Bitcoin Price Prediction Today March 18

2025-03-17

Bittime - Bitcoin continues to be a digital asset that attracts attention with its dynamic price movements every day. Today's Bitcoin price analysis and predictions provide important insights for investors to understand the latest market trends.

Influenced by market sentiment, global news, and technical indicators, Bitcoin offers both great opportunities and challenges for those immersed in the world of crypto.

In this article, we will review the latest predictions, technical analysis, and factors that influence Bitcoin prices, so you can always be ready to face market changes.

Bitcoin Price Performance Today

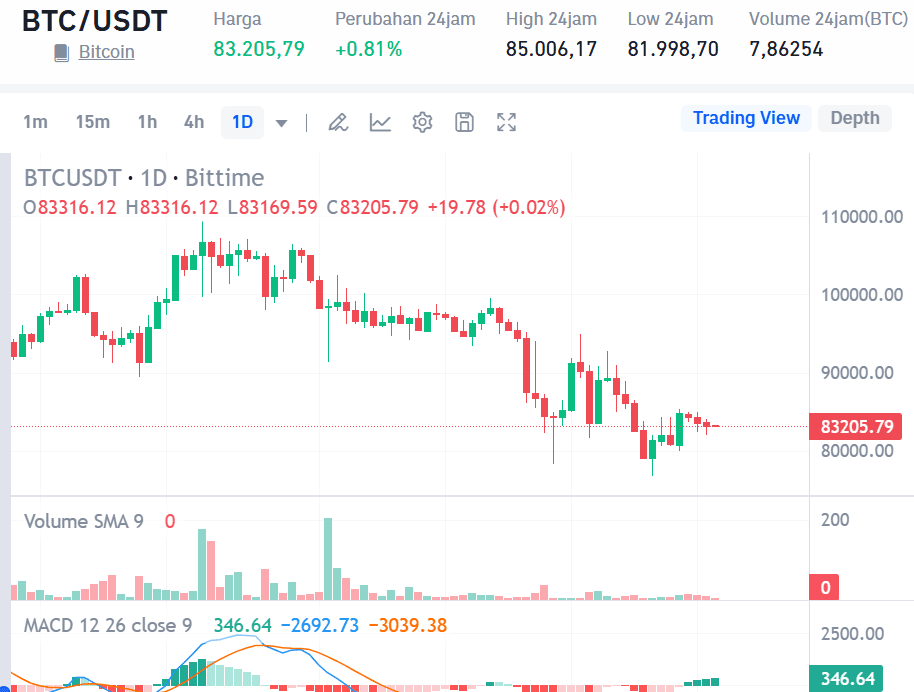

Bitcoin price is currently (03/17/2025) trading in a range $83,205,79 take notes increase of 0.81% in Last 24 hours. The market is showing volatility with daily lows at $81,998,70 and highest in $85,006,17. Bitcoin's total market capitalization stands at approx $1,653,836,213,427.16 go on 0.82% Last 24 Hours.

Price BTC to USDT via Market Endtime

Historical Bitcoin Price Movements

Bitcoin has experienced significant growth over the past year, with a notable increase of approx 141,83% since January 2024, when the price is approx $42.461. This cryptocurrency hit an all-time high in $109.588 before Donald Trump's inauguration on January 20, 2025. This surge reflects bullish market sentiment, driven by expectations of pro-crypto policies from the new administration.

Bitcoin Price Analysis Today March 17 2025

Currently, Bitcoin is in a consolidation phase with high volatility. Selling pressure increased after failing to defend the nearby resistance level IDR 1.37 billion (USD 85,000). If the price falls below IDR 1.33 billion (USD 82,000), there is potential for a further decline of up to IDR 1.15 billion (USD 70,000).

Despite this, some analysts remain optimistic. Historical data shows that Bitcoin price peaks typically occur 12–18 months after a halving event. If this trend continues, the price peak could occur in mid to late 2025.

It should be noted that the crypto market is highly volatile, and price movements can be influenced by various factors, including market sentiment and regulatory developments.

Read too Bitcoin (BTC) Price Prediction: Comprehensive Analysis

Factors That Influence Bitcoin Price On March 17, 2025

Donald Trump's New Tariff Policy

The new tariff policy announced by former President Donald Trump is no longer the main concern of the crypto market today. Investors' focus is now more on the Federal Reserve's policy regarding interest rates, where speculation of additional interest rate increases has increased pressure on risk assets, including Bitcoin.

Massive Hack on Bybit

The Bybit hacking incident that previously affected the market is now starting to subside, although concerns over the security of crypto trading platforms remain. However, recent news shows that Bybit has increased security measures and announced a compensation plan for affected users, which has eased the negative sentiment somewhat.

US Economic Slowdown

The latest data shows that US economic growth slowed more than expected, with the last quarter's GDP report showing a figure lower than analysts' expectations. This has further strengthened recession fears, prompting investors to avoid speculative assets such as Bitcoin.

Trade Volume Surge

Interestingly, Bitcoin trading volume continues to increase significantly, rising more than 150% in the last 24 hours. Data from CoinMarketCap shows that this surge was largely driven by whale activity (large investors) who took advantage of volatility to accumulate assets at low price levels.

Market Sentiment and Fear & Greed Index

The Fear & Greed Index for Bitcoin today is at the “extreme fear” level, reflecting investors' uncertainty over the near-term direction of the market. However, some analysts believe that this condition could create a buying opportunity for long-term investors.

Conclusion

Bitcoin prices are currently under pressure due to a combination of global macroeconomic factors and bearish market sentiment. Nonetheless, the surge in trading volume suggests there is strong interest from large investors to take advantage of the price drop as an accumulation opportunity. Investors are advised to continue monitoring Federal Reserve policy and other macroeconomic developments as these will be the main drivers of Bitcoin price movements in the near future.

Read too Everything Happening to Bitcoin Through 2024: BTC ETFs, Trump, and the All-Time High

Bitcoin Support and Resistance Levels

The following is an update regarding Bitcoin (BTC) support and resistance levels as well as price scenarios based on the latest information published today, February 27, 2025:

Bitcoin Support and Resistance Levels

Main Support

$86,000 - $87,500: Currently, this zone is the closest support that needs to be defended to avoid further decline. A drop below this level could trigger additional selling.

$81,700 - $85,100: If selling pressure continues, this area will become the next major support. A drop to this level could take the price towards the critical zone around $80,000.

Main Resistance

$90,000: This level now serves as the first resistance that must be broken to restore short-term bullish momentum.

$91,000 - $92,000: After breaking $90,000, Bitcoin needs to clear this area to show recovery potential.

$94,381: Previously critical support, this level has now become strong resistance that needs to be overcome to indicate signs of further recovery.

Bitcoin Price Movement Scenarios

Bullish Scenario

Bitcoin needs to break the resistance level at $90,000 And $91,000 to return to the bullish path. If the positive momentum continues and is supported by improving global market sentiment, the price could return to approaching the psychological target nearby $100,000.

Consolidation Scenario

If market uncertainty remains high due to global factors such as the Bybit hack and uncertain US economic policies, Bitcoin will likely move sideways in the range between $86,000 to $90,000 over the next few days.

Bearish Scenario

If selling pressure continues to increase and the price falls below key support in the range $86,000, will most likely take the price towards the critical zone nearby $81,700 to $85,100. Further downside below $80,000 can trigger greater panic selling.

With the current volatile market conditions, it is important for investors to monitor the latest developments and key levels that can determine the direction of Bitcoin price movements in the future.

Read too How to Buy Bitcoin (BTC)

Conclusion

Based on Bitcoin price movements on March 17, 2025, where BTC is trading in a range $83,205.79 with an increase 0.81%, the market still shows high volatility. Daily price range between $81,998.70 to $85,006.17 indicates strong buying interest, although selling pressure remains present.

For March 18, 2025, Bitcoin is expected to continuing the consolidation phase with the possibility of movement in the range $82,000 to $85,500. If buying pressure increases and Bitcoin manages to break the level $85,500, then there is a chance to continue the rise towards $87,000 or higher. However, if selling pressure dominates again, Bitcoin could retest support at $82,000 or even down deeper into the range $80,500.

Factors that could influence price movements on March 18 include global market sentiment, macroeconomic data, and regulatory policies regarding crypto assets. Investors and traders are advised to keep an eye on trading volume and key support and resistance levels to anticipate larger market movements.

FAQ about Bitcoin (BTC) Price Prediction March 18, 2025

1. What caused the current decline in Bitcoin prices?

The current decline in Bitcoin prices is caused by several factors, including the new tariff policy announced by Donald Trump, a massive hacking incident on the Bybit platform, as well as the US economic slowdown which increases uncertainty in the market.

2. What are the main support and resistance levels for Bitcoin?

The main support level is located in the $81,700 to $85,100 range, while the nearest resistance is around $90,000. If the price falls below this support level, there could be potential for a further decline towards the $80,000 zone.

3. What is the Bitcoin price prediction for March 18, 2025?

For March 18, 2025, Bitcoin is expected to continuing the consolidation phase with the possibility of movement in the range $82,000 to $85,500. If buying pressure increases and Bitcoin manages to break the level $85,500, then there is a chance to continue the rise towards $87,000 or higher. However, if selling pressure dominates again, Bitcoin could retest support at $82,000 or even down deeper into the range $80,500.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.