EigenLayer Token (EIGEN): Everything You Need to Know

2024-10-05

Bittime - Recently, the EigenLayer (EIGEN) token has received more attention because it presents a unique and quite 'spooky' approach.

Based on a brief reading, the EigenLayer (EIGEN) token becomes a kind of means to become an 'enforcer of justice' in the crypto world.

Let's get to know and learn more about the EigenLayer (EIGEN) token in the following article.

Get to know the EigenLayer Token (EIGEN)

The EIGEN token is a type of working token that is universal and can be used in various contexts.

The working tokens in question are tokens that can be "staking" or used to carry out certain work in the blockchain system.

The work a work token can do could be processing transactions or validating data.

The presence of the EigenLayer (EIGEN) token is a work token that attempts to overcome the current work token problem, namely the problem of errors that are attributed intersubjectively.

What is Intersubjectively Attributed Error?

Intersubjectively attributable errors are errors that cannot be directly detected by automated systems such as smart contracts, but can be recognized by many people who see them.

This means that even though the system cannot confirm that an error exists, the people observing it can agree that an error exists.

In other words, it's the kind of mistake that honest people can all agree on, even if the computer system can't directly prove it.

It is also necessary to understand that Objectively attributable errors also fall into the category of intersubjective errors.

For example, an error in running a deterministic virtual machine such as an EVM is an objective error, and all honest observers outside the system would agree on the error.

Solution from EigenLayer Token (EIGEN)

The EigenLayer (EIGEN) token carries the vision and mission to resolve errors attributed intersubjectively through the EIGEN staking method.

The EIGEN staking method, which is the main way to solve the problem of attribution error, is based on three main ideas, namely:

1. Setup and execution phase

2. Cutting (slashing)

3. Token forking

A more complete explanation of the three main ideas above, among others:

1. Preparation and Execution Phase

The first idea is about two phases in any coordination system: the setup phase and the execution phase.

The setup phase involves discussing, agreeing on, and defining the execution rules that will be applied to run the digital task, as well as error monitoring and verification rules during the execution process.

After the setup phase is complete, enter the execution phase, in the execution phase the existing rules will be applied.

Rules are created so that each user can detect errors clearly without having to meet in person or go through dispute resolution channels.

An example outside of blockchain is the passage of the US Constitution, when any new law must conform to the constitution.

In a blockchain context, a similar example is the longest chain consensus rule on bitcoin which is used to determine the newest block.

2. Cutting (Slashing)

The second idea is slashing, which is a mechanism to punish network participants who behave badly during the execution phase.

Punishment is carried out by taking away some of the tokens they have staked.

This method will have a negative impact on those who break the rules and is one of the cryptoeconomic benefits of the proof-of-stake (PoS) system.

In short, slashing becomes a kind of "karmic" punishment for dishonest participants.

3. Token Forking

The third idea is token forking, a solution that avoids the risk of “tyranny of the majority”.

In many current systems, intersubjective errors are resolved by punishing operators whose answers deviate from the majority or by a committee determining correctness. However, this approach can be risky if the majority is unfair.

The token forking method offers a solution by separating the chain state and allowing new forks when the majority of validators make a mistake.

In the context of EIGEN staking, if the majority of stakers act maliciously and cause intersubjective wrongdoing, a new token fork can be created in which the malicious stakers are punished by being restricted from redeeming tokens in the new fork.

Social consensus will recognize the new fork as legitimate, so that malicious stakers suffer the consequences.

EIGEN Staking Features

After discussing what it is and the vision of the EigenLayer (EIGEN) token through the technical or EIGEN staking method, now let's review what features exist in EIGEN staking.

According to documentation from EIGEN, EIGEN staking has four main features, namely universality, isolation, matering, and compensation.

Universality

The EIGEN setup phase determines that EIGEN can be used broadly to resolve a wide range of intersubjectively attributable errors, not just specific errors.

Each AVS that wishes to leverage the cryptoeconomic benefits of EIGEN will need to code agreed upon coordination rules in their respective setup phases.

These special AVS rules, such as the slashing provisions, act like changes or amendments to EIGEN.

Additionally, these withholding provisions must ensure that any intersubjective errors can be independently verified beyond reasonable doubt.

Isolation

EIGEN's second main feature is isolation. To understand this feature, imagine an alternative design where each token fork forces the DeFi market to become aware of the fork, so that the token can no longer be used in a long-term DeFi position.

To avoid these negative effects on DeFi, EIGEN uses a two-token model.

The first token, beIGEN, is used for staking and is subject to forks.

Meanwhile the second token, EIGEN, can still be used for DeFi or other non-staking applications without being affected by the fork in bEIGEN.

Measurement

Resolving intersubjective errors involves costs to social consensus, either in switching from one token to another or resisting dangerous forks.

Therefore, claims to fork must be accompanied by a bond (guarantee) in the form of bEIGEN to prevent detrimental challenges.

The value of this guarantee must be greater than the costs borne by the social consensus (users and AVS) to reject the malicious fork.

A successful challenge will also result in major costs to the ecosystem, such as contract upgrades to accommodate new ramifications in daily operations.

Thus, the challenge can only be carried out if there is enough EIGEN staked and deemed problematic, so that it can be burned and reduce the total number of tokens in circulation.

Compensation

The intersubjective staking protocol ensures that if an AVS is attacked by a malicious group of EIGEN stakers, the AVS can prune and redistribute the stakes of those malicious stakers to AVS users.

If an AVS can ensure that this “attributable security” outweighs the harm caused to its users, it is deemed to have achieved strong cryptoeconomic security.

Such things indicate that no honest users were harmed.

Strong cryptoeconomic security focuses on user protection and does not need to consider adversaries or other user incentives.

What is Meant by AVS?

AVS (Autonomous Verification System) is an automatic system that functions to verify tasks or operations in a blockchain environment.

In short, AVS became a kind of legal enforcer on EIGEN.

Within EIGEN, AVS acts as an independent entity that oversees and coordinates the execution of complex digital tasks.

Each AVS has a specific set of rules that are agreed upon during the setup phase, including provisions regarding slashing and other conditions.

The rules are designed to ensure cryptoeconomic security and fairness in managing staking.

AVS optimizes the cryptoeconomic benefits of EIGEN, such as self-verification of intersubjectively attributable errors.

If an error occurs, AVS is responsible for detecting and reporting it.

AVS also has a mechanism to punish malicious stakers by cutting and redistributing their stakes to affected users.

In this way, AVS ensures that the tasks executed in the system are safe and reliable, without burdening the main consensus, such as Ethereum.

Token EigenLayer (EIGEN) Allocation

Seeing the high enthusiasm for EigenLayer (EIGEN), let's observe how the allocation for EigenLayer (EIGEN) tokens is going.

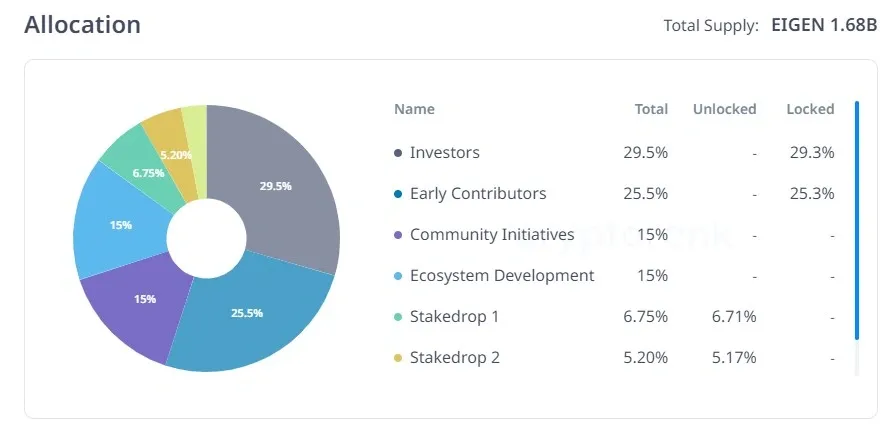

EIGEN tokens have a total supply of 1.68 billion EIGEN, the allocation distribution is divided as follows:

1. Investors

- Total allocation: 29.5%

- Opened: -

- Locked: 29.3%

2. Early Contributors

- Total allocation: 25.5%

- Opened: -

- Locked: 25.3%

3. Community Initiatives

- Total allocation: 15%

- Opened: -

- Locked:-

4. Ecosystem Devopment

- Total allocation: 15%

- Opened: -

- Locked:-

5. Stakedrop 1

- Total allocation: 6.75%

- Opened: 6.71%

- Locked:-

6. Stakedrop 2

- Total allocation: 5.20%

- Opened: 5.17%

- Locked:-

The image and explanation above is the distribution of token allocations, it can be seen that most of the allocations are still locked, especially for investors and early contributors.

Meanwhile, most of the tokens for Stakedrop have already been unlocked.

Final Note

Armed with such a concept and ability, it is not surprising when many are interested and follow the development of the EigenLayer token.

You can get comprehensive information about the EigenLayer (EIGEN) token by regularly monitoring the Bittime blog. Hope it is useful.

How to Buy Crypto on Bittime

Want to trade, sell, buy Bitcoin and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with CoFTRA, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.