Hooked Protocol (HOOK) Coin Price Prediction

2024-09-24

Bittime - Hooked Protocol (HOOK) price prediction, potential increase of up to 347.95% in 2025 and 288.72% in 2030.

Technical analysis and RSI momentum suggest the market is neutral, while price indicators hint at HOOK's current buying opportunity. Listen to the explanation!

Hooked Protocol (HOOK) Coin Price Prediction

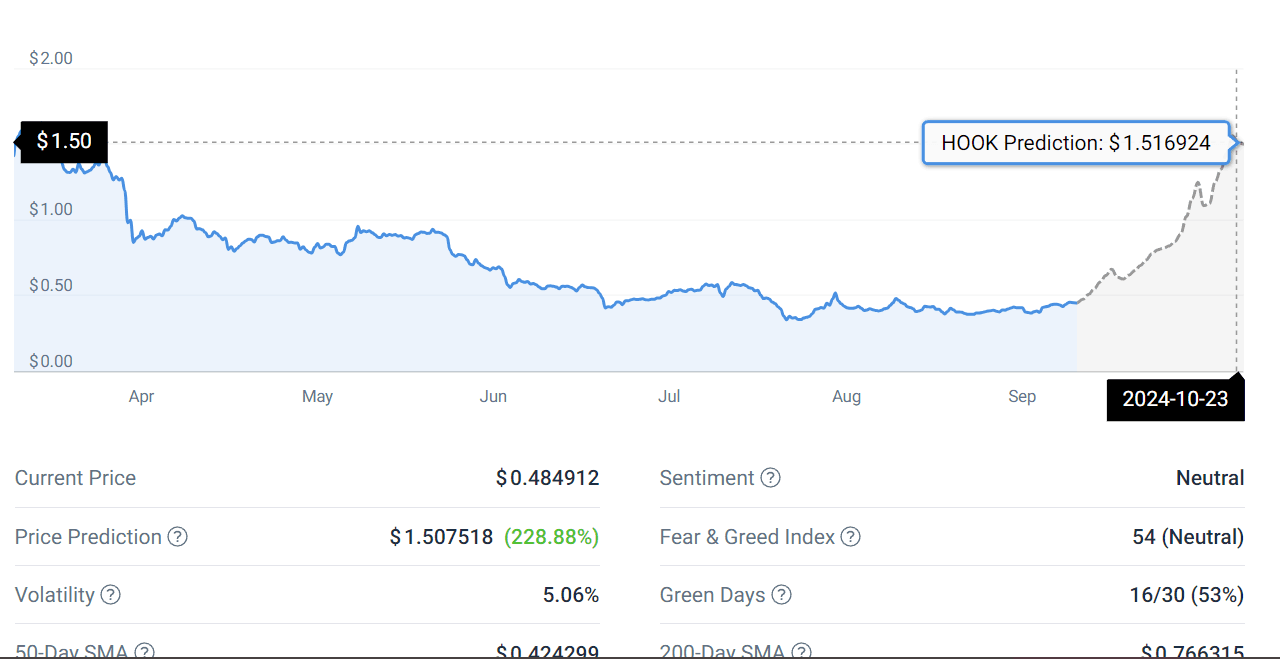

The current Hooked Protocol price prediction predicts a price increase of 228.88% and will reach $1.505718 on October 24, 2024.

The Fear & Greed Index is currently showing 54 (Neutral), according to technical indicators. The Hooked Method shows 16/30, or 53 percent, green days, with price volatility of 5.06% over the last thirty days.

The Hooked Protocol forecast shows that the right time to buy Hooked Protocol is now.

Hooked Protocol Price Prediction 2025

Hooked Protocol price prediction for 2025 currently stands between $0.458377 at the low and $2.17 at the high.

Compared to today's price, Hooked Protocol could gain 347.95% in 2025 if HOOK reaches its upper price target.

Hooked Protocol Price Prediction 2030

Hooked Protocol price prediction for 2030 currently stands between $1.162529 at the low and $1.884939 at the high.

Compared to the current price, Hooked Protocol can gain 288.72% in 2030 if it reaches the upper price target.

Read Also: Bittensor AI Coin (TAO) Increased Significantly in the Last Week

Hooked Protocol (HOOK) Coins Analysis

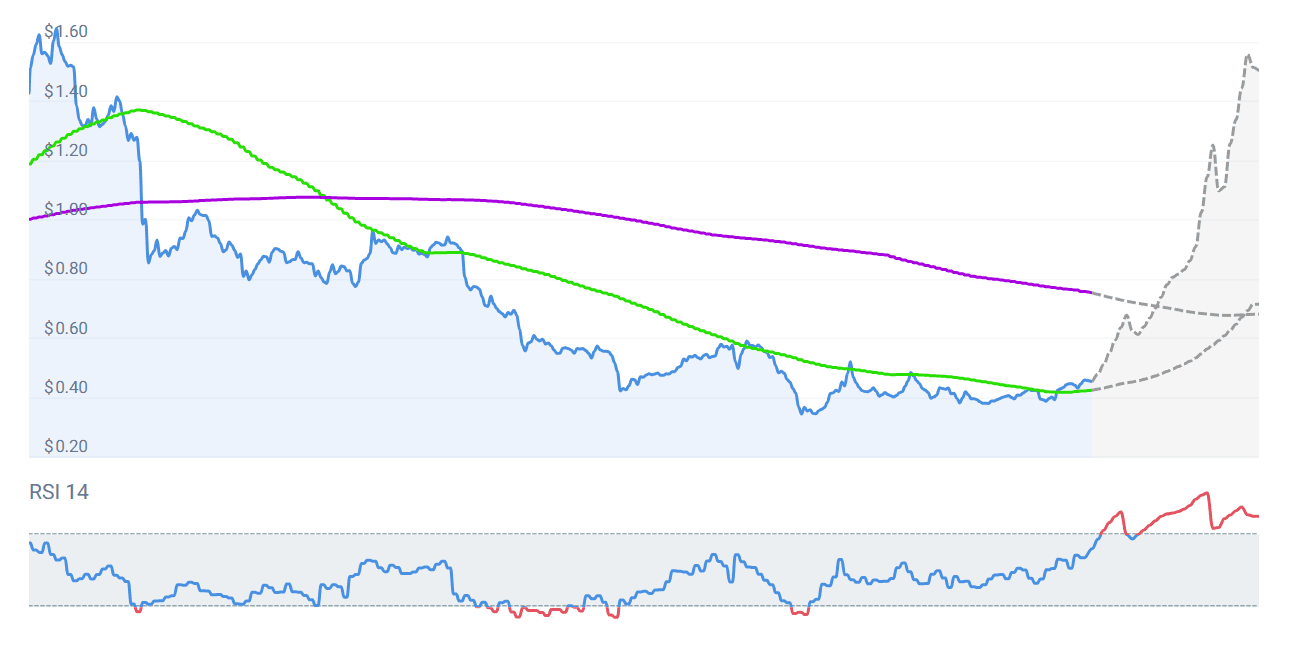

Based on technical indicators, Hooked Protocol's 200-day SMA will decline in the next month and will reach $0.684787 on October 24, 2024. Hooked Protocol's short-term 50-Day SMA is expected to reach $0.718785 on October 24, 2024.

The Relative Strength Index (RSI) momentum oscillator is a popular indicator that signals whether a cryptocurrency is oversold (below 30) or overbought (above 70).

Currently the RSI value is at 58.75 which indicates the HOOK market is in a neutral position.

Conclusion

AI Companion (AIC) price is currently showing signs of instability with strong resistance around the $0.082 level.

Although AIC managed to surpass this price, the token has not been able to maintain the momentum necessary to continue its rise.

Technical indicators, such as narrowing Bollinger bands and fluctuating RSI, indicate that selling pressure may continue.

If the price breaks the support line at $0.070, a sharper decline could potentially occur. On the other hand, the recovery of the RSI past 65 indicates that buyers are interested in falling prices.

The short-term movement of AIC will greatly depend on whether selling pressure or buying interest is more dominant.

How to Buy Crypto on Bittime

Want to trade, sell, buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.