Tether (USDT) Becomes Payment for Insurance Program in the Philippines

2024-07-05

Bittime - Philippine financial ecosystem Tether has introduced USDT as a payment option for Social Security System (SSS) contributions. The move aims to streamline the payment process for citizens, offering a modern alternative to traditional payment methods. This article explores Cointelegraph’s exploration and adoption of USDT in the Philippines.

Bittime - Philippine financial ecosystem Tether has introduced USDT as a payment option for Social Security System (SSS) contributions. The move aims to streamline the payment process for citizens, offering a modern alternative to traditional payment methods. This article explores Cointelegraph’s exploration and adoption of USDT in the Philippines.

What is SSS? A Government-Managed Insurance Program

The SSS is a government-run social insurance program, serving employees in various sectors, including formal, informal, and private. Operating under a legal mandate to provide support during difficult times, the SSS currently administers social security and employee compensation programs.

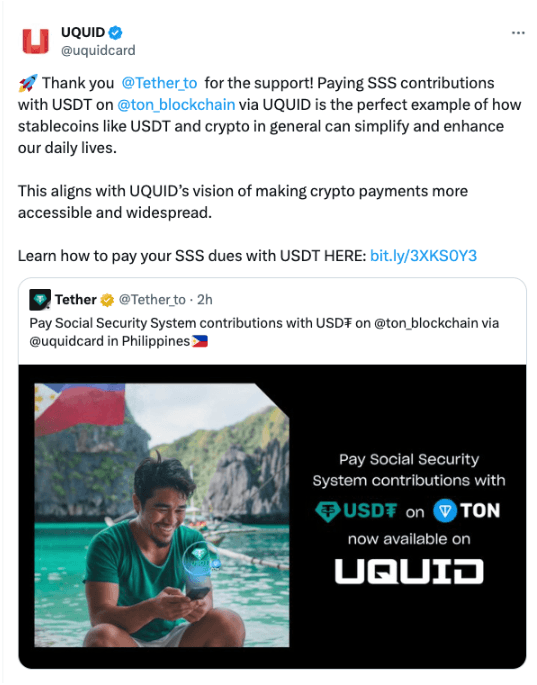

To facilitate this transition, Tether has partnered with Uquid, a Web3 shopping and infrastructure company, to enable USDT payments on The Open Network blockchain. Uquid CEO Tran Hung emphasized that this collaboration bridges the gap between digital currencies and everyday transactions, making micropayments using crypto more practical and accessible.

What is Uquid?

Uquid, a decentralized trading platform, leverages blockchain technology to offer crypto payment solutions. With over 260 million users amassed over the past eight years, Uquid has positioned itself as a leader in decentralized finance (DeFi).

The partnership with Tether is seen as an important step in increasing daily financial activity through stablecoins.

Check Crypto Market Today:

Real-World Adoption of USDT and Other Stablecoins Begins to Spread

The introduction of USDT for SSS payments is part of a broader trend of increasing stablecoin adoption. Stablecoins, originally used as entry points for centralized exchanges, have evolved into vital liquidity providers in both centralized and decentralized markets.

This trend is underscored by mainstream platforms such as PayPal, which has launched its own stablecoin, PayPal USD (PYUSD), and Ripple’s plans to introduce a stablecoin by 2025 to meet growing demand.

Also Read How To Buy Crypto:

Rising Interest in USDT

Crypto assets, especially stablecoins, are gaining traction due to their role in cross-border transactions at the institutional level. The integration of USDT into the Philippine social security payment system exemplifies this growing adoption, highlighting the potential of stablecoins to simplify and improve day-to-day financial operations.

How To Buy Crypto With Bittime

You can buy and sell crypto assets easily and safely through Bittime. Bittime is one of the best crypto applications in Indonesia that has been officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Monitor the price chart movements of Bitcoin (BTC) , Ethereum (ETH) , Solana (SOL) and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.