RedStone Crypto: Everything You Need to Know

2025-03-10

Bittime - RedStone, with its modular oracle solution, now reaches a wider audience thanks to Binance Launchpool. Users have the opportunity to earn RED tokens by staking BNB, FDUSD, and USDC. What makes RedStone attractive? Here's the discussion!

What is RedStone Oracle?

RedStone Oracle is a next-generation blockchain oracle. It is designed to be modular, providing customizable, cost-effective, and high-frequency data feeds for users decentralized applications (dApps).

In essence, RedStone is here to fix existing oracle shortcomings such as Chain link and Pyth. They offer a more scalable, flexible, and secure way to provide off-chain data to smart contracts.

Today, RedStone is trusted by more than 100 dApps across 70+ blockchain networks, securing billions of dollars in value. They support various blockchain ecosystems, including EVM and non-EVM. This flexibility allows RedStone to serve a wide range of data needs in the Web3 world.

RedStone Featured Features

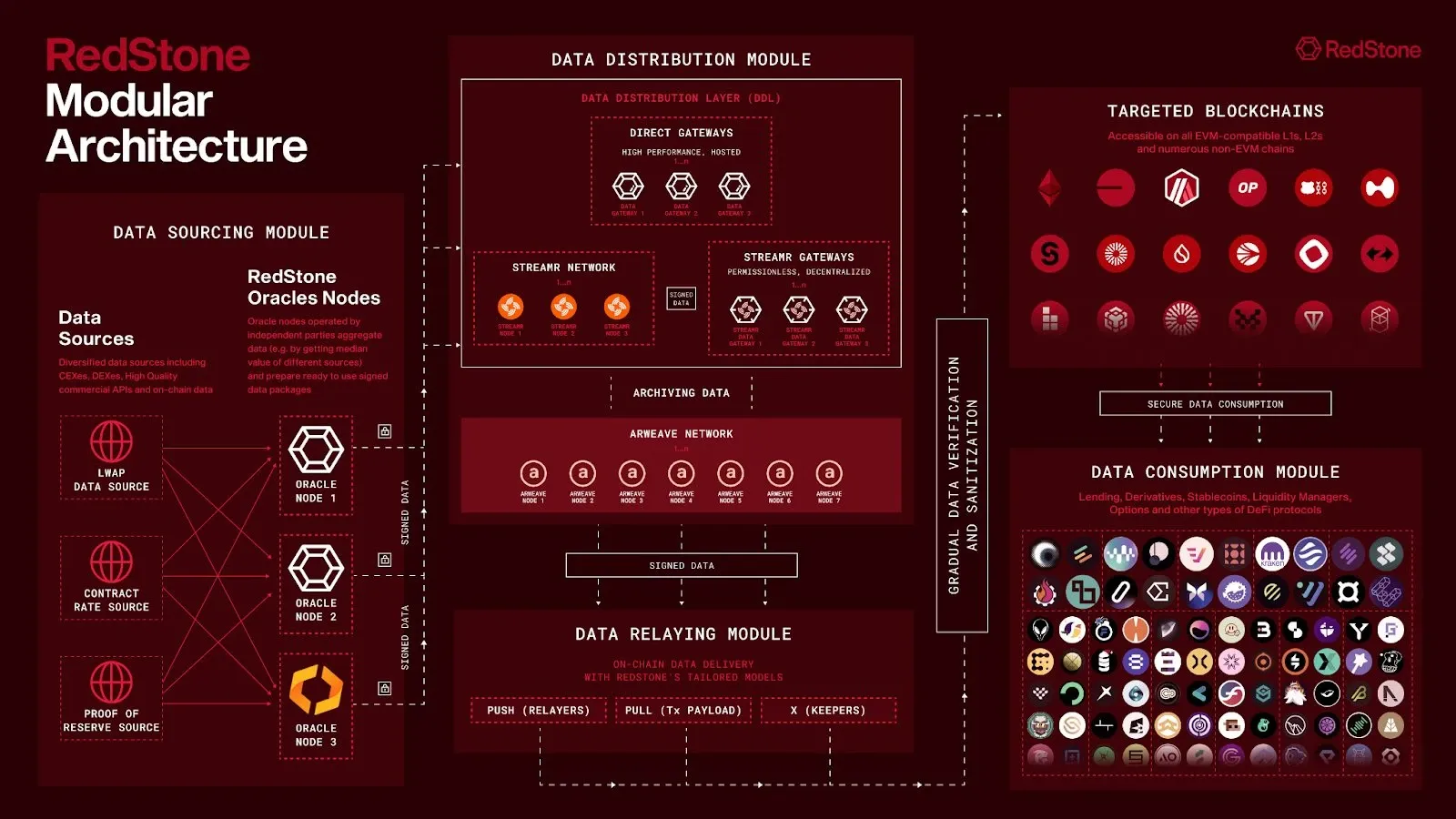

1. Modular Architecture: Scalable Multi-Chain Data Delivery

RedStone has a unique approach to managing data. Instead of requiring separate infrastructure for each blockchain, RedStone separates data collection from data delivery. This means one price feed can be used across multiple networks without the need for additional setup.

Some of the advantages of RedStone's modular architecture:

Supports more than 70 blockchain networks, including Ethereum, L2, and non-EVM chains.

No need for redundant nodes per chain, making integration faster and more cost-effective.

Optimized for DeFi, perpetuals, and liquid staking markets.

2. Cost-Effective & Flexible Data Delivery Model

RedStone offers three different data delivery models, making gas costs more efficient and adaptable to various dApp needs:

Pull Model (On-Demand Data Injection)

Inject real-time data into transactions, saving gas by only fetching data when needed.

Push Model (Continuous Data Updates)

Periodically updates on-chain price feeds, ideal for protocols that require constant availability.

Hybrid Model (ERC7412 Standard)

A combination of Push and Pull models, first introduced by Synthetix and optimized by RedStone.

Why Is This Important?

These models significantly reduce gas fees compared to traditional oracles like Chainlink. Additionally, dApps can choose the best model based on their specific needs.

3. High Data Security & Integrity

RedStone ensures data accuracy, reliability and security through multiple layers of validation:

Cryptographic Signing & Attestation

Each data point is signed by an independent provider, ensuring authenticity and tamper-proof data.

On-Chain Aggregation & Medianization

Price feeds are aggregated using median or weighted-liquidity-based models, filtering out anomalies.

Anomaly Detection & Timestamp Validation

Automatic price monitoring prevents inaccurate or manipulated data from being recorded.

Economic Security Model

Providers must stake collateral, which can be deducted if they send incorrect data.

The result?

There have been no incidents of mispricing since its inception.

Audited by leading security companies such as ABDK, Halborn, and AuditOne.

4. Diverse & Customizable Data Feeds

RedStone supports a variety of data types, making it more versatile than traditional oracles:

Market Feed

Traditional price feeds from centralized (Binance, Coinbase) and decentralized (Uniswap, Balancer) exchanges.

Contract Rate Feed

On-chain exchange rates from protocols such as Lido (wstETH/stETH) and EtherFi (weETH/eETH).

Real World Feed

Off-chain financial data such as SOFR interest rates and stock indices.

Proof of Reserve Feed

Real-time monitoring of collateralized assets, such as BlackRock's BUIDL token reserves.

Protocol Native Oracle

Custom price feeds designed for specific blockchain ecosystems (for example, LBTC/BTC for Lombard Protocol).

5. Wide Blockchain Support & Cross-Chain Compatibility

RedStone operates across multiple blockchain ecosystems, including:

Ethereum & Layer 2s – Decision, Optimism, Base, Starknet, Fuel, Sei.

Non-EVM Chains – Sui, Solana, Bitcoin Layer.

Rollup-as-a-Service (RaaS) Networks – EigenLayer.

Read too How to Register for RedStone Airdrop and How to Play: Complete Guide!

RedStone Ecosystem

RedStone is tightly integrated with some of the largest DeFi, staking, and trading protocols, enabling secure and cost-effective data feeds across the Web3 space. There are three main categories in the RedStone ecosystem:

RedStone Core

Designed for DeFi applications that require on-demand pricing. TVL secured: Over $100 million.

RedStone Classic

Push-based model for protocols that require constant price updates. Used by lending markets, stablecoins, and automated vaults.

RedStone X

Optimized for perpetual contracts, options, and derivatives. Eliminates front-running risks and increases trading security.

Read too RedStone (RED) Price Prediction: Its Premarket Price, Tokenomics and Airdrop

Why Choose RedStone Over Other Oracles?

Of course, here is a comparison table of RedStone, Chainlink, and Pyth in Indonesian, with some terms remaining in English:

Token Details: RED Tokenomics

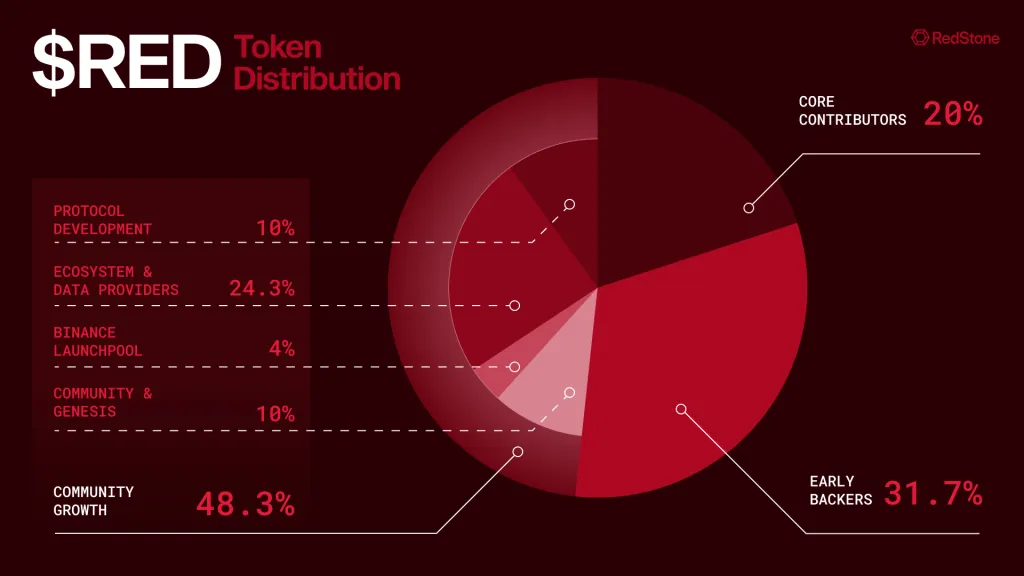

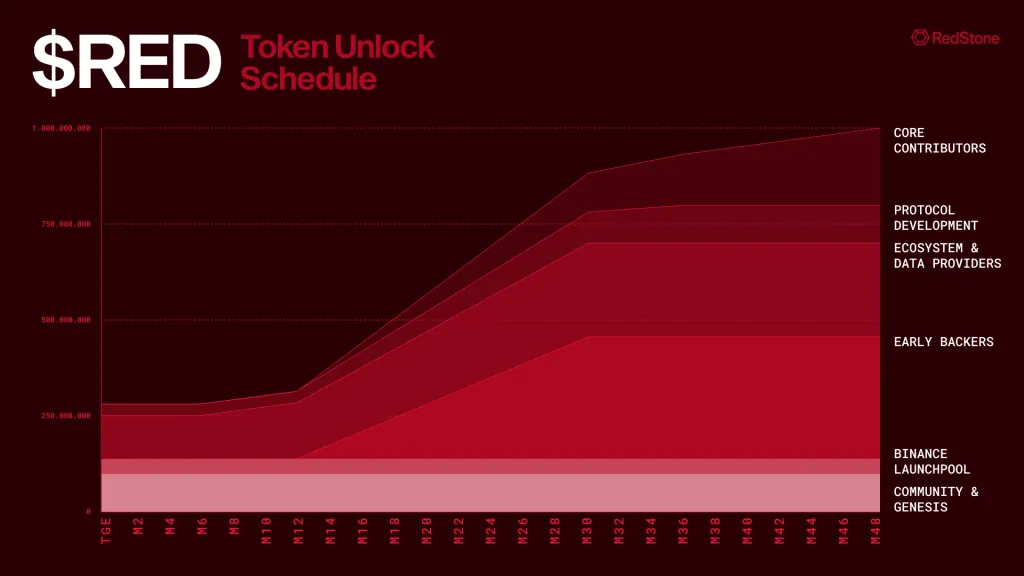

RED Token is the native utility and governance token of the RedStone network. With a total supply of 1 billion tokens, RED is designed to support the long-term sustainability and expansion of oracle services.

Ticker: RED

Token Contract: 0xc43c6bfeda065fe2c4c11765bf838789bd0bb5de [Ethereum Mainnet]

Max Supply: 1.000.000.000 RED

Float at TGE: 28% (280.000.000 RED)

Percentage for Community Growth: 48,3%

Token Standard: ERC-20 (Ethereum)

Lock-Up Period: 72% RED initially locked, unlocked for 4 years

RED Token Utility – Staking for Security

RED powers RedStone's sustainable oracle ecosystem, ensuring long-term security for DeFi.

Staking via EigenLayer AVS enhances Oracle RedStone's security, leveraging billions in staking assets.

Data Providers & Token Holders can stake RED to strengthen the network.

Rewards are earned from data users across various blockchains, paid out in ETH, BTC, SOL, and USDC.

Latest Launchpool Event

RedStone (RED) officially launched on Binance Launchpool as the 64th project, marking an important milestone in RedStone's journey towards wider adoption and decentralization.

Launchpool events allow users to earn RED tokens by staking their assets in designated pools.

Binance Pre-Market & Detail Trading

Following the Launchpool event, Binance listed RedStone (RED) in the pre-market trading segment on February 28, 2025. To manage volatility, Binance introduced a Price Limit Mechanism for RED.

Funding and Partnerships

RedStone has raised approximately $23 million across three rounds, including a $7 million seed round in August 2022 and a $15 million Series A in July 2024, backed by investors such as Coinbase Ventures and Arrington Capital. The company partners with major players such as Lido, EigenLayer, and Sei Network, enhancing its credibility.

RedStone Team

RedStone has built a world-class team of blockchain engineers, developers, and business leaders to revolutionize the Oracle sector.

The team has extensive experience from leading technology companies, including OpenZeppelin, Meta, Google Cloud, Toptal, and ICB Ventures, bringing deep expertise in DeFi security, decentralized systems, and large-scale cloud infrastructure.

In short, RedStone is an innovative oracle solution with a strong team, leading investor support, and a unique approach to providing data in the blockchain world. With advanced features, a growing ecosystem, and a commitment to security, RedStone has great potential to become a key player in Web3 infrastructure.

FAQ

What is RedStone and why is it important?

RedStone is a new generation oracle solution that is more efficient and secure than traditional oracles such as Chainlink. This oracle provides accurate data for smart contracts on the blockchain, supporting DeFi, gaming, and cross-chain applications.

What differentiates RedStone from other oracles?

RedStone uses a unique modular architecture, enabling cost-effective and flexible data delivery. This oracle also supports multiple blockchains (including non-EVM), has a variety of data feeds, and has proven security.

How to get RED tokens?

One way is through Binance Launchpool by staking BNB, FDUSD, or USDC. RED tokens are important for the security and governance of the RedStone ecosystem.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Reference

Akinyemi Okedeji Amoo, RedStone – The Novel Oracle Brings 40M RED Tokens to Binance, Accessed March 10, 2025

Author: IN

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.