US Bitcoin ETF Daily Trading Volume Stagnant Since May!

2024-07-03

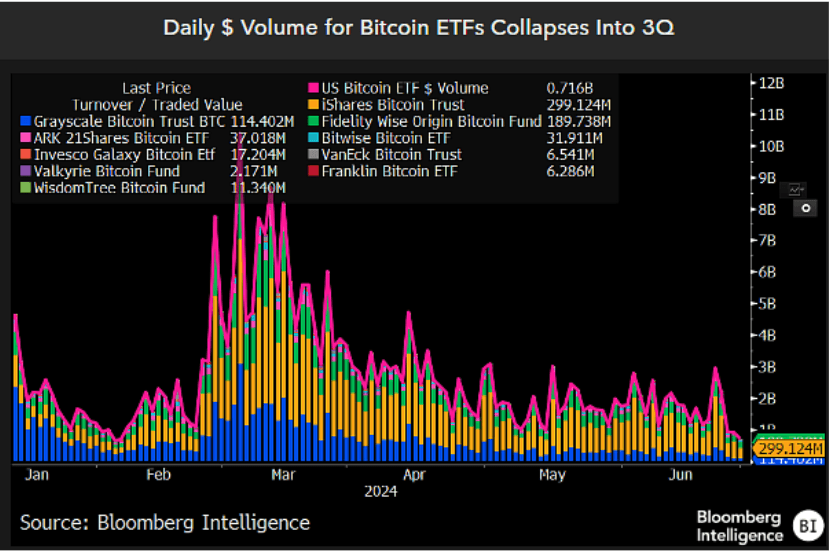

Bittime - In recent months, US Bitcoin ETFs have shown a significant decline in daily trading volume. According to Bloomberg ETF analyst James Seyffart, fund flows into US Bitcoin ETFs have been stagnant since May.

US Bitcoin ETF Daily Trading Volume Declines

Source: Twitter.com/JSeyff

Data taken from Bloomberg Intelligence shows a significant decline in daily trading volume for US Bitcoin ETFs during the third quarter of 2024.

The graph shows how daily trading volumes look like for various Bitcoin ETFs, including Grayscale Bitcoin Trust, ARK 21Shares The Bitcoin ETF, and the Invesco Galaxy Bitcoin ETF, have experienced drastic declines.

This decline indicates that despite a steady inflow of funds, daily trading activity has not been able to maintain the same momentum.

Impact on the Crypto Industry

The decline in daily trading volume of US Bitcoin ETFs has had several impacts on the crypto industry, such as decreased liquidity, reduced revenue for ETF providers, and challenges for retail investors.

Decreased Liquidity

Lower trading volume means lower liquidity. Liquidity is an important factor in the crypto market because it allows large transactions to be carried out without significantly affecting the price. With reduced liquidity, the spread between bid and ask prices can widen, making trading more expensive for investors.

Income Reduction for ETF Providers

Lower trading volume also means lower revenue for ETF providers. ETF providers earn revenue from trading and management fees. With decreasing trading volumes, income from these sources will also decrease.

Challenges for Retail Investors

For retail investors, a decrease in trading volume can make trading more difficult and expensive. Lack of liquidity can lead to increased trading costs and a higher risk of slippage.

Bitcoin ETFs Need a New Strategy

The decline in daily trading volume for US Bitcoin ETFs in the third quarter of 2024 reflects the challenges faced by the current crypto market. Despite a steady inflow of funds, daily trading volumes continue to decline, indicating the need for new strategies and innovation to revive investor interest.

How to Buy Crypto with Bittime

You can buy and sell crypto assets in an easy and safe way through Bittime. Bittime is one of the best crypto applications in Indonesia which is officially registered with Bappebti.

To be able to buy crypto assets on Bittime, make sure you have registered and completed identity verification. Apart from that, also make sure that you have sufficient balance by depositing some funds into your wallet. For your information, the minimum purchase of assets on Bittime is IDR 10,000. After that, you can purchase crypto assets in the application.

Monitor graphic movement Bitcoin (BTC), Ethereum (ETH), Solana (SOL) price and other cryptos to find out today's crypto market trends in real-time on Bittime.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.