VanEck Files First Solana ETF in US, SOL Price Soars!

2024-06-28

Bittime - VanEck has just made important history in the crypto ecosystem! The investment management company has filed an application with the SEC for the first Solana ETF in the United States.

The filing marks a watershed moment for Solana, which is often considered a competitor to Ethereum.

VanEck Files Solana ETF with SEC

The document, entitled VanEck Solana Trust, was filed following the successful launch of the VanEck Bitcoin ETF in Australia. The Solana ETF, if approved by crypto regulators, will track the Solana spot price and will be listed on the Cboe BZX exchange.

The filing comes just days after digital asset manager 3iQ submitted a similar request for a Solana ETF on the Toronto Stock Exchange (TSE) in Canada.

SOL Price Rises

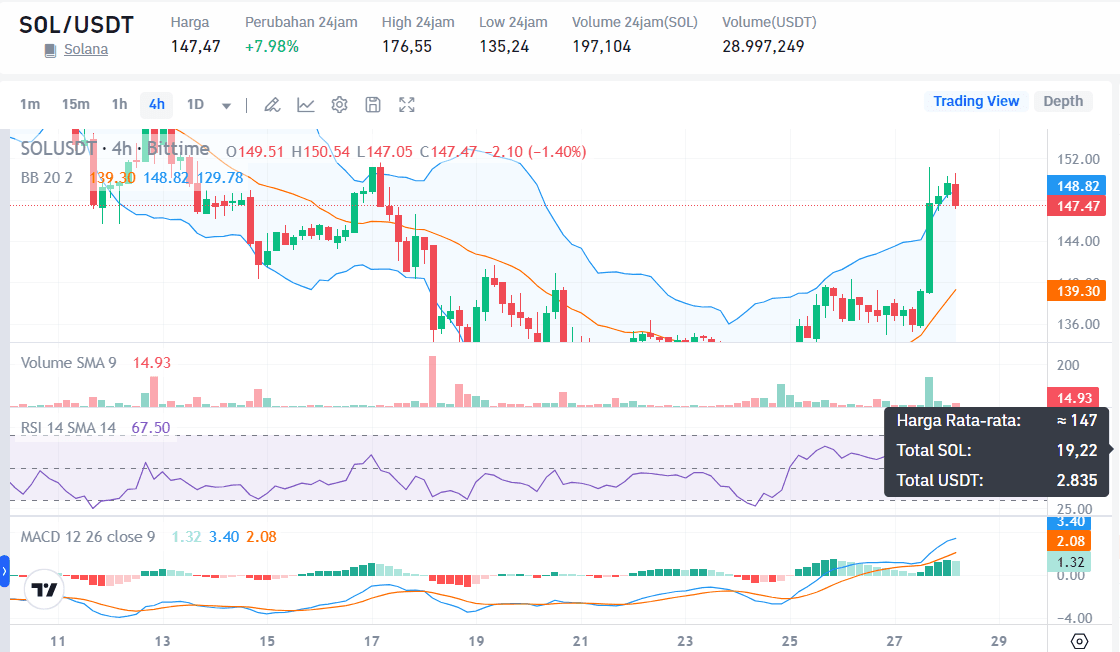

Source: Bittime

This news immediately had a positive impact on the crypto market. The price of Solana (SOL) increased 7.98% immediately after the filing announcement.

SOL is currently trading above $147, indicating significant gains since the document was published.

This shows the influence such news can have on crypto prices and highlights the importance of institutional adoption for the recognition and stability of digital assets.

ETFs: A Central Point for Crypto Adoption?

VanEck's entry into the Solana space with an ETF is a sign of confidence in the blockchain and its future potential.

This could also signal a growing trend towards diversifying crypto investment products offered to traditional investors who want exposure to crypto without holding assets directly.

It is worth noting that all of this significant progress in ETFs is thanks to Bitcoin ETFs. They pave the way for investment managers to consider providing similar investment vehicles tied to other cryptocurrencies.

Potential Impact of the Solana ETF

In addition to short-term price increases, VanEck's Solana ETF filing has several other potential implications for the crypto ecosystem as a whole. Let's take a look at some of them:

1. Increased Liquidity

ETFs typically attract many institutional investors, which can increase the overall liquidity of the crypto market.

Higher liquidity can lead to lower price fluctuations and greater stability for crypto assets like Solana.

2. Increased Legitimacy

Regulatory-backed ETFs could help legitimize crypto as an asset class in the eyes of traditional investors. This could attract more institutional capital into the crypto space, which could ultimately spur growth and innovation across the sector.

3. Crypto Investment Diversification

Solana ETFs can be an attractive option for investors who want to gain exposure to Solana without needing to purchase and hold coins directly.

This can open up the world of crypto investing to investors who may have previously been hesitant to jump right in.

4. Regulatory France

The SEC's ETF approval process could help establish clearer regulatory standards for crypto assets. Regulatory clarity can encourage greater institutional participation and long-term growth of the crypto industry.

Challenges of Solana ETFs in the Future

However, it's also important to note that there are some potential challenges to consider:

1. Market Volatility

The crypto market is known for its high volatility. While ETFs can help reduce some of this volatility, investors should still be alert to the risk of significant price declines.

2. Regulatory Approval

There is no guarantee that the SEC will approve VanEck's Solana ETF application. The approval process can be long and complicated.

3. ETF Fees and Structure

Fees associated with the Solana ETF may impact investors' returns. It is important to understand the structure of an ETF before investing.

Conclusion

VanEck's filing of a Solana ETF is a promising development for the crypto industry. This not only represents a step forward for Solana as a cryptocurrency but also for the entire sector.

This could lead to greater institutional adoption and increased recognition of cryptocurrencies as a legitimate asset class.

How to Buy Solana (SOL) on Bittime

You can buy and sell Solana (SUN) in an easy and safe way through over. Bittime is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

Solana (SUN) available on Bittime with market pair SOL/IDR. To be able to buy SOL IDR Of over Make sure you have registered and completed identity verification.

Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Study Complete Guide How to Buy Crypto on Bittime.

Monitor graphic movement Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.