Ethereum Volatility Exceeds Bitcoin, Opportunity or Risk?

2024-08-13

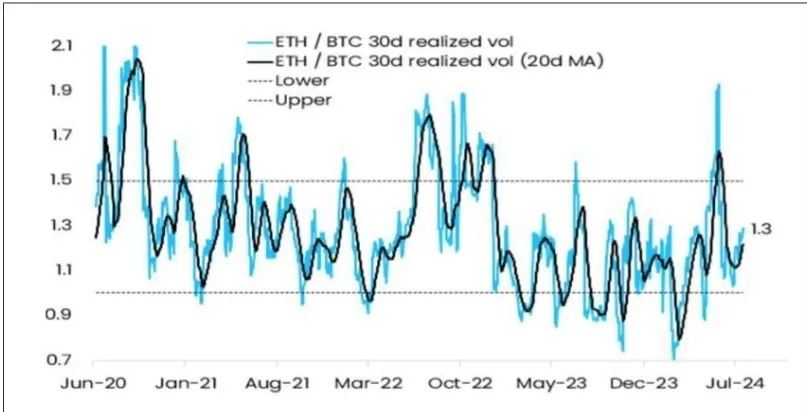

Bittime - Matrixport revealed the 30-day actual volatility difference between Ethereum and Bitcoin that continues to fluctuate between 1.0 to 1.5. This means that during peak volatility periods, Ethereum experiences 50% higher volatility than Bitcoin.

Why is Ethereum Volatility High?

Source: Twitter.com/Matrixport

Ethereum, as a blockchain platform that supports smart contracts and various DApps, has unique market dynamics compared to Bitcoin. This higher volatility is largely due to the speculative nature of crypto assets, as well as developments and innovations occurring in the Ethereum ecosystem.

While Bitcoin is known as a more stable “digital gold”, Ethereum offers more features and opportunities for developers, ultimately increasing market expectations and speculation.

Even though Ethereum has strong fundamentals and continues to grow, this high volatility is a double-edged sword. On the one hand, volatility provides traders with a great opportunity to gain quick profits from sharp price movements. On the other hand, high volatility also increases risks for investors who prefer stability.

Also Read: Ethereum Only Burns 210 ETH, a Record Low This Year!

Ethereum Performance in a Bull Market

Despite high volatility, Ethereum is not showing optimal performance in the current bull market. Since the start of the bull market, Ethereum has not been able to catch up with the significant price increases, as many expected.

This higher volatility actually weakens Ethereum's appeal for some investors who tend to avoid high risks.

However, high volatility is not always a negative indicator. For traders and investors who are used to risk, Ethereum's volatility can be an opportunity to profit from fluctuating price movements.

As long as the volatility difference between Ethereum and Bitcoin remains in the 1.0 to 1.5 range, the opportunity to take advantage of Ethereum's price fluctuations remains wide open.

Opportunities in Low Volatility

Matrixport also highlights the potential opportunities of a "low-level layout" or structuring at a low level in the context of Ethereum's volatility. Although high volatility provides trading opportunities, the situation where Ethereum's volatility tends to stabilize or decrease can be an opportunity for investors to enter the market with more measured risks.

This setup can be an effective strategy for those looking to optimize their portfolio with lower risk, but still take advantage of potential profits from Ethereum price movements.

Also Read: Ethereum Support Level is at $2,314 to $2,435

How to Buy Crypto with Bittime

You can buy and sell crypto assets in an easy and safe way via Bittime. over is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Monitor graphic movement price Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.