XRP vs XLM: Fundamental and Technical Comparison

2024-12-07

Bittime - XRP vs XLM, following is a fundamental and technical comparison. The cryptocurrency market has experienced a significant surge in recent weeks, driven by resilience Bitcoin and institutional steps towards wider Bitcoin adoption.

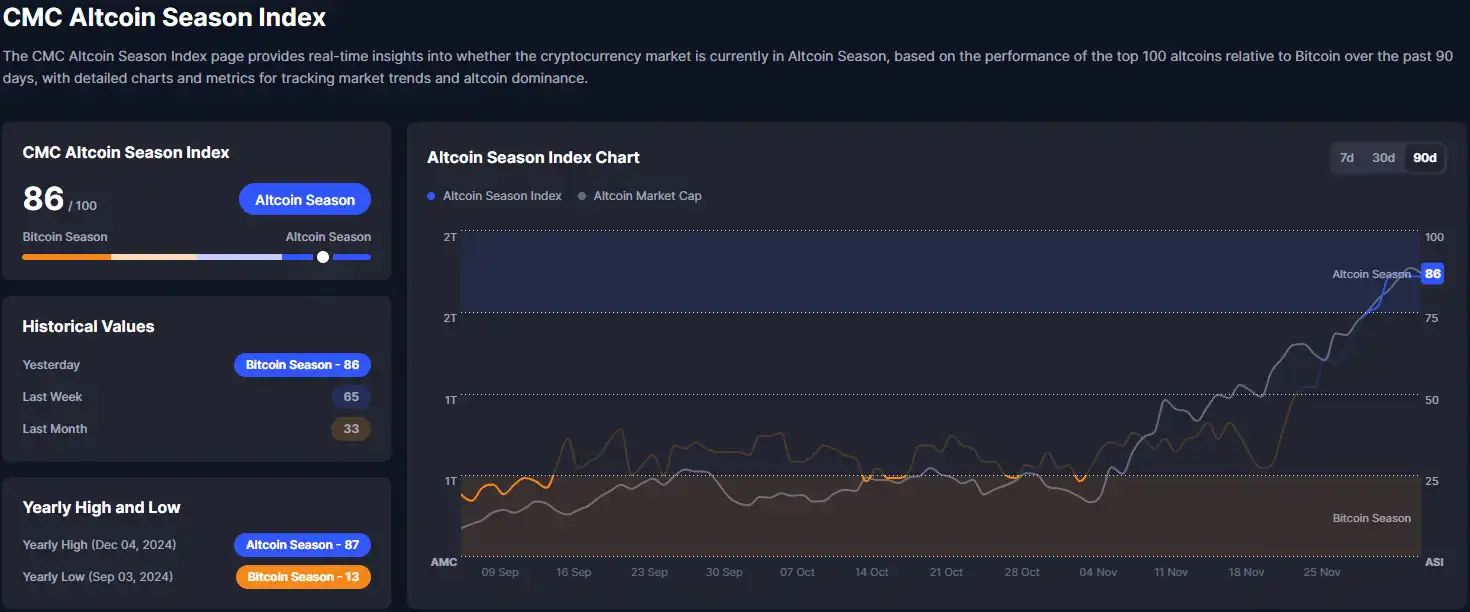

Altcoin Season Index

The altcoin season index recently reached 86/100, indicating that small assets such as $HBAR, $XRP, And Solana ($SOL) outperforms Bitcoin in terms of performance.

XRP, known as the favorite asset of institutions, and XLM, its younger sibling, are now the focus of investors' attention.

While the two had striking similarities, such as their founders and ETF hopes, their paths began to diverge.

Here's an analysis of what makes these two assets attractive and whether they are worth paying attention to or just a victim of "chase the pump".

Fundamentals: Strengths, Weaknesses of XRP and XLM

XRP Institutional Advantage

XRP has overcome many obstacles, including a legal battle with the SEC.

Now, XRP is capitalizing on the institutional narrative with Ripple expanding its ecosystem through launches stablecoin $RLUSD.

Institutions may soon gain access via spot ETFs as early as 2025 (subject to SEC approval).

While there is huge adoption potential, there is a dark side to be aware of.

Ripple still holds tens of billions of XRP, which could cause inflationary pressure.

This centralization raises the question: will institutions trust highly controlled assets?

Apart from that, privacy issues are also a major concern for institutions.

XLM: Community Driven Underdog

XLM, once marginalized by XRP, is now distinguishing itself with a more decentralized approach.

The 50% token burn in 2019 drastically reduced supply, giving it a deflationary edge.

However, XLM trading volume is still 50% lower than XRP, and the XLM network has not experienced the same adoption narrative.

Both assets appear poised for institutional adoption, but their tokenomics and growth models are very different.

XRP relies on institutional support, while XLM develops through community-based utilities.

Technicals: Reading XRP and XLM Graphical Comparison

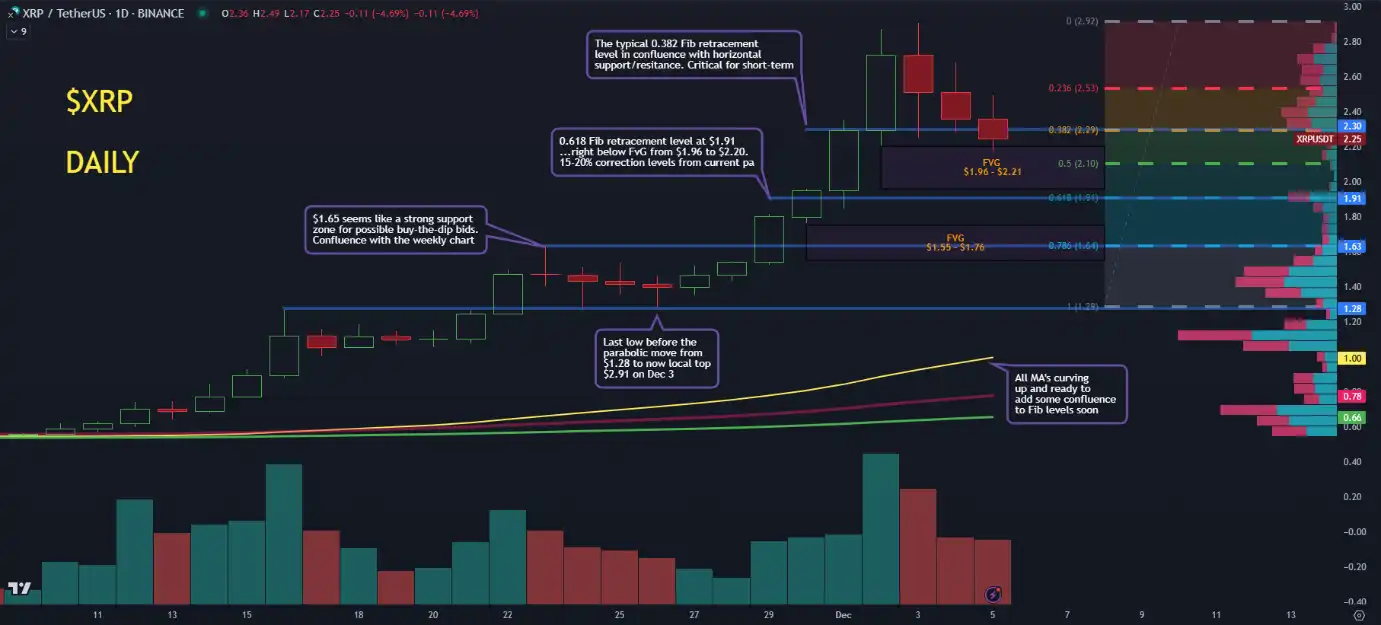

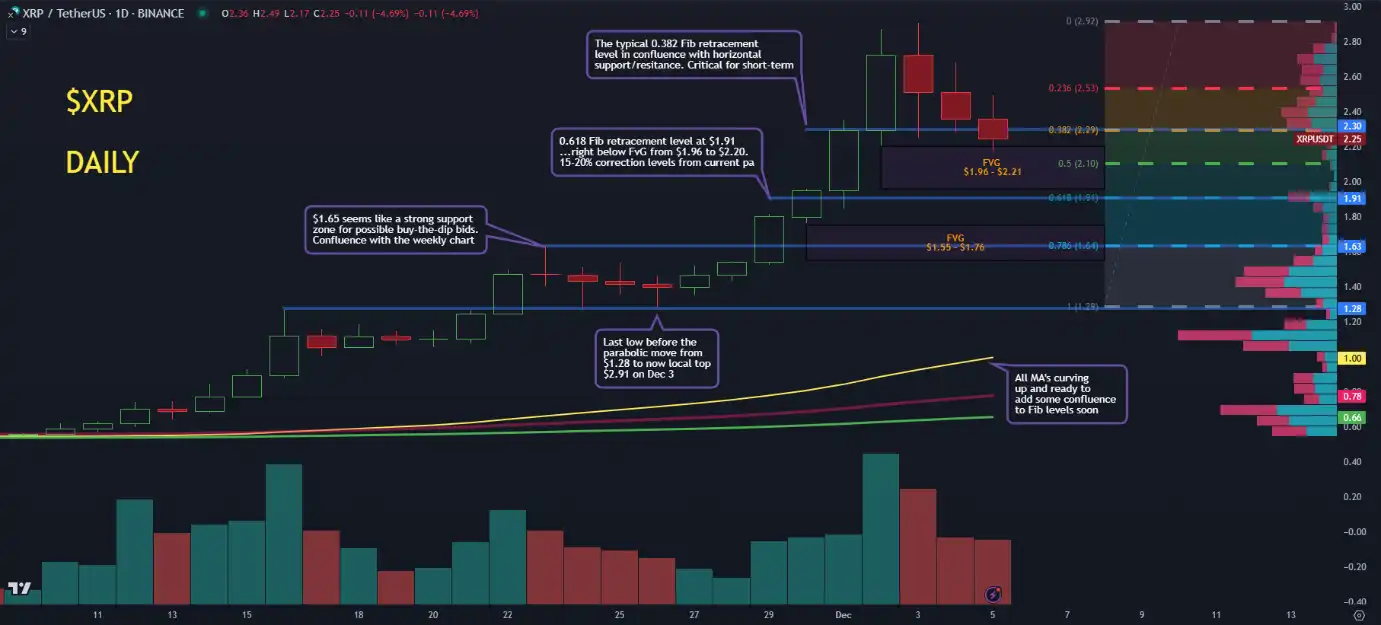

XRP Parabolic Surge

A gain of more than 280% in November has pushed XRP to overbought RSI levels, which have not been seen since the peak of the 2021 bull market.

On the daily chart, the RSI is above 80, while the weekly RSI is reaching historical extremes—a sign of overextension.

However, this parabolic movement does not mean the end of everything. Here are the buy zones to pay attention to:

$2.29 (.382 Fib): First retracement area from the local top, confluence with horizontal resistance-turned-support.

$1.91 (.618 Fib): A deeper retracement, supported by the 50-day moving average and below the Fair Value Gap (FVG) at $1.96-$2.20.

$1.63 (0.786 Fib): Key multi-cycle support with weekly confluence.

$1.28: The last low before November's parabolic surge—a critical test of XRP's strength.

XLM Is Like A Reflection Of XRP?

XLM followed XRP's surge with a rise of more than 450%.

The weekly chart shows similarities, but RSI levels are not as extreme as XRP. $0.414 is a critical pivot point—if lost, selling could accelerate.

The 200-week moving average is approaching, providing a potential safety net for long-term investors.

What about Altcoin Season Index?

The Altcoin Season Index at 86/100 confirms that altcoins are outperforming Bitcoin as market dominance shifts.

However, this often comes with risks.

Historically, strong altcoin rallies like this tend to be followed by sharp corrections.

While XRP and XLM have been on a tear, both may be entering a distribution phase—a period when early buyers lock in profits, leaving new entrants at risk.

Summary: How to Timing the Market?

XRP and XLM have a similar history but are very different in terms of fundamentals. XRP's centralized narrative contrasts with XLM's community-driven approach, but both face challenges from overextension, high market caps ($130 billion for XRP, $14.5 billion for XLM), and a "sell the news" backdrop.

The best time to buy is when it accumulates at $0.30 or $0.55, not after a 300%-400% rise.

The second best strategy? Patience. Don't chase the pump; wait for a discount. As the saying goes:

“Bulls make money, bears make money, but pigs get slaughtered.”

Buying at overbought RSI levels is a gamble, especially when macro conditions remain uncertain.

With the DXY stable and equity markets under pressure (Nasdaq and S&P500 stagnant), December could bring the answers we need.

FAQ

Does XLM Have a Future?

XLM (Stellar) has good future potential, especially due to its focus on cross-border payment solutions and partnerships with various financial institutions. However, its success will depend on technology adoption and development.

Which Is Better XRP or XLM?

What is better between XLM and XRP depends on the user's goals.

XRP is more focused on financial institutions, while XLM is more individual and community oriented.

Both have their respective advantages.

Is XLM a Fork of XRP?

No, XLM is not a fork of XRP.

Although both were founded by the same person (Jed McCaleb), XLM and XRP have different goals and technologies.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Reference

Michal D. Ciesla, Turbo-Charged Brothers: $XRP & $XLM’s Rocket Ride or Mirage?, Accessed December 6, 2024

Author: IN

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.