Bitcoin (BTC) Price Prediction : In-Depth Analysis and Insights

2025-02-05Bittime's Bitcoin price prediction for 2025 is in the range of $100,000 to $120,000. This prediction is driven by the growing interest of institutions in Bitcoin as a reliable hedge and its increasingly important role in institutional investment portfolios.

Factors such as the post-2024 halving supply reduction and the market's growing confidence in Bitcoin as "digital gold" are key drivers of this optimism.

Although market volatility remains a challenge, Bittime's predictions show that Bitcoin prices will continue to increase year after year, as BTC strengthens its position as a major investment asset in the digital economy era.

Bitcoin Price Overview

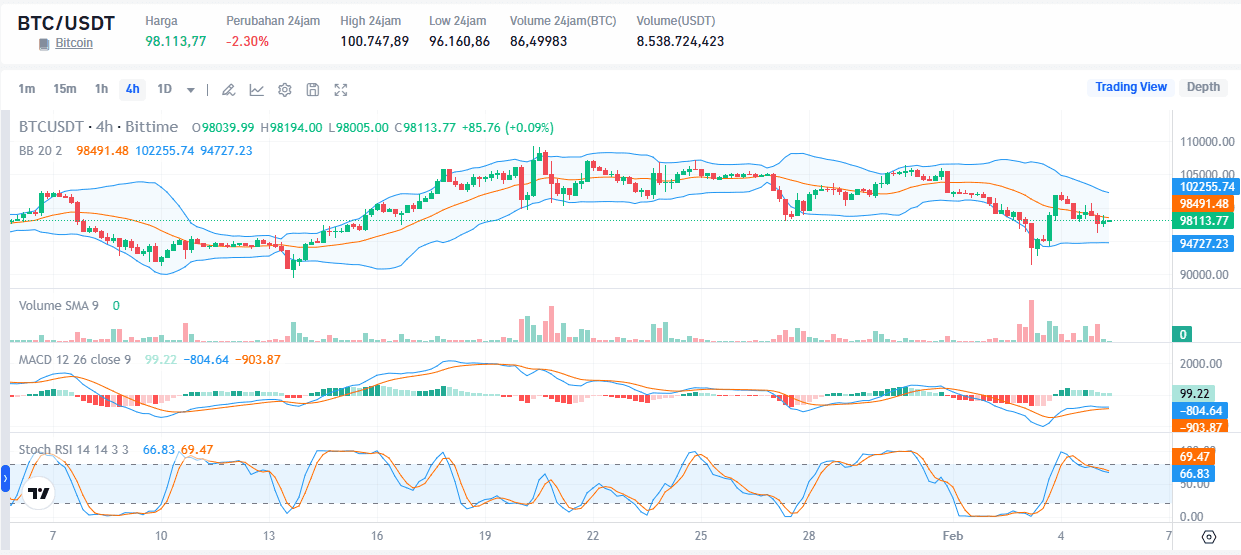

- Bitcoin Price Today: As of February 5, 2025, Bitcoin (BTC) is trading on the Bittime market at around $98,113 USD. During today’s trading session, Bitcoin’s highest price reached $100,747 USD, while the lowest was $96,160 USD.

Bitcoin Price Prediction: According to Bittime’s analysis, Bitcoin’s price on February 6, 2025, is expected to remain volatile. If it can hold above the key support level of $97,000 USD, there is potential for a continued bullish trend toward a short-term target above $105,000 USD.

Market Sentiment: Currently, market sentiment is leaning bearish, with significant selling pressure. However, demand for Bitcoin remains strong compared to other altcoins, which are still struggling to recover from previous declines.

Recent Performance: In recent days, Bitcoin briefly weakened to a weekly low of $95,730 USD but managed to recover partially. This indicates that there is still strong buying interest despite the overall sluggish market conditions.

Technical Indicators: Bitcoin is currently consolidating within the range of $97,000 - $101,000 USD. If it manages to break through the $101,000 USD resistance level, further gains could follow, with the next target approaching an all-time high.

Bitcoin (BTC) Technical Analysis Overview

Bitcoin price prediction 2025 is done using technical analysis, namely analyzing historical price data, trading volume, and market trends to project future price movements.

This analysis involves the use of charts, patterns, and indicators such as Moving Averages (MA), Relative StrengthIndex (RSI), and market sentiment gauges to provide a more complete picture.

Moving Averages (MA)

Moving Averages help smooth out price fluctuations to identify trends more clearly:

- SMA (Simple Moving Average): Calculates the average price over a specified period.

- EMA (Exponential Moving Average): Gives more weight to recent prices, making it more responsive to recent changes in the market.

Short-term MAs (e.g. 10-day or 20-day) track daily momentum, while intermediate-term MAs (50-day) evaluate weekly trends, and long-term MAs (200-day) analyze yearly patterns.

- Bullish crossover (example: 50-day MA crosses above 200-day MA) indicates potential uptrend.

- Conversely, a bearish crossover indicates downward momentum.

Relative Strength Index (RSI)

RSI is a momentum indicator that measures trend strength based on overbought or oversold levels.

- RSI above 70: Indicates overbought conditions, where prices are likely to experience a correction.

- RSI below 30: Indicates oversold conditions, which often signals a potential price reversal to the upside.

- RSI Neutral (30-70): Indicates a stable trend without excessive buying or selling pressure.

Market Sentiment Indicator

Sentiment reflects traders' emotions which greatly influence Bitcoin prices:

Fear and Greed Index:

Sentiment reflects traders' emotions which greatly influence Bitcoin prices:

- Scores range from 0 ( extreme fear ) to 100 ( extreme greed ).

- Extreme fear can trigger massive selling that depresses prices.

- Extreme greed often increases buying pressure, pushing prices up.

- In January 2025, the Fear and Greed Index for Bitcoin was at 36, indicating “Extreme Fear,” which is in line with the current bullish sentiment.

Impact of News:

- Positive news, such as institutional adoption or favorable regulatory developments, tends to push prices up.

- Negative events, such as government bans or hacking incidents, often cause prices to drop.

Factors Affecting Bitcoin Price Prediction Price

Macroeconomic Trends

Global economic conditions, inflation rates, and central bank policies have a major influence on the demand for Bitcoin as a hedge or speculative asset.

Institutional Adoption

Widespread adoption by corporations, hedge funds, and financial institutions could increase demand and stabilize Bitcoin's value.

Supply Dynamics

Bitcoin's fixed supply of 21 million coins and the deflationary impact of halving events are important factors in influencing long-term price trends.

Technological development

The development of blockchain technology or partnerships with large technology companies could drive the adoption of Bitcoin technology and its scalability, such as through the development of the Lightning Network.

Regulatory Environment

A clear and supportive regulatory framework can attract more investors. Conversely, restrictions or unfavorable regulations can suppress growth.

Bitcoin Price Year by Year

Below is a detailed table of Bitcoin price movements from when it first appeared until 2024.

2009-2012: Period of Experimentation and Early Adoption

For the first three years, Bitcoin was in an experimental phase. The price began to rise slowly as people began to understand its potential as a decentralized payment system.

In 2011, Bitcoin reached $4.70 by the end of the year, fueled by increasing adoption by the tech community.

2013: The First Big Surge

This year has been a milestone with the price surging by more than 5,400%. The main reasons are the increasing media attention to Bitcoin and early adoption by various e-commerce platforms.

However, volatility is also high, and prices crashed in late 2014 due to regulatory concerns and hacking cases, such as the Mt. Gox incident.

2017: An Iconic Bullish Year

Bitcoin reached a price of nearly $14,000 in 2017, driven by a surge in interest from retail and institutional investors.

At the time, Bitcoin was considered “digital gold,” and the hype surrounding blockchain technology created huge demand. However, the market was also highly speculative, and a major correction occurred the following year.

2018-2019: Market Correction and Stabilization

After a huge surge, Bitcoin prices plunged to $3,800 in late 2018, signaling a “crypto winter.”

The decline was caused by negative sentiment related to unclear regulations and profit-taking by investors. However, in 2019, Bitcoin began to recover slowly.

2020-2021: Dramatic Rise in the Pandemic Era

The COVID-19 pandemic has been one of the main factors driving Bitcoin prices up significantly. As central banks print massive amounts of money to stimulate the economy, many investors are looking for alternatives like Bitcoin to protect their wealth from inflation.

Additionally, adoption by major companies like Tesla and PayPal strengthens market confidence.

2022: Drastic Decline

This year has been a major challenge for Bitcoin with its price dropping sharply. Negative global market sentiment, including interest rate hikes by central banks to combat inflation, has caused many investors to turn to safer assets. Major scandals in the crypto world, such as the collapse of FTX, have also affected market confidence.

2023-2024: Recovery and Uptrend Again

In 2023, Bitcoin is again showing a bullish trend, driven by increasing institutional adoption, stabilization of the crypto market, and interest in Bitcoin as a hedge against global economic uncertainty.

This increase is also supported by the reduction in supply through Bitcoin halving which strengthens the upward price pressure.

Bitcoin Price Prediction for Tomorrow, This Week, and the Next 30 Days

Bitcoin remains a major focus for investors in the crypto market, with today's price standing at $98,113. Understanding market movements is crucial for making informed decisions, especially in a highly volatile environment.

This price forecast provides an outlook on potential short-term trends, helping investors anticipate fluctuations in Bitcoin's value.

Bitcoin Price Prediction for Tomorrow

The Bitcoin price prediction for January 29, 2025, is expected to trade between $101,000 and $105,000, with an average price of $103,000. The predicted movement is influenced by profit-taking following recent price volatility.

Analysts suggest that if Bitcoin surpasses the $101,000 resistance level, there is potential for an extended bullish trend toward $105,000 in the short term.

Bitcoin Price Prediction for This Week

Throughout the first week of February, Bitcoin is anticipated to fluctuate between $92,000 and $106,000, with an estimated average of $99,635.

Market sentiment remains cautious due to external pressures, particularly from U.S. tariff policies, which have created some economic uncertainty. Despite these challenges, there is still a possibility of market stabilization or moderate price gains.

Bitcoin Price Prediction for Next 30 Days

Looking ahead over the next 30 days, Bitcoin is projected to trade within the range of $92,000 to $109,588, with potential growth to $105,273 in early February.

The market is currently in a consolidation phase following significant volatility, yet medium-term indicators suggest stable growth with a possible move toward an all-time high if key resistance levels are broken.

Monitoring support and resistance levels will be essential in making strategic investment decisions. While the crypto market remains unpredictable, staying informed about market sentiment and global economic policies can help investors navigate price fluctuations.

Implementing a risk management strategy is highly recommended to mitigate potential losses amid ongoing volatility.

Bitcoin Price Prediction 2025

The year 2025 is predicted to be a golden momentum for Bitcoin, where the price of this digital asset is projected to continue to increase throughout the year. Here is the analysis and prediction of the price of Bitcoin 2025:

Optimistic Predictions for Bitcoin in January 2025

Bitcoin is expected to trade in the range of $$100,000$$ 110,000 , supported by the effects of the year-end rally in December. Investors remain optimistic due to macroeconomic trends and the increasing adoption of cryptocurrencies as an asset class. However, market activity may slow down in the middle of the month after the holiday season ends.

February 2025 Institutional Interest Increases

The price range is expected to rise to $$105,000$$ 120,000 , driven by growing institutional interest and increased regulatory clarity in key markets. Positive news on crypto regulation in Europe and North America could further boost market confidence.

Bitcoin Price Prediction March 2025

Anticipation of the Federal Reserve interest rate decision may create volatility, with Bitcoin trading in the $$110,000$$ 125,000 range . Additionally, investments in blockchain technology by tech companies could be a catalyst for continued growth.

April 2025

During the altcoin season, Bitcoin is predicted to be in the range of $$115,000$$$ 130,000 , with short-term fluctuations in BTC dominance. Increased altcoin activity may temporarily distract the market, but Bitcoin is likely to maintain its upward momentum.

May 2025

Bitcoin price is estimated to be in the range of $$120,000$$ 135,000 , driven by high speculation as the market anticipates the 2028 Bitcoin halving. This period often brings a surge in buying activity, with investors positioning themselves for long-term gains.

June 2025

Anticipation of the 2028 Bitcoin halving is expected to push the price higher, reaching $$125,000$$ 140,000 . Long-term investors and institutions are likely to increase their holdings, strengthening the upward pressure on the price.

July 2025

Positive sentiment from the previous quarter could see Bitcoin trading in the $$130,000$$ 145,000 range . Mid-year reports of institutional adoption and improved crypto infrastructure could further strengthen the bullish outlook.

August 2025

Seasonal fluctuations and broader macroeconomic conditions could stabilize Bitcoin prices between $$135,000$$ 150,000 . Trading volumes during the summer may have decreased slightly, but overall sentiment remains positive.

September 2025

Increased retail trading activity ahead of the fourth quarter is expected to push Bitcoin prices to $$140,000$$ 160,000 . Excitement about the upcoming holiday season and new crypto investment products may attract more buyers.

October 2025

Historically a bullish month for Bitcoin, with prices expected to be in the range of $$145,000$$$ 165,000 . The year-end trend, coupled with optimistic market sentiment, could support further upside.

November 2025

Bitcoin is expected to trade between $150,000-$ 175,000 , taking advantage of the Black Friday and Thanksgiving shopping seasons. Increased adoption of Bitcoin for payments during this period could drive demand even higher.

December 2025

The year could end with Bitcoin reaching $$160,000$$$ 200,000 , supported by the end-of-year rally. Holiday spending, institutional portfolio adjustments, and a bullish market outlook for 2026 are the main drivers of strong upside potential.

Bitcoin Price Prediction 2026, 2027, 2028 - 2030

Bitcoin has become one of the most sought-after digital assets in the world, with its growing role as a store of value and transaction tool.

Although the cryptocurrency market is notoriously volatile, long-term projections show significant growth potential, especially as global adoption and technological innovation in the blockchain ecosystem increases.

Here are the Bitcoin price predictions for 2026, 2027, 2028 - 2030:

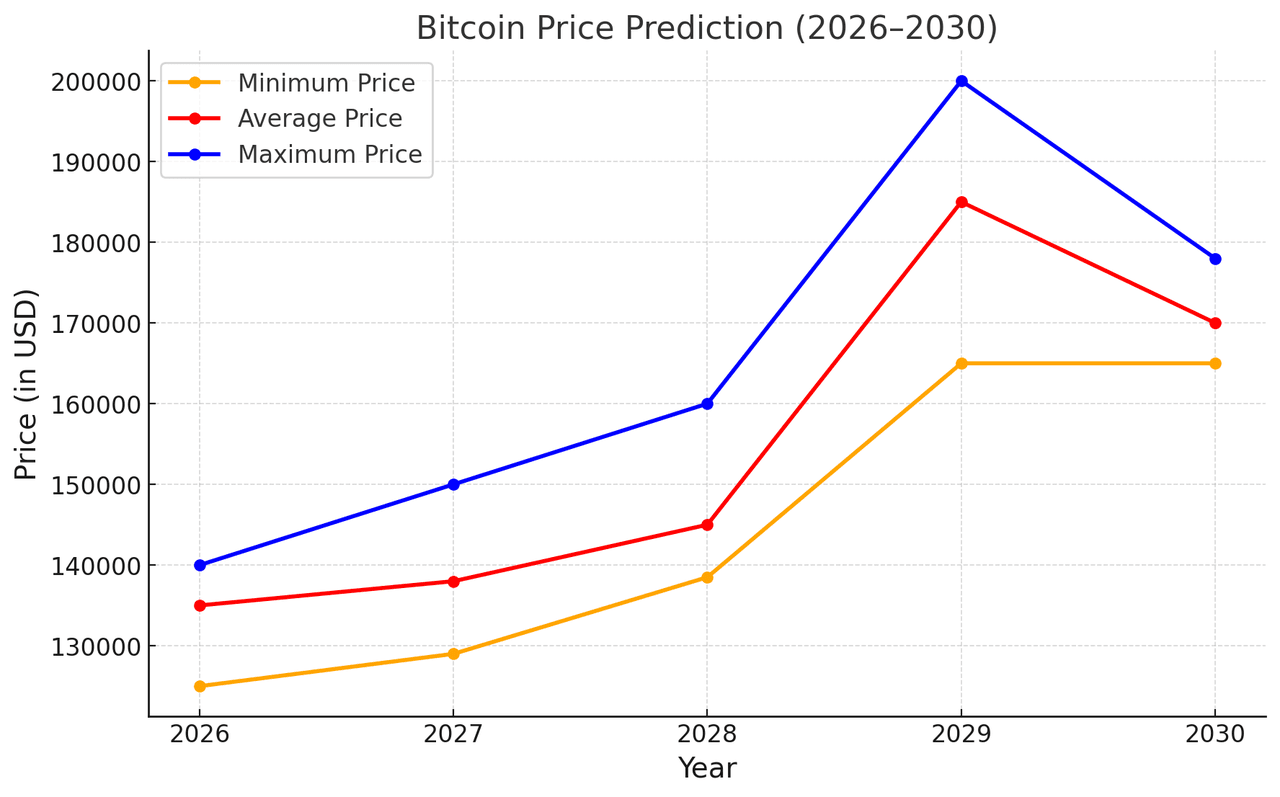

Bitcoin Price Prediction 2026

Bitcoin is expected to have an average price of around USD 135,000 , with the highest potential reaching USD 140,000 . This prediction is based on the assumption of stable adoption and increasing institutional interest. Clearer regulations and the development of Bitcoin-based financial products are also major factors driving the price increase.

Projected price : USD 135,000

Price range : USD 125,000 - USD 140,000

Quarterly predictions :

- Q1 : USD 108,717

- Q2 : USD 109,483

- Q3 : USD 110,255

- Q4 : USD 111,032

Bitcoin Price Prediction 2027

In 2027, Bitcoin is projected to increase with an average price reaching USD 138,000 , reflecting the increasing use of Bitcoin as a store of value.

The development of technology to increase scalability and the integration of Bitcoin into the global financial system is expected to further drive price growth.

Projected price : USD 138,000

Price range : USD 129,000 - USD 150,000

Quarterly predictions :

- Q1 : USD 130,000

- Q2 : USD 135,000

- Q3 : USD 145,000

- Q4 : USD 150,000

Bitcoin Price Prediction 2028

Bitcoin is expected to continue to strengthen in 2028, with an average price of USD 145,000 . The price surge is driven by higher institutional adoption, the use of Bitcoin in cross-border transactions, and increasing trust in the digital currency.

Projected price : USD 145,000

Price range : USD 138,500 - USD 160,000

Quarterly predictions :

- Q1 : USD 140,000

- Q2 : USD 145,000

- Q3 : USD 155,000

- Q4 : USD 160,000

Bitcoin Price Prediction 2029

2029 is a pivotal year for Bitcoin, with an average price projected to reach USD 185,000 and a maximum potential of USD 200,000 .

At this point, Bitcoin is likely to be recognized as a mainstream financial instrument and may be used as a national reserve in some countries. Furthermore, this significant increase is thought to be a direct result of the halving event, which reduces the supply of new Bitcoins.

Projected price : USD 185,000

Price range : USD 165,000 - USD 250,000

Quarterly predictions :

- Q1 : USD 170,000

- Q2 : USD 180,000

- Q3 : USD 190,000

- Q4 : USD 250,000

Bitcoin Price Prediction 2030

Entering 2030, Bitcoin is estimated to be in a stable phase with an average price of USD 170,000.

Its role as a digital store of value and underlying asset for decentralized finance (DeFi) will further strengthen its position in the financial ecosystem.

Projected price : USD 170,000

Price range : USD 165,000 - USD 178,000

Quarterly predictions :

- Q1 : USD 165,000

- Q2 : USD 170,000

- Q3 : USD 175,000

- Q4 : USD 500,000

Bitcoin price prediction 2026 to 2030 shows the potential for significant growth of Bitcoin in the next five years, but it should be remembered that the cryptocurrency market is very dynamic.

Therefore, it is important to do thorough research and consult a financial expert before making investment decisions.

Market Analysis

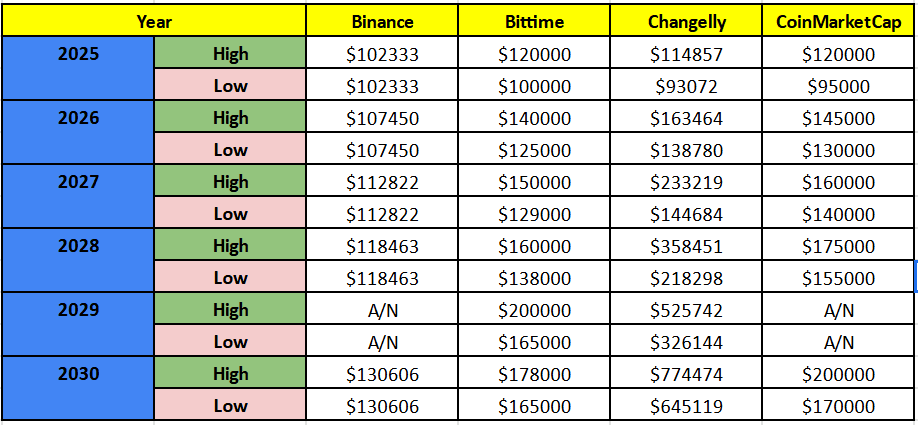

Bitcoin continues to show tremendous potential as a promising digital asset, with increasingly optimistic price predictions through 2030.

In 2025, Bittime predicts Bitcoin to be in the range of $100,000 to $ 120,000 , while CoinMarketCap and Changelly peg the maximum price at $120,000 and $ 114,857 . Binance, although more conservative, keeps the figure steady at $102,333.57 .

Entering 2026 and 2027, the price growth is increasingly evident. Bittime predicts a surge of up to $140,000 in 2026 and $ 150,000 in 2027 , while CoinMarketCap and Changelly predict more optimistic figures, reaching $145,000 and $ 233,219 respectively in 2027. The year 2028 is the main highlight, with Changelly projecting a maximum price of up to $358,451 , reflecting great confidence in Bitcoin's long-term prospects.

In 2029 and 2030, expectations are skyrocketing. Bittime and CoinMarketCap project Bitcoin’s maximum price to reach $200,000 , while Changelly gives a very bullish view with a prediction of up to $774,474.00 in 2030. With this growth trend, Bitcoin continues to prove itself as a future asset full of opportunities, making it a strategic investment choice for anyone looking to make big profits in the digital era.

Conclusion

Looking at the various Bitcoin price predictions from 2025 to 2030, it is clear that the digital asset continues to offer great opportunities in the future. Although the crypto market is notoriously volatile, Bittime's projections show significant growth potential, both moderate and aggressive.

For investors, this is the momentum to plan long-term financial strategies and take advantage of existing trends.

However, it is important to remember that these predictions are based on current data and analysis, so there is always the possibility of changes due to unexpected market dynamics.

With a wise approach, proper education, and good risk management, Bitcoin remains one of the most interesting digital assets to explore.

Disclaimer

The Bitcoin price prediction information on this page is for educational purposes only and is not a recommendation to buy or invest in Bitcoin or any other cryptocurrency. The data on potential returns (ROI) is only an estimate and should not be taken as financial advice. Always do your own research and consult a financial professional before making any investment decisions.

FAQ

What Is Bitcoin Price Prediction?

Bitcoin price prediction is an estimate or projection of how the price of Bitcoin will move in the future. These predictions are usually based on analysis of historical data, market trends, investor sentiment, and economic and technological factors that affect the supply and demand of Bitcoin.

What is the future price prediction for Bitcoin?

Bitcoin price predictions vary depending on analysts and platforms. Some expect Bitcoin to reach $100,000 to $200,000 by 2025–2030, while others are more optimistic with projections of up to $774,000 by 2030. Keep in mind, these predictions are just speculation and do not guarantee a definite outcome.

What factors influence Bitcoin price prediction?

Bitcoin price predictions are influenced by many factors, such as adoption rates, regulations, blockchain technology developments, as well as global market conditions and user demand.

Is Bitcoin a good investment?

Bitcoin is highly volatile and speculative. It can be profitable, but it does carry risks. Always do your research and consider your financial situation before investing.

Is Bitcoin legal?

The legality of Bitcoin varies from country to country; some countries support it, while others prohibit or restrict its use.

Will BTC go up again?

Bitcoin has the potential to rise again due to volatile market cycles. Factors such as technology adoption, investor interest, and positive market sentiment can drive its rise.

Why did BTC go down?

Bitcoin can fall due to high volatility, negative news, heavy selling, regulatory changes, or security issues such as hacks.

How to Buy Crypto on Bittime

Want to trade and buy Bitcoin and invest in crypto easily? Bittime is ready to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures that every transaction is safe and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check BTC to IDR , ETH to IDR , SOL to IDR and other crypto assets rates to find out today's crypto market trends in real-time on Bittime.

Also, visit Bittime Blog for interesting updates and educational information about the crypto world. Find trusted articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your knowledge in the crypto world.

Bitcoin News Updates

Trump Wants All Bitcoin Mined in America — Is It Possible?

Donald Trump has ambitions to make America the center of Bitcoin mining, with the hope that all remaining coins can be mined on American soil.

Bitcoin Records New All-Time High (ATH) on January 20

Bitcoin recorded a new all-time high (ATH) on Monday, January 20, 2025 at $109,356 (around Rp1.781 billion) at 06:56 UTC.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.