Bitcoin Predictions This Week: Fed Interest Rates, Inflation, and Volatility

2024-09-18

Bittime - Bitcoin is entering a crucial week in macroeconomic markets, where the interest rate decision by the Federal Reserve (The Fed) will be the main determining factor. This week, the Fed is expected to announce a 0.5% interest rate cut, their first move in more than four years.

This move could potentially impact Bitcoin's already high price volatility and risk a major battle for the $60,000 support level.

Bitcoin Price Movement and Key Resistance

Since the weekly close on September 15, Bitcoin has experienced pressure that resulted in the price dropping from the $60,000 level and reducing much of its weekly recovery.

Data from Cointelegraph Markets Pro and TradingView shows that BTC/USD prices are currently hovering around $59,000, although they are still showing a 7.8% gain over the last week.

Read Also: ETH/BTC Drops to Its Lowest Level Since April 2021, What Does It Mean?

Popular trader Mark Cullen indicated that this week will be tumultuous for Bitcoin, especially due to the Fed's interest rate decision scheduled for September 18.

Cullen emphasized that the interest rate decision will largely determine the direction of Bitcoin price movements. “This week starts in the red, and the very important interest rate decision is on Wednesday,” he said.

Technical Challenges and Long Term Analysis

Despite the pressure, analyst Caleb Franzen of Cubic Analytics sees support in both the 365-day moving average (SMA) and exponential moving average (EMA).

Franzen noted that Bitcoin has managed to maintain its position above the one-year average and even turned it into support several times, including during the recent downturn.

However, technical indicators point to some challenges. BTC/USD remains trapped below the Tenkan-sen and Kijun-sen trend lines on the Ichimoku indicator, while the Relative Strength Index (RSI) remains below the 50 level.

This obstacle indicates that Bitcoin must overcome this resistance obstacle to continue its upward trend.

External Factors: Potential Fed Interest Rate Cuts

The main event that will influence macroeconomic volatility this week is the interest rate decision by the Fed.

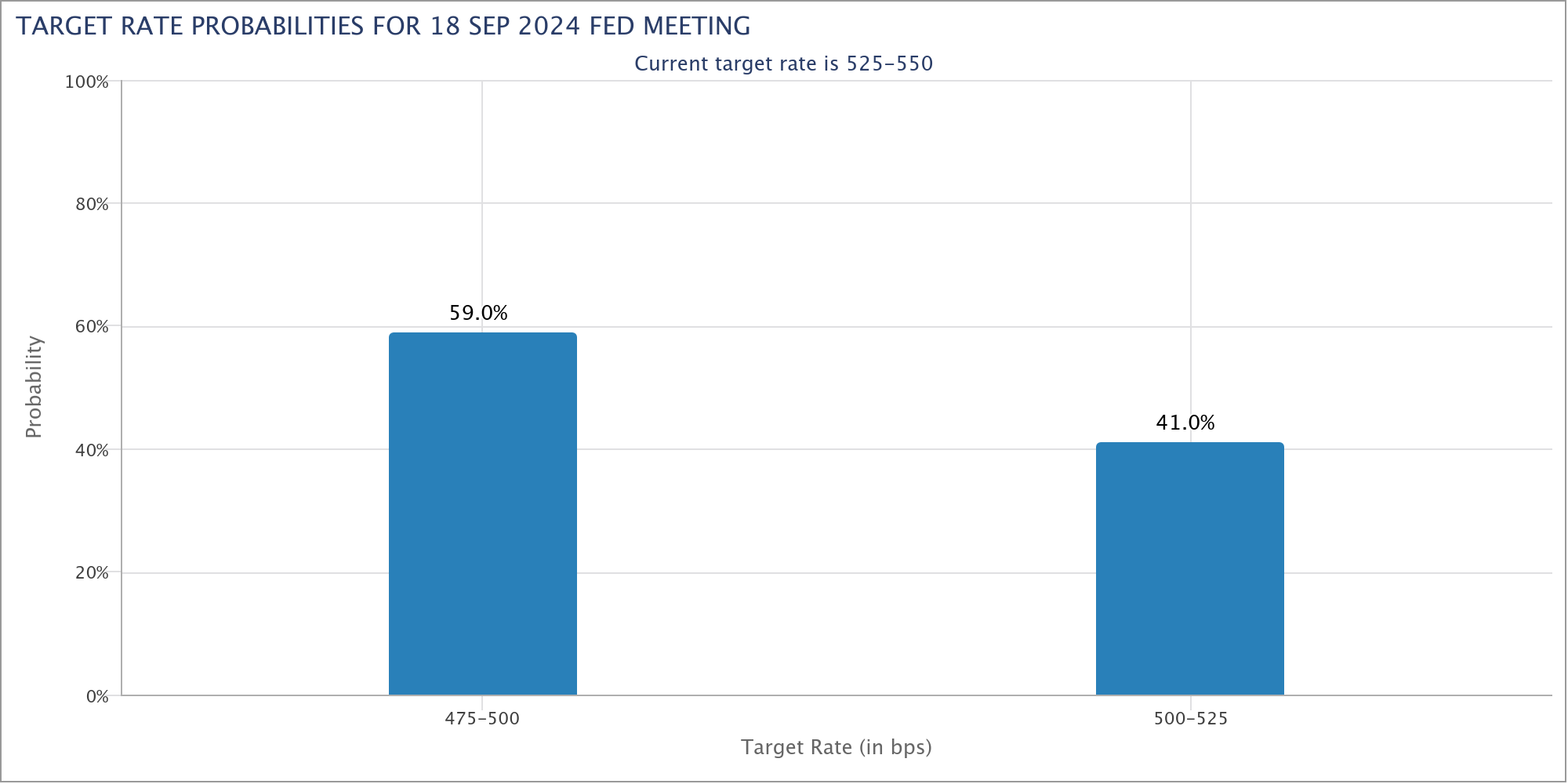

The move, the first since March 2020, has long been expected by markets, with the current debate centering on how big the cut would be—0.25% or 0.5%.

The latest data from the CME Group's FedWatch tool suggests a greater likelihood of a cut of 0.5%.

For Bitcoin, this situation is complex. While in theory risk assets like Bitcoin should benefit from the additional liquidity resulting from policy easing, market observers also warn that a sharp interest rate cut could indicate deeper economic problems, such as a decline in borrowing, spending and investment.

Bitcoin Dominance Tendency and Its Impact on Altcoins

Bitcoin's dominance in the cryptocurrency market is currently at its highest level in three and a half years, with a peak of 58.07% on September 16.

During this period, Ether (ETH) experienced a significant decline against Bitcoin, with the ETH/BTC pair reaching new lows not seen since April 2021.

Analyst Alex Thorn notes that the pair has lost more than 50% of its value since the Ethereum Merge two years ago.

Crypto trader Michaël van de Poppe predicts that Bitcoin dominance may peak in this area, but also sees the potential for a new bull run for Bitcoin in the near future, with the possibility of reaching a new all-time high price next October.

Conclusion: Dealing with Uncertainty and Volatility

This week, Bitcoin will face a number of important challenges triggered by the Fed's interest rate decision and high market volatility.

While there is potential for recovery and price increases, investors should remain alert to macroeconomic changes and their impact on cryptocurrency markets.

With Bitcoin's increasing dominance and existing technical challenges, the crypto market as a whole should monitor developments carefully to determine short- and medium-term direction.

With expected high volatility and global economic uncertainty, investors are advised to conduct in-depth research and consider the risks before making an investment decision in the cryptocurrency market.

How to Buy Crypto on Bittime

You can buy and sell crypto assets easily and safely via Bittime. Bittime is one of Indonesia's best crypto applications, officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also ensure you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application. Study Complete Guide How to Buy Crypto on Bittime.

Monitor graphic movement of Bitcoin (BTC) price, Ethereum (ETH), Solana (SOL), and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.