10x Research Suggests Long Bitcoin and Short Ethereum Strategy, Why?

2024-08-22

Bittime - 10x Research recommends investment strategies for long Bitcoin and short Ethereum, considering Bitcoin's ever-increasing market dominance. Read this article to find out more!

Bitcoin Price Rise

Source: 10xresearch.co

Since yesterday, Bitcoin price has risen by 4%, breaking out of a symmetrical triangle pattern that has long been a concern. This pattern is often an indication that the next price movement will be significant, and in this case, the direction of the movement is positive.

This price increase was also supported by an increase in open interest of $1 billion, which shows that many traders are placing new positions in Bitcoin futures contracts.

Additionally, Bitcoin's funding rate, which indicates the cost of maintaining a long or short position in the futures market, has returned to a premium. This indicates that more traders are willing to pay to maintain long positions, which is an indication of bullish sentiment in the market.

Read Also: Ethereum Volatility Exceeds Bitcoin, Opportunity or Risk?

Long Bitcoin and Short Ethereum Strategy

10x Research recommended a strategy long Bitcoin and short Ethereum. This means, you are advised to buy Bitcoin in the hope that the price will continue to rise, while selling Ethereum in the hope that the price will fall or at least not rise as high as Bitcoin.

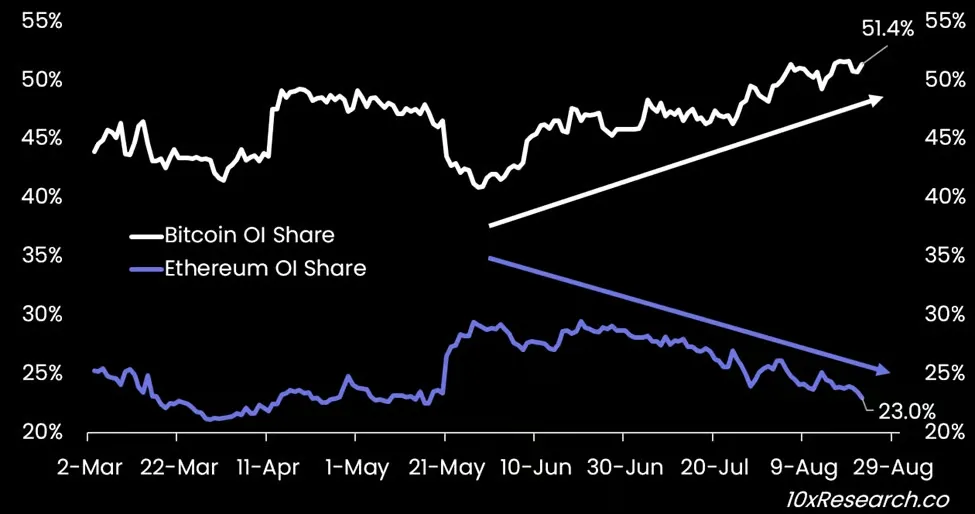

This recommendation is based on Bitcoin's increasing market dominance, which continues to attract more interest from investors, as well as the spread in open interest that favors Bitcoin.

Bitcoin's increasingly strong market dominance shows that Bitcoin is the main choice for investors looking for security amidst global economic uncertainty. Meanwhile, Ethereum may face greater challenges, especially with upcoming changes in monetary policy.

The Fed's Policy and Its Impact on the Crypto Market

10x Research also discusses the upcoming monetary policy from the US Federal Reserve (The Fed). The Fed's latest meeting minutes showed a dovish stance, with the main focus on the employment aspect of its dual mandate.

The inflation target appears to be within reach based on current economic data projections. Most FOMC members support a rate cut in September, with some even considering a cut in July, making a cut in September almost certain.

Fed Chairman Jerome Powell's speech, scheduled for next Friday, is expected to reinforce this dovish view. A dovish stance is usually interpreted as looser monetary policy, which tends to increase the appeal of risk assets such as stocks and Bitcoin.

If Powell signals further support for interest rate cuts, this could trigger a further price spike in Bitcoin, while Ethereum may not benefit the same way.

Read Also: Compared to Ethereum (ETH), Solana (SOL) and Dogwifhat (WIF) are more promising?

How to Buy Crypto with Bittime

You can buy and sell crypto assets in an easy and safe way via Bittime. over is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Monitor graphic movement price Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.