January 9 PEPE Price Prediction: Whale Sells 427 Coins and RSI Indicates Death Crossover

2025-01-09

Bittime - Pepe (PEPE), the third largest popular crypto meme coin, is poised for a massive price drop after forming bearish price action.

This bearish outlook follows a significant price drop on January 7, 2024, and suggests further declines in the future. With the PEPE whale selling 427 billion coins, the price of PEPE is expected to be pressured further.

Amidst this price drop, blockchain-based transaction tracker Lookonchain reported that the smart whale dumped 427 billion PEPE meme coins worth $8.5 million on cryptocurrency exchange Kraken. Despite dumping such a huge amount of coins, the whale still owns 1 trillion PEPE for a profit of $2 million.

This is not the first time the whale has dumped PEPE; in late December 2023, the whale also sold a large amount of meme coins and made a profit of over $2 million. However, this time, the whale's dumping has the potential to create selling pressure and cause further price drops.

Also read: Could PEPE Be The Next Dogecoin in 2025?

PEPE Technical Analysis and Upcoming Levels

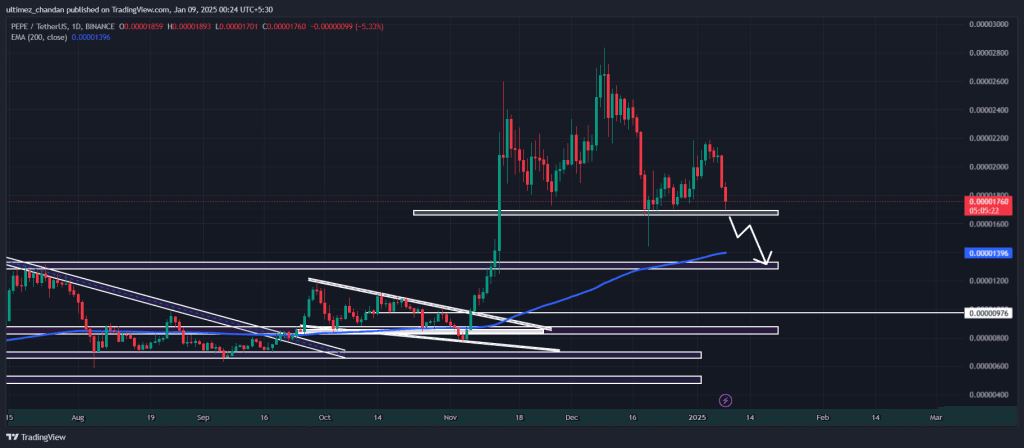

According to CoinPedia's technical analysis, PEPE has formed a bearish head and shoulders price action pattern on the daily chart and is poised for a major breakout. Currently, the price has taken support from the neckline of the pattern, but it seems that the support level is weakening.

If PEPE breaks out of the pattern and closes the daily candle below the $0.0000166 level, the price could drop 20% to reach the $0.000013 level in the foreseeable future.

On the positive side, PEPE's Relative Strength Index (RSI) is approaching the oversold area, which indicates a potential upward momentum. However, this seems unlikely due to the ongoing bearish market sentiment across the market.

This price drop and bearish price action has raised concerns among investors, resulting in a decrease in open positions, as revealed by on-chain analysis firm Coinglass.

Decline in Open Interest and Price Momentum

Currently, PEPE is trading near $0.0000178 and has experienced a price drop of over 5.5% in the last 24 hours. During the same period, its trading volume increased by 10%, indicating increased participation from investors and traders compared to the previous day.

The price of PEPE has dropped 13.27% in less than two days and formed a bearish candlestick pattern.

The PEPE coin price has been in a consolidation phase since mid-November after a bullish rally. In December, PEPE coin price tried to resume the bullish trend but the sellers were quite strong.

The price failed to reach the last high and showed a decent decline. Amid this decline, the price has slipped below the 20-day EMA and is heading towards the 200-day EMA.

Also read: PEPE Coin: Trading Volume Drops, How Will PEPE Price Look in the Future?

PEPE Price and Whale Activity

A whale recently deposited 217 billion PEPE ($4.496 million) on the Kraken exchange, generating a profit of $767K (+20%) in just 17 days. Even so, one whale still holds $25.1 million worth 1.21 trillion PEPE tokens, with $4.05 million in unrealized gains spread across two wallets.

This kind of whale movement increases market liquidity but also increases volatility, especially if it occurs in significant amounts.

The price of PEPE is under downward pressure due to increased selling activity, but overall market conditions are still negative. With a head and shoulders pattern forming, the price of PEPE is trading at $0.0000178 and has dropped 3.56% over the past 24 hours. The market capitalization is $7.59 billion and the 24-hour trading volume is $1.94 billion.

Conclusion: PEPE Price Outlook Going Forward

The recent performance of PEPE coin shows a worrying bearish trend after a significant price drop. The formation of a bearish candlestick pattern and the movement below the critical support level suggest that further downside movement may be in the offing.

However, if the price can rebound from this level and surpass the 20-day EMA, it will attract buying interest, potentially reversing the bearish momentum. Investors should remain vigilant and monitor the price movement of PEPE amid increased whale activity.

FAQ

Why did PEPE price drop after the whale sold 427 billion coins?

PEPE price dropped after the whale sold 427 billion coins as this large sell-off created selling pressure in the market. The selling caused concern among investors, which contributed to further price drops.

What is the head and shoulders pattern on the PEPE price chart?

The head and shoulders pattern is a bearish pattern that indicates a potential trend reversal. If the price of PEPE breaks the support level below the neckline of this pattern, it could indicate a further decline in the price.

What does the Relative Strength Index (RSI) for PEPE currently indicate?

PEPE's RSI is approaching the oversold area, which usually indicates that digital assets may have been over-sold and could experience a rebound. However, the current bearish market sentiment may hinder any potential price recovery.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

References

coinpedia.org, PEPE Price Prediction for January 9, Whale Sells 427 Billion Coins, accessed on January 9 , 2025.

themarketperiodical.com, PEPE Coin Price: RSI Shows Death Crossover While Whales Offload, accessed on January 9, 2025.

Author: AWW

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.