Apple Shares Drop Dramatically: Causes and Impact for Investors

2025-03-11

Bittime - Apple (AAPL) shares experienced their biggest decline in the last three years. What is the cause of the decline in Apple's share price, and what is the impact on investors? Check out the complete analysis here.

Apple Stock Experiences Sharp Drop

Apple Inc. shares (AAPL) experienced its largest decline in the last three years, reaching its lowest point in March 2025. This decline was influenced by various factors, including global economic uncertainty, intense competition in the technology industry, and an increasingly saturated smartphone market.

Apple is known as a company with strong fundamentals, but uncertain market conditions have affected its share price. This article will discuss the main causes of the decline in Apple shares and their impact on investors.

What is Apple Stock?

Apple stock (AAPL) is one of the most popular technology stocks on the global stock market. This company is famous for innovative products such as iPhone, iPad, MacBook, and digital services such as iCloud and Apple Music.

For years, Apple has been the top choice for investors looking for shares in technology companies with steady growth. However, the global economic situation and increasingly fierce competition have put pressure on its share value.

Reasons for the Decline in Apple Shares

There are several main factors that cause Apple's stock price to experience a significant decline in 2025.

- Global Economic Uncertainty

The increase in import tariffs imposed by the United States government on goods from China increases Apple's production costs. Fluctuations in currency exchange rates and global inflation worsen market sentiment and affect consumer purchasing power.

- Tight Competition in the Technology Industry

Companies like Samsung, Xiaomi, and Huawei are increasingly aggressive in developing products that rival the iPhone and MacBook. Apple lost some market share in key regions, including China and Europe.

- iPhone Sales Decline

The global smartphone market is experiencing saturation, so iPhone sales growth is starting to slow down. Many consumers are choosing not to buy new devices due to the lack of significant innovation in the latest iPhone models.

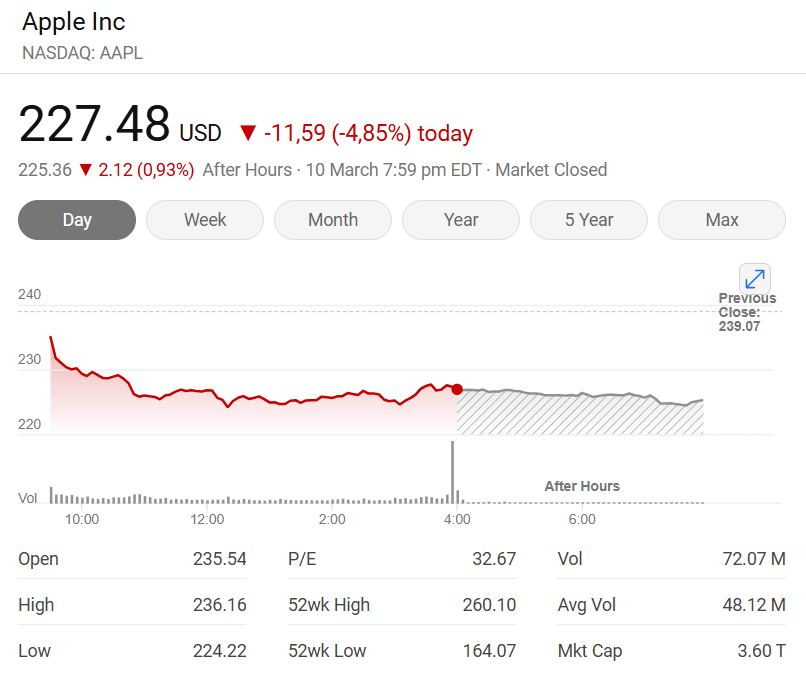

Apple Stock Price Today

On March 10 2025, Apple's share price closed at 227.48 US dollars, down 4.85 percent compared to the previous day.

In the last three years, Apple's share price movements have experienced the following changes:

- 2023: Stock price stabilizes above 300 US dollars.

- 2024: Experiencing volatility with a price range of 250 to 270 US dollars.

- 2025: Experiences a drastic decline to the level of 227.48 US dollars.

Impact for Investors

For investors, the decline in Apple shares can be both a challenge and an opportunity.

- Portfolio Diversification Strategy

Investors are advised to not only rely on AAPL shares, but also consider other assets such as technology-based ETFs.

- Apple Performance Monitoring

It is important to continue to observe Apple's financial reports and business strategy to find out the company's future prospects.

- Long Term Investment

If Apple is able to overcome challenges and introduce new innovations, its shares have the potential to recover in the long term.

Conclusion

The decline in Apple shares in 2025 is the impact of global economic conditions, increasingly fierce competition, and changing technology industry trends.

Even though Apple shares are experiencing pressure, investors who want to invest in the long term can still consider the potential for recovery if the company is able to innovate and adapt its business strategy.

Frequently Asked Questions (FAQ)

- What is the main cause of the decline in Apple shares?

The main causes are global economic uncertainty, increasing competition in the technology industry, and decreasing demand for iPhones.

- How will US import tariffs impact Apple?

Higher tariffs increase Apple's production costs because most of its components are made overseas, especially in China.

- Is this a good time to buy Apple stock?

Investors need to consider long-term strategies and conduct market analysis before making decisions.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Writer: Irwan

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.