, 2025

Looking at current price movements and technical indicators, here is the Bitcoin price prediction for tomorrow, March 27 2025, if BTC is able to break through resistance at $88.000 USD, the bullish trend is likely to continue. The next target increase is expected to be towards the area $92.500 until $95.000 USD. If BTC price fails to break out $88.000 and weakens again below $85.000 USD, further correction may occur with a potential decline towards the next support in the range $82.500 USD.

Factors Affecting Bitcoin Price:

Market Sentiment

Market sentiment remains mixed. Outflows from Bitcoin ETFs spot in the US shows negative sentiment, but accumulation by large investors (whales) can trigger positive sentiment.

Technical Indicators

Relative Strength Index (RSI) is approaching level oversold, which indicates potential rebound if selling pressure subsides.

Government policy

Crypto-related regulations, especially in the US, are still a significant factor that can influence price movements.

Macroeconomic Factors

Global economic conditions and geopolitical events can also influence investor decisions.

Potential Scenarios

Scenario Bullish (Optimistic)

If market sentiment improves, and selling pressure subsides, Bitcoin could experience another bull run $95.000. Supporting factors include RSI oversold and potential support of pro-crypto policies.

Scenario Bearish (Pessimistic)

If selling pressure continues, Bitcoin has the potential to fall further towards the level support Of $85.000 Triggering factors include outflows from ETFs and economic uncertainty.

Conclusion

Bitcoin price movements on March 27, 2025 are expected to depend heavily on BTC's ability to break through resistance at $88.000 USD. If successful, the bullish trend is projected to continue with an upward target towards $92,500 to $95,000 USD. However, if it fails to penetrate this level and falls below $85.000 USD, a deeper correction is headed $82.500 USD could happen. Factors influencing the price include market sentiment which is currently still mixed due to outflows from spot Bitcoin ETFs in the US, although accumulation by large investors (whales) is a sign of long-term confidence.

Technically, the RSI is approaching oversold indicating the potential for a rebound if selling pressure subsides. Apart from that, government policies, especially crypto regulations in the US, as well as macroeconomic factors and global geopolitical conditions also influence price movements. If sentiment improves and selling pressure decreases, BTC has the potential to strengthen to $95.000, but if selling pressure continues, the price could weaken towards $82.500. Investors are advised to remain vigilant, monitor key levels, and implement strategies according to their respective risk profiles.

FAQ about Bitcoin (BTC) Price Prediction March 27, 2025

What is the predicted Bitcoin price range for tomorrow, March 27, 2025?

BTC was able to break through resistance at $88.000 USD, the bullish trend is likely to continue. The next target increase is expected to be towards the area $92.500 until $95.000 USD. If BTC price fails to break out $88.000 and weakens again below $85.000 USD, further correction may occur with a potential decline towards the next support in the range $82.500 USD.

What factors most influence the current Bitcoin price prediction?

Market sentiment (especially outflows from ETFs), technical indicators (RSI is close to oversold), and government policies regarding crypto regulation are the main factors.

Are Bitcoin price predictions definitive?

No, Bitcoin price predictions are not definitive because the crypto market is very volatile. Predictions are just a picture of potential movements based on analysis of existing factors.

How to Buy Crypto with Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your knowledge in the world of crypto.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.